Gold Rush 2.0: Australia Floods US Markets with Unprecedented Precious Metal Shipment

Finance

2025-03-07 06:53:58Content

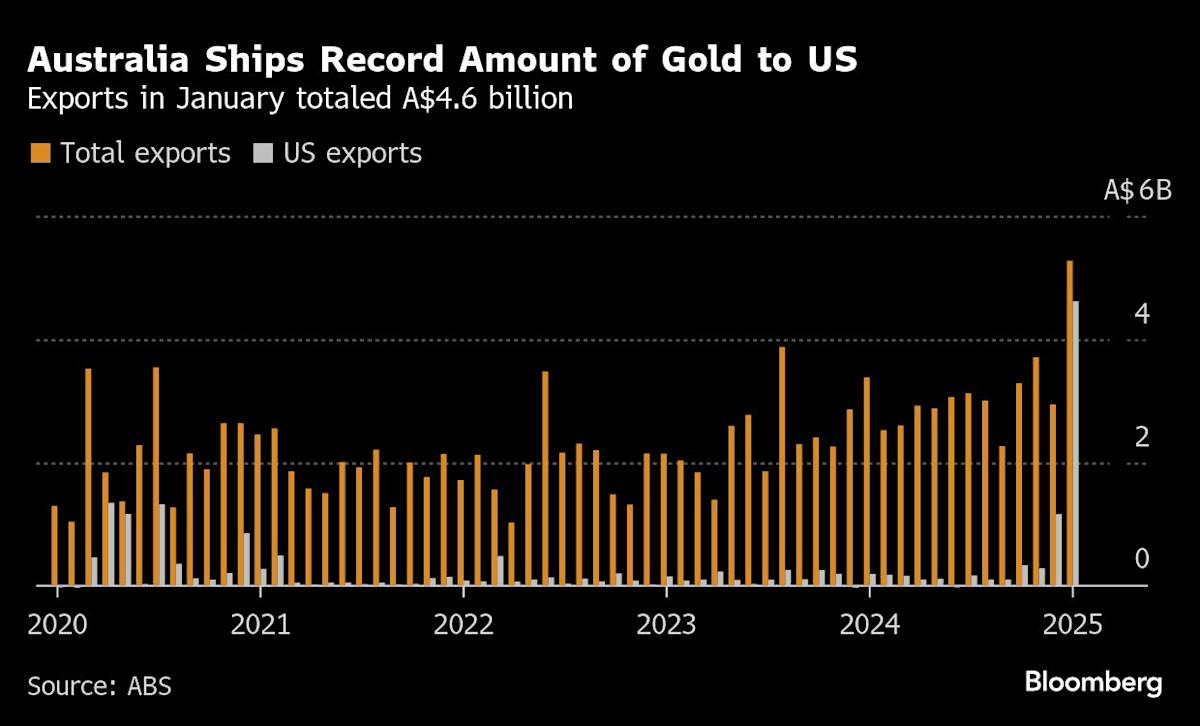

In a remarkable surge of international gold trade, Australia has set a new record by shipping an unprecedented volume of gold to the United States in January. The dramatic increase was driven by traders seeking to capitalize on extraordinary price disparities across global markets, amid growing concerns about potential tariff implications.

Savvy market participants rushed to deliver precious metal into New York warehouses, sensing a unique opportunity to navigate complex international trading conditions. The unprecedented shipment highlights the dynamic and responsive nature of global commodity markets, where traders quickly adapt to potential economic shifts and regulatory uncertainties.

This gold export milestone underscores Australia's significant role in the international precious metals landscape, demonstrating the country's ability to respond swiftly to changing market dynamics. The record-breaking shipment not only reflects the strategic thinking of Australian traders but also signals the intricate interconnectedness of global financial markets.

As economic tensions and trade uncertainties continue to evolve, such strategic movements in commodity trading provide fascinating insights into how nations and traders anticipate and respond to potential economic challenges.

Gold Rush Unleashed: Australia's Unprecedented Shipment Sparks Global Market Frenzy

In the intricate world of international trade and precious metals, Australia has emerged as a pivotal player, sending shockwaves through global financial markets with an extraordinary gold shipment that defies conventional expectations. The recent surge in gold exports to the United States represents more than just a routine transaction—it's a complex narrative of economic strategy, market anticipation, and strategic positioning in an increasingly volatile global landscape.Navigating Uncertain Waters: The Gold Market's High-Stakes Gamble

The Strategic Landscape of Gold Exports

The unprecedented gold shipment from Australia to the United States reveals a nuanced and sophisticated approach to international trade. Traders and financial experts have been closely monitoring the intricate dynamics that drive such massive metal transfers. The motivation behind this record-breaking shipment extends far beyond simple economic transactions, encompassing complex geopolitical considerations and market speculation. Financial analysts suggest that the surge is rooted in a multifaceted strategy designed to capitalize on emerging market opportunities. The potential threat of tariffs has created a unique environment where precious metal traders are compelled to make strategic decisions that could potentially mitigate financial risks and maximize potential returns.Market Dynamics and Price Dislocations

The extraordinary movement of gold highlights the intricate interconnectedness of global financial markets. Price dislocations between key markets have created a rare opportunity for traders to leverage differences in valuation and market sentiment. These disparities represent more than mere numerical variations—they are symptomatic of broader economic shifts and strategic positioning. Experts argue that such significant gold transfers are not merely transactional but represent a sophisticated risk management strategy. By rapidly moving substantial gold quantities into New York warehouses, Australian traders are effectively hedging against potential economic uncertainties and positioning themselves strategically in an unpredictable global market.Geopolitical Implications and Economic Strategies

The gold shipment serves as a microcosm of broader international economic dynamics. It reflects the complex interplay between national economic policies, global trade tensions, and the strategic importance of precious metals in maintaining financial stability. Traders are not just moving metal; they are navigating a complex chessboard of economic and geopolitical considerations. The timing and scale of this shipment suggest a calculated response to potential tariff implementations. By preemptively positioning gold in U.S. markets, Australian traders demonstrate a proactive approach to managing potential economic disruptions. This strategy underscores the importance of agility and foresight in contemporary international trade.Technological and Market Intelligence Driving Decisions

Advanced market intelligence and sophisticated technological tools have played a crucial role in facilitating this unprecedented gold transfer. Real-time data analysis, predictive modeling, and instantaneous communication networks enable traders to make rapid, informed decisions in an increasingly complex global marketplace. The ability to quickly identify and capitalize on market opportunities requires not just financial acumen but also a deep understanding of technological infrastructure. The gold shipment represents a convergence of financial strategy, technological capability, and strategic foresight.Future Outlook and Market Predictions

As global economic landscapes continue to evolve, such strategic gold movements are likely to become increasingly common. The Australian example serves as a potential blueprint for how nations might navigate economic uncertainties, leverage market opportunities, and maintain financial resilience in an era of unprecedented global complexity. Financial experts predict that similar strategic metal transfers could become a more frequent occurrence as countries seek to optimize their economic positioning and mitigate potential risks associated with international trade tensions.RELATED NEWS

Finance

Breaking: Finance Expert Reveals the Hidden Truths Behind Car Insurance Rates

2025-03-27 12:00:00

Finance

Tesla's Bold China Move: Free Self-Driving Trial Sparks Stock Rollercoaster

2025-03-17 15:22:48

Finance

Navigating Wealth: How West Branch Capital Is Redefining Personal Financial Strategy

2025-03-25 07:00:00