Insider Stakes: The Hidden Growth Titans Controlling 13-31% of Their Own Empires

Companies

2025-02-17 16:02:34Content

As U.S. stock markets surge toward unprecedented heights this week, with growth stocks stealing the spotlight from their value counterparts, savvy investors are keenly scanning the landscape for strategic opportunities. In this dynamic financial environment, companies boasting significant insider ownership emerge as particularly intriguing prospects.

Insider ownership offers a unique window into a company's potential, providing investors with valuable insights that extend beyond traditional market analysis. When company executives and board members hold substantial stakes in their own businesses, it signals a profound confidence in the organization's future trajectory. These insiders, deeply invested both financially and emotionally, often have an intimate understanding of the company's strategic vision and growth potential.

The current market momentum creates an ideal backdrop for exploring such investment opportunities. As growth stocks continue to outperform and market sentiment remains optimistic, companies with strong insider commitment could represent hidden gems for discerning investors. Their aligned interests and long-term perspective can serve as a compelling indicator of potential success, offering a nuanced approach to navigating today's complex investment landscape.

Insider Ownership: The Hidden Catalyst in Today's Dynamic Stock Market Landscape

In the ever-evolving world of financial markets, savvy investors are constantly seeking strategic insights that go beyond traditional investment metrics. The intricate dance of stock performance, particularly in a landscape where growth stocks are gaining momentum, demands a nuanced understanding of corporate dynamics and insider perspectives.Unlock the Secrets of Smart Money: Where Insider Confidence Meets Market Potential

The Insider Advantage: Decoding Corporate Confidence

Corporate leadership's financial commitment reveals far more than standard financial reports ever could. When executives and board members invest substantial personal capital into their own companies, it signals an unprecedented level of confidence that transcends typical market analysis. These strategic investments represent a profound belief in the organization's future trajectory, offering investors a unique window into potential growth opportunities. Insider ownership isn't merely a financial statistic; it's a sophisticated indicator of management's strategic vision. Executives who maintain significant personal stakes demonstrate alignment between their personal wealth and the company's performance, creating a powerful motivational framework that drives innovation and sustainable growth.Market Dynamics: Growth Stocks and Insider Perspectives

The current market environment presents a fascinating landscape where growth stocks are experiencing remarkable momentum. This trend underscores the importance of understanding how insider ownership correlates with potential market performance. Companies where leadership maintains substantial equity positions often exhibit more disciplined strategic planning, more innovative approaches to challenges, and a more holistic view of long-term value creation. Sophisticated investors recognize that insider ownership can serve as a critical differentiator in evaluating potential investment opportunities. By examining the depth and consistency of insider investments, market participants can gain insights that traditional financial metrics might overlook.Strategic Investment Signals: Reading Between the Financial Lines

Analyzing insider ownership requires a multifaceted approach that goes beyond simple percentage calculations. Investors must consider the context of these investments, including the timing, scale, and frequency of insider transactions. A consistent pattern of insider purchases during market uncertainties can signal management's confidence in the company's fundamental strengths. Moreover, industries vary significantly in their typical insider ownership patterns. Technology and innovation-driven sectors often see higher levels of insider investment, reflecting the entrepreneurial spirit and long-term vision of their leadership teams. Conversely, more traditional industries might demonstrate different ownership dynamics that require nuanced interpretation.Risk Mitigation and Alignment of Interests

Insider ownership serves as a powerful risk mitigation strategy for external investors. When corporate leaders have substantial personal capital at stake, they are inherently motivated to make decisions that protect and enhance shareholder value. This alignment of interests creates a natural governance mechanism that can potentially reduce agency risks associated with corporate management. The psychological impact of personal financial commitment cannot be understated. Executives with significant personal investments are more likely to approach strategic decisions with heightened diligence, considering long-term implications rather than pursuing short-term gains that might compromise sustainable growth.Technological Innovations and Transparency in Insider Tracking

Modern technological platforms have revolutionized how investors can track and analyze insider ownership. Advanced data analytics and real-time reporting mechanisms provide unprecedented transparency, enabling investors to make more informed decisions based on comprehensive insider investment patterns. These technological advancements democratize access to sophisticated investment insights, allowing both institutional and individual investors to leverage similar analytical tools previously reserved for high-end financial professionals.RELATED NEWS

Companies

Ethical Excellence: JLL Clinches World's Most Ethical Companies® Honor for Record 18th Consecutive Year

2025-03-11 12:23:00

Companies

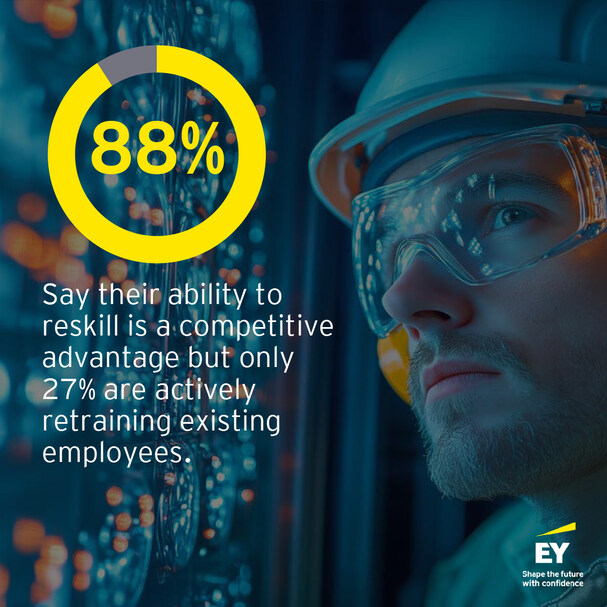

Digital Transformation Dilemma: Energy Sector's Massive Tech Leap Leaves Workforce Behind

2025-03-03 13:00:00

Companies

Cyber Espionage Alert: North Korean Agents Breach US Mortgage Agencies

2025-05-07 05:12:01