Dollars and Sense: How CASH Campaign Has Transformed Baltimore's Financial Landscape for 18 Years

Finance

2025-03-29 21:08:02Content

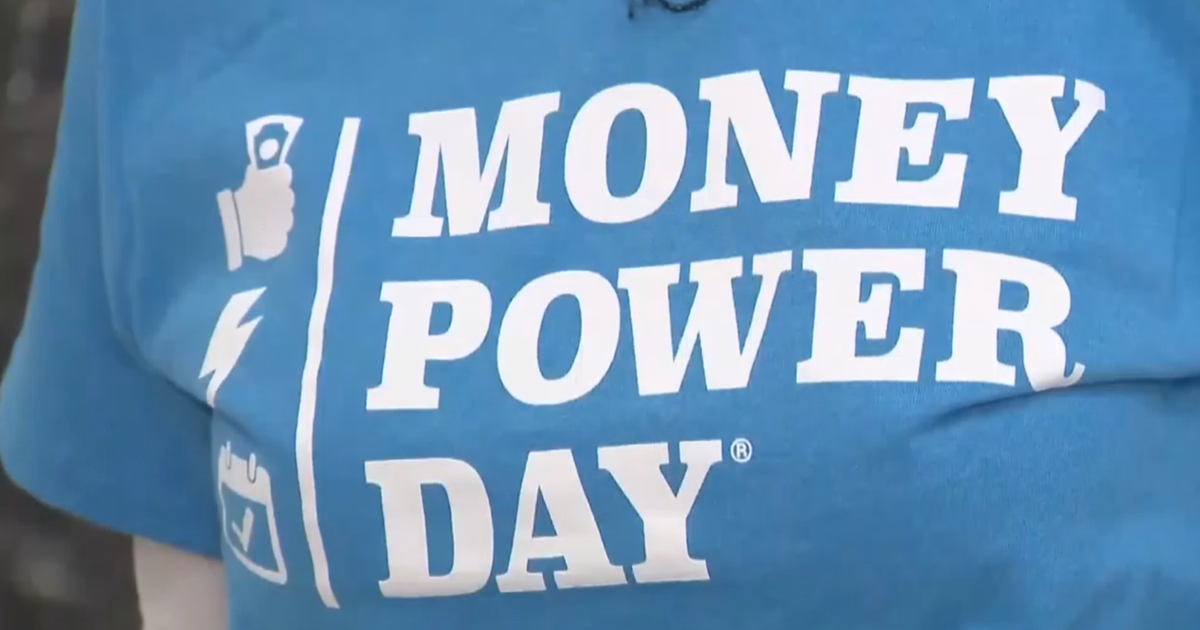

Empowering Financial Wellness: CASH Campaign's Annual Money Power Day Comes to North Baltimore

For nearly two decades, the CASH Campaign of Maryland has been a beacon of financial education, annually hosting its transformative Money Power Day. This year, the event brought its powerful financial fitness workshop to Poly-Western High School in North Baltimore, turning the campus into a vibrant hub of financial empowerment and learning.

The long-standing initiative, which has been running for 18 remarkable years, continues to provide community members with essential tools and resources to take control of their financial futures. By offering expert guidance, interactive workshops, and personalized financial advice, the CASH Campaign helps individuals develop the skills and confidence needed to make smart money decisions.

At this year's event, participants had the opportunity to engage with financial professionals, learn practical money management strategies, and gain insights into building a more secure financial foundation. The high school venue served as an ideal backdrop, symbolizing the campaign's commitment to financial education across all generations.

Empowering Financial Futures: Maryland's Grassroots Financial Wellness Revolution

In the heart of Baltimore, a transformative movement is quietly reshaping how communities approach financial literacy and economic empowerment. Beyond traditional financial education, a dedicated organization has been pioneering innovative approaches to help individuals gain control of their financial destinies, one workshop at a time.Unlocking Financial Potential: Where Knowledge Meets Opportunity

The Genesis of Financial Transformation

The CASH Campaign of Maryland represents more than just a nonprofit organization; it's a beacon of hope for individuals seeking to break free from financial constraints. For nearly two decades, this remarkable initiative has been meticulously crafting strategies to empower individuals with critical financial management skills. Their annual Money Power Day has become a landmark event, transcending traditional financial education by creating immersive, hands-on learning experiences. By strategically selecting Poly-Western High School in North Baltimore as their hub, the campaign demonstrates a commitment to reaching communities where financial education is most needed. The choice of location is deliberate, signaling an understanding that true financial empowerment begins at the grassroots level.Comprehensive Financial Wellness Strategies

The organization's approach goes far beyond simple money management workshops. They've developed a holistic framework that addresses multiple dimensions of financial health, recognizing that economic well-being involves more than just balancing a checkbook. Their programs integrate practical skills training with psychological insights into financial decision-making. Participants are guided through complex financial landscapes, learning not just about budgeting and saving, but also understanding systemic economic challenges. The workshops provide nuanced strategies for navigating personal finance, from understanding credit scores to developing long-term investment strategies.Community Impact and Transformation

What sets the CASH Campaign apart is its profound commitment to community-driven change. By creating accessible, engaging financial education platforms, they're effectively democratizing economic knowledge. Each workshop becomes a catalyst for individual and collective economic empowerment. The ripple effects of their work extend far beyond immediate financial skills. Participants gain confidence, develop critical thinking about money, and become potential change agents within their communities. This approach transforms financial education from a passive learning experience into an active, transformative journey.Innovative Learning Methodologies

Recognizing that traditional lecture-style financial education often fails to engage participants, the CASH Campaign has pioneered interactive, experiential learning techniques. Their workshops incorporate real-world scenarios, role-playing exercises, and personalized financial coaching. Technology plays a crucial role in their educational approach. Interactive digital tools, personalized financial assessment platforms, and multimedia resources ensure that learning remains dynamic and relevant to participants' lived experiences.Future-Oriented Financial Empowerment

As economic landscapes continue to evolve rapidly, the CASH Campaign remains committed to staying ahead of emerging financial trends. Their forward-thinking approach ensures that participants are not just learning current financial strategies but are prepared for future economic challenges. By continually adapting their curriculum and embracing innovative educational technologies, they're creating a sustainable model of financial education that can be replicated in communities nationwide.RELATED NEWS

Finance

Saudi Summit: Aurangzeb's Strategic Diplomatic Breakthrough at AlUla Conference

2025-02-16 01:42:30

Finance

Industry Powerhouse Amy Heller Lands Key Role at Meridian Capital, Shaking Up Healthcare Real Estate Finance

2025-03-06 22:41:00