Trump Teases Potential Shift in Auto Tariff Strategy: Automakers Get Breathing Room

Companies

2025-04-15 04:08:48Content

Asian markets displayed cautious optimism on Tuesday, gradually recovering from recent volatility as investors breathed a sigh of relief. The financial landscape saw a glimmer of hope after US President Donald Trump hinted at a potential pause in auto-related trade tensions, which immediately injected renewed confidence into the automotive sector.

Following a turbulent week of market fluctuations, investors welcomed the prospect of stabilization. The subtle uptick in Asian stocks reflected a growing sense of calm, with traders carefully monitoring the evolving economic landscape. The potential easing of trade pressures in the automotive industry provided a much-needed boost, helping to restore some semblance of market equilibrium.

Investors remain watchful, but the day's modest gains suggest a tentative return to more predictable market conditions. The automotive sector, in particular, showed signs of resilience, buoyed by the possibility of reduced trade-related uncertainties.

Global Markets Stabilize: Trump's Strategic Pause Signals Economic Recalibration

In the ever-evolving landscape of international finance, recent developments have sparked renewed interest in market dynamics, with geopolitical strategies playing a pivotal role in shaping economic trajectories. The intricate interplay between presidential decision-making and global market sentiment continues to captivate investors and analysts alike.Navigating Uncertainty: A Comprehensive Market Analysis

Economic Landscape and Market Sentiment

The global financial ecosystem has been experiencing unprecedented volatility, with investors closely monitoring every nuanced signal from key economic powerhouses. Asian markets demonstrated remarkable resilience, displaying a cautious yet optimistic approach to recent economic indicators. The delicate balance between international trade tensions and potential diplomatic resolutions has created a complex environment that demands sophisticated strategic interpretation. Financial experts have been meticulously analyzing the subtle shifts in market dynamics, recognizing that even the most minor policy adjustments can trigger significant market movements. The intricate web of global economic interactions requires a multifaceted approach to understanding potential market trajectories.Presidential Intervention and Market Dynamics

Presidential communication has emerged as a critical factor in market stabilization efforts. The potential pause in auto-related trade tensions signaled by the administration represents a strategic maneuver designed to provide breathing room for economic recalibration. This approach demonstrates the nuanced diplomatic and economic strategy employed at the highest levels of government. Market participants have been carefully dissecting every statement and potential policy shift, understanding that such interventions can dramatically alter investment landscapes. The delicate balance between protectionist policies and open market principles continues to challenge traditional economic frameworks.Sector-Specific Market Responses

The automotive sector has been particularly responsive to these recent developments, experiencing a notable boost following weeks of uncertainty. Investors and industry analysts are closely examining the potential long-term implications of these strategic pauses and their potential impact on global supply chains. Technological innovations, geopolitical considerations, and economic policy intersect in complex ways, creating a multidimensional environment that requires sophisticated analysis. The automotive industry stands at a critical juncture, balancing technological advancement with economic pragmatism.Global Economic Interconnectedness

Contemporary economic systems demonstrate an unprecedented level of interconnectedness, where actions in one region can instantaneously ripple across global markets. The recent market stabilization reflects a sophisticated understanding of international economic mechanisms, highlighting the importance of strategic communication and measured diplomatic approaches. Financial institutions and government bodies are increasingly recognizing the need for collaborative approaches in managing global economic challenges. The ability to navigate complex international economic landscapes requires unprecedented levels of strategic thinking and adaptive policy-making.Future Outlook and Strategic Considerations

Looking forward, market participants must remain vigilant and adaptable. The current economic environment demands a nuanced approach that balances risk mitigation with strategic opportunity identification. Emerging technologies, shifting geopolitical dynamics, and evolving market mechanisms will continue to reshape global economic interactions. Investors and policymakers alike must develop sophisticated analytical frameworks that can effectively interpret and respond to the increasingly complex global economic ecosystem. The ability to anticipate and strategically position oneself will be paramount in navigating the uncertain economic terrain.RELATED NEWS

Companies

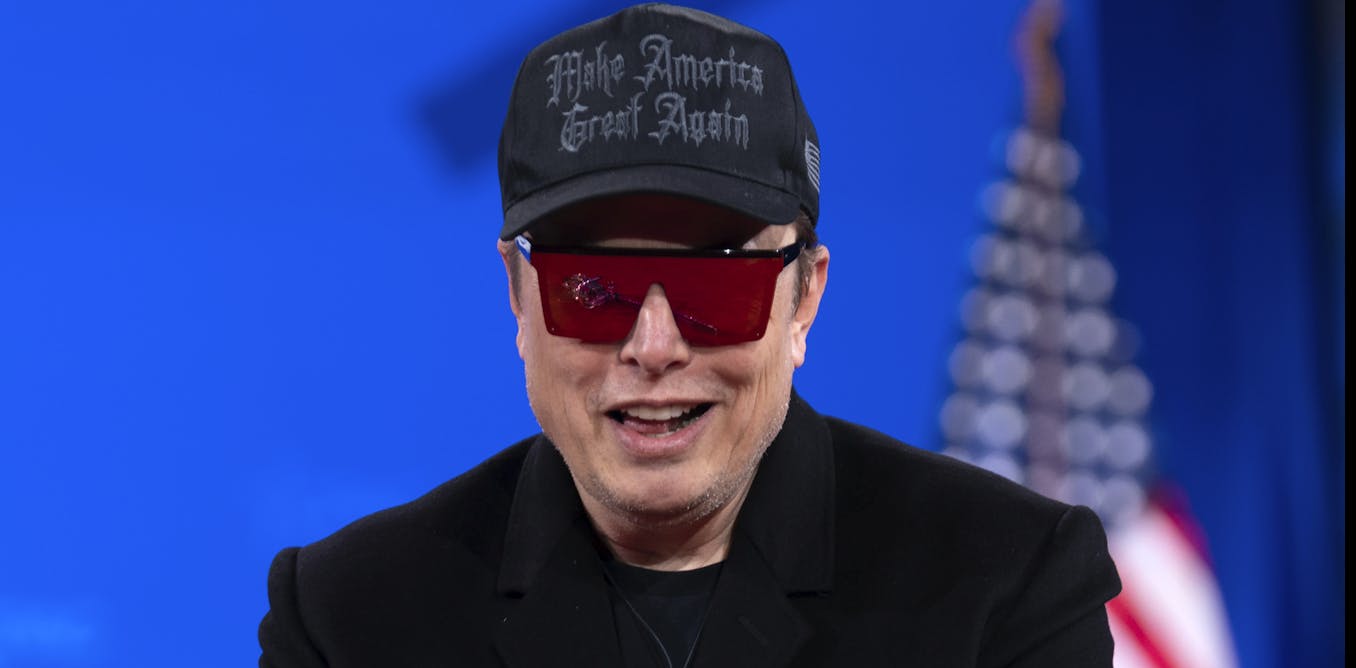

Dogecoin's Dark Side: AI Giant's Potential Monopoly on Government Secrets

2025-03-06 13:37:37

Companies

Behind Tuan Sing Holdings: The Power Players Controlling Over Half the Company's Shares

2025-04-07 03:54:30

Companies

Retail Revolt: Consumers Mobilize Against Major Brands in Unprecedented Boycott Wave

2025-03-03 12:07:51