Eaton Fire Victims Caught in Insurance Adjuster Carousel: Homeowners Demand Answers

Companies

2025-04-08 06:19:40Content

In the wake of the devastating Eaton Fire, homeowners are facing yet another challenge: a frustrating claims process marked by constant adjuster turnover. Residents report that insurance companies are repeatedly changing their claims adjusters, creating significant roadblocks to recovering and rebuilding their lives.

The revolving door of insurance adjusters has left many homeowners feeling trapped in a bureaucratic nightmare. Each time a new adjuster is assigned, the claims process seems to restart, causing substantial delays and mounting frustration. Families who have already lost so much are now struggling to navigate an increasingly complex and seemingly endless claims process.

These repeated adjuster changes not only prolong the resolution of insurance claims but also add emotional strain to homeowners already dealing with the trauma of losing their homes. The uncertainty and lack of consistent communication have left many wondering when they will finally be able to move forward and begin rebuilding their lives.

Insurance Claim Chaos: Homeowners Caught in Endless Adjuster Shuffle After Devastating Eaton Fire

In the wake of the destructive Eaton Fire, homeowners are facing an unprecedented challenge that goes beyond the physical devastation of their properties. The insurance claims process has transformed into a labyrinthine nightmare, with residents experiencing repeated disruptions that threaten their path to recovery and financial stability.Navigating the Treacherous Landscape of Post-Disaster Insurance Claims

