Betting on Their Future: How Parents Can Shield Teens from the Digital Gambling Trap

Finance

2025-04-11 21:09:05Content

In today's digital age, teenagers are wielding unprecedented financial influence. With more disposable income and easier access to spending opportunities, young people are becoming a significant economic force. Recognizing this trend, states across the country are taking proactive steps to equip students with essential financial literacy skills.

Schools are now implementing comprehensive financial education programs designed to transform teenagers from impulsive spenders into savvy money managers. These innovative curricula go beyond traditional math classes, offering practical lessons in budgeting, saving, investing, and responsible spending.

The goal is clear: empower the next generation with the knowledge and skills needed to make smart financial decisions. By introducing financial literacy early, educators hope to help teenagers develop healthy money habits that will serve them well throughout their lives. From understanding credit to creating personal budgets, students are learning crucial life skills that extend far beyond the classroom.

As teenagers continue to gain more spending power, these educational initiatives represent a critical investment in their financial future. By teaching financial responsibility now, schools are helping to create a generation of financially confident and competent young adults.

Financial Literacy Revolution: Empowering Teens to Master Money Management in the Digital Age

In an era of unprecedented economic complexity and digital financial opportunities, today's teenagers stand at a critical crossroads of financial education and personal empowerment. The traditional paradigms of money management are rapidly evolving, challenging educational institutions and parents to equip young generations with sophisticated financial skills that extend far beyond basic budgeting.Transforming Financial Futures: Why Teen Money Skills Matter Now More Than Ever

The Emerging Economic Landscape for Young Consumers

Modern teenagers navigate an intricate financial ecosystem dramatically different from previous generations. With smartphones serving as personal banking platforms and digital payment systems becoming ubiquitous, adolescents encounter unprecedented spending opportunities and financial risks. The traditional boundaries between financial education and real-world economic engagement have dramatically blurred, creating an urgent need for comprehensive financial literacy programs. Contemporary economic trends reveal that teenagers now possess significantly more purchasing power and financial autonomy than ever before. Digital platforms, part-time employment opportunities, and entrepreneurial ecosystems enable young individuals to generate and manage personal income streams with remarkable sophistication. This economic transformation demands a radical reimagining of financial education strategies.Educational Innovations in Financial Curriculum Development

Progressive states are pioneering innovative approaches to integrate comprehensive financial education into standard academic curricula. These groundbreaking programs transcend traditional classroom learning, incorporating interactive digital simulations, real-world financial scenario training, and personalized economic skill development. Cutting-edge educational models emphasize practical financial competencies such as understanding credit mechanisms, developing investment strategies, analyzing complex financial products, and cultivating sustainable spending habits. By transforming financial education from abstract theoretical concepts to tangible, applicable skills, schools are empowering teenagers to become financially resilient and strategically minded consumers.Technological Disruption and Financial Learning Platforms

Emerging technological platforms are revolutionizing how teenagers engage with financial education. Gamified learning applications, artificial intelligence-driven financial coaching tools, and immersive digital experiences are making complex economic concepts accessible and engaging for younger generations. These technological interventions provide personalized learning experiences that adapt to individual financial comprehension levels, enabling teenagers to develop nuanced understanding of economic principles through interactive, real-time feedback mechanisms. By leveraging advanced technological frameworks, financial education becomes a dynamic, personalized journey of economic discovery.Psychological Dimensions of Teenage Financial Decision-Making

Understanding the psychological underpinnings of teenage financial behavior represents a critical component of effective financial education. Researchers are uncovering complex emotional and cognitive factors that influence spending patterns, risk assessment, and long-term financial planning among adolescents. Neurological studies suggest that targeted financial education can fundamentally reshape neural pathways associated with economic decision-making, potentially mitigating impulsive spending behaviors and cultivating more strategic financial thinking. By integrating psychological insights with practical financial training, educational institutions can develop holistic approaches to economic skill development.Global Economic Preparedness and Future-Oriented Skills