The Adjuster Rotation Dilemma

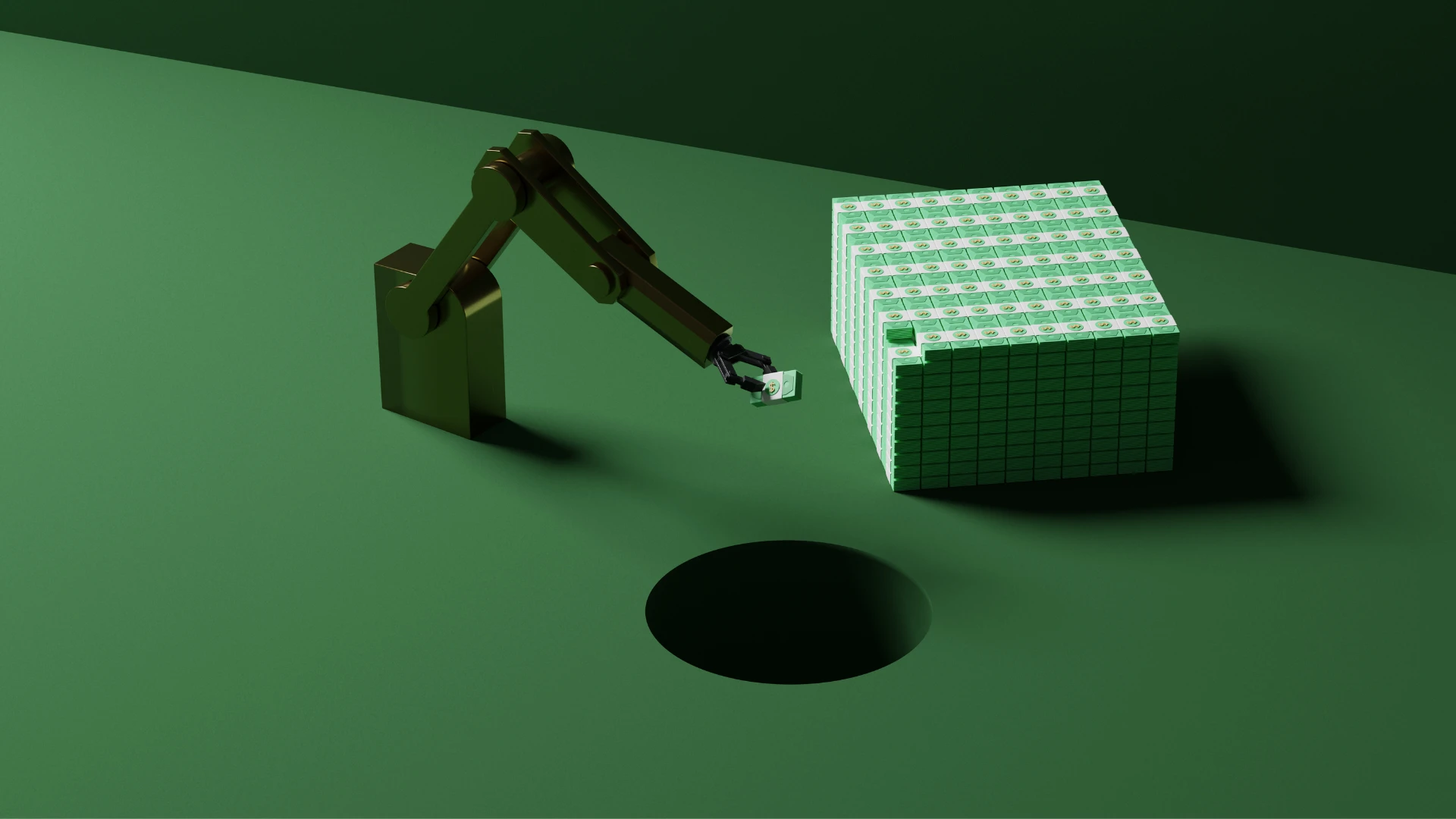

The insurance industry's practice of repeatedly rotating adjusters has emerged as a critical pain point for Eaton Fire victims. This systematic disruption creates a complex web of challenges that significantly impedes the claims resolution process. Homeowners find themselves trapped in an endless cycle of reintroduction, forced to repeatedly explain their unique circumstances to new adjusters who lack comprehensive context of their specific case. Each adjuster rotation represents more than just an administrative inconvenience; it symbolizes a deliberate strategy that potentially undermines the legitimate claims of devastated homeowners. The constant personnel changes create substantial gaps in communication, documentation, and understanding, effectively prolonging the already traumatic recovery process.Psychological and Financial Toll of Claim Uncertainty

The continuous adjuster shuffling inflicts profound psychological damage on already traumatized homeowners. Individuals who have lost everything in the Eaton Fire are confronted with an additional layer of emotional stress, navigating a claims process that seems intentionally designed to frustrate and discourage. Financial implications are equally severe. Delayed claims mean delayed reconstruction, leaving families in precarious living situations. The economic strain extends beyond immediate repair costs, encompassing temporary housing, lost personal property, and the broader economic disruption caused by prolonged uncertainty.Systemic Challenges in Insurance Claims Management

The Eaton Fire claims process reveals deeper systemic issues within insurance claim management. Insurance companies appear to prioritize bureaucratic processes over genuine customer support, implementing rotation strategies that seemingly protect corporate interests at the expense of policyholder recovery. Legal experts suggest these practices might constitute a deliberate tactic to wear down claimants, potentially reducing the overall financial liability for insurance providers. The repeated adjuster changes create intentional friction, making the claims process increasingly complex and emotionally exhausting for homeowners.Community Impact and Collective Resilience

Beyond individual struggles, the adjuster rotation phenomenon has galvanized the Eaton community. Affected homeowners are increasingly organizing, sharing experiences, and developing collective strategies to navigate the claims landscape. Support networks have emerged, providing crucial emotional and practical assistance to those battling insurance bureaucracy. Local advocacy groups are now documenting these experiences, preparing potential legal challenges and pushing for regulatory intervention. The community's response demonstrates remarkable resilience, transforming individual frustration into a powerful collective voice demanding accountability and fair treatment.Potential Regulatory and Industry Reforms

The ongoing claims crisis has attracted attention from state insurance regulators and consumer protection agencies. Preliminary investigations suggest the need for comprehensive reforms addressing adjuster management, claim processing transparency, and consumer rights in disaster recovery scenarios. Proposed reforms include mandatory training for adjusters, stricter guidelines on personnel rotation, and enhanced accountability mechanisms. These potential changes could fundamentally reshape how insurance companies approach claims management, particularly in post-disaster contexts.Technological Solutions and Future Outlook

Emerging technological innovations offer promising alternatives to the current claims management model. Advanced digital platforms, artificial intelligence, and blockchain technologies could potentially streamline the claims process, reducing human error and creating more transparent, efficient systems. Insurance technology startups are developing solutions that could revolutionize claims management, offering hope for more responsive, empathetic approaches to supporting homeowners during their most vulnerable moments.RELATED NEWS

Companies

AI Revolution Stalls: Why Employees Aren't Buying the Corporate Tech Pitch

2025-03-06 12:00:27

Companies

Green Energy Titans Merge: The Power Revolution That Could Transform Residential Living

2025-03-26 06:00:00

Companies

Renewable Revolution: Energy Giants Transform Abandoned Coal Lands into Green Power Goldmine

2025-03-15 07:30:00