The contemporary financial education landscape extends beyond national boundaries, preparing teenagers for a globally interconnected economic environment. Comprehensive programs now incorporate international financial systems, cross-cultural economic perspectives, and emerging global economic trends. By equipping teenagers with adaptable financial skills, educational institutions are creating a generation of economically sophisticated global citizens capable of navigating complex, rapidly evolving financial landscapes. These forward-thinking approaches represent a fundamental reimagining of financial preparedness for future economic challenges.RELATED NEWS

Finance

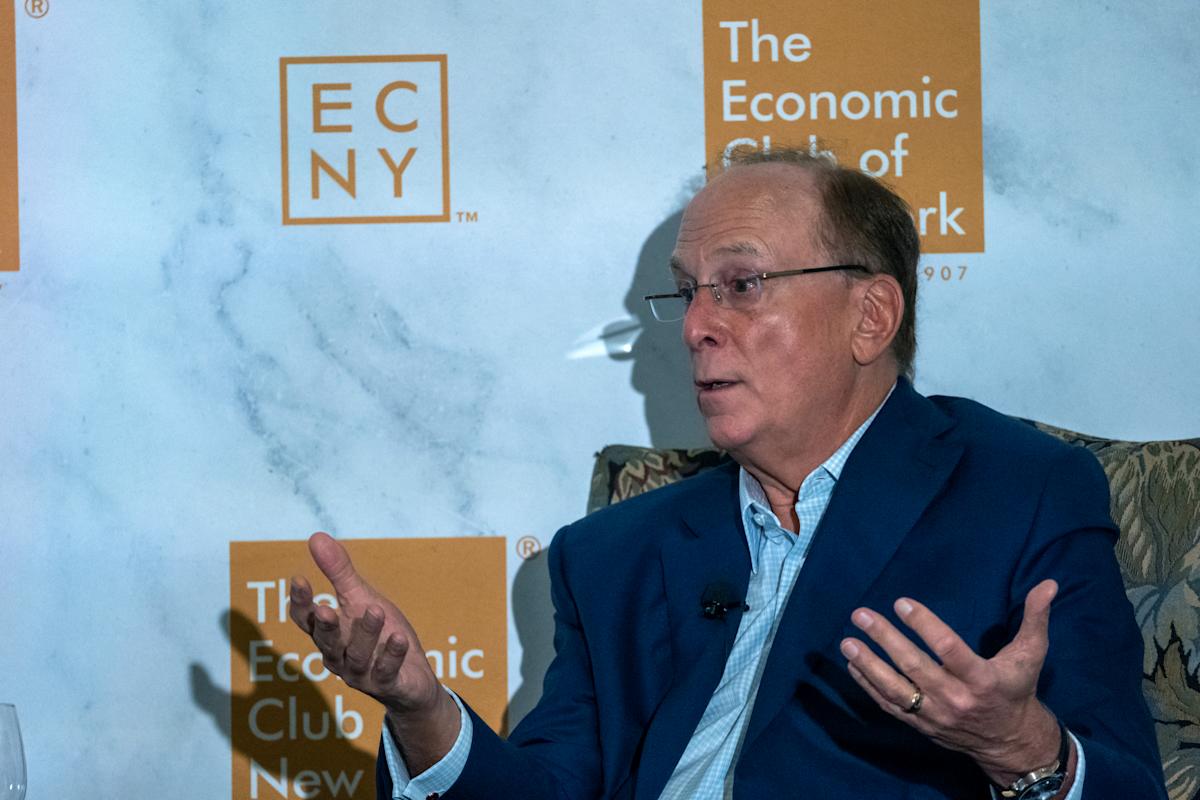

Corporate Pulse: CEOs Signal Economic Storm Brewing, BlackRock's Fink Reveals

2025-04-07 18:16:53

Finance

Market Mayhem: Dow Soars 3,000 Points in Historic Rally as Trump Halts Trade War Tensions

2025-04-09 20:06:36