Treasury Diplomacy: Japan's Finance Chief Plays Strategic Card in High-Stakes Trump Talks

Finance

2025-05-02 08:57:11Content

In a bold diplomatic maneuver, Japan's finance minister has signaled that the country's substantial portfolio of U.S. Treasury securities could serve as a strategic bargaining chip during trade negotiations with the Trump administration. By hinting at the potential leverage of their massive U.S. debt holdings, Japanese officials are subtly reminding Washington of the intricate financial interdependence between the two economic powerhouses.

The statement underscores Japan's nuanced approach to international trade discussions, suggesting that they are prepared to use their significant financial assets as a negotiating tool. With hundreds of billions of dollars invested in U.S. government bonds, Japan possesses a powerful economic instrument that could potentially influence trade policy discussions and tariff negotiations.

This strategic positioning reflects the complex dynamics of global economic diplomacy, where financial holdings can be as potent as traditional diplomatic channels in shaping international relations and trade agreements.

Financial Diplomacy: Japan's Strategic Treasury Leverage in U.S. Trade Negotiations

In the intricate world of international finance and geopolitical maneuvering, nations often employ sophisticated economic strategies to gain diplomatic advantages. Japan's recent approach to U.S. trade relations represents a nuanced and calculated method of exerting soft power through financial instruments, particularly its substantial holdings of U.S. Treasury securities.Unveiling the Hidden Power of Financial Diplomacy: When Bonds Become Bargaining Chips

The Geopolitical Significance of Treasury Holdings

Japan's massive portfolio of U.S. Treasury securities represents more than a mere financial investment—it's a strategic asset with profound geopolitical implications. By positioning these securities as a potential negotiation tool, Japan demonstrates a sophisticated understanding of modern economic statecraft. The sheer scale of Japan's Treasury holdings provides significant leverage in bilateral discussions, transforming financial instruments into diplomatic instruments. The intricate relationship between Japan and the United States extends far beyond traditional trade agreements. Each Treasury bond represents not just a financial commitment but a complex web of economic interdependence that can be strategically manipulated during high-stakes negotiations. This approach reflects a nuanced understanding of global economic dynamics, where financial assets can be wielded with the precision of diplomatic communiqués.Economic Leverage in the Global Arena

The concept of using Treasury holdings as a negotiation strategy is not unprecedented, but Japan's explicit acknowledgment of this approach marks a significant moment in international economic relations. By framing these securities as a potential "card on the table," Japan's finance minister signals a willingness to employ sophisticated economic pressure tactics. Such strategic positioning requires delicate balance. While the potential to influence negotiations exists, Japan must carefully consider the broader implications of any potential financial maneuvers. The global financial ecosystem is interconnected, and abrupt changes in Treasury holdings could trigger complex ripple effects across international markets.Navigating Trade Tensions and Diplomatic Complexities

The Trump administration's approach to international trade was characterized by aggressive bilateral negotiations, often employing tariffs and economic pressure as primary diplomatic tools. Japan's response—positioning its substantial U.S. Treasury holdings as a potential negotiation lever—represents a calculated and measured counterstrategy. This approach demonstrates Japan's diplomatic sophistication, transforming what might appear to be a passive financial investment into an active geopolitical instrument. By suggesting the potential mobility of these Treasury securities, Japan creates a subtle yet powerful form of economic diplomacy that transcends traditional negotiation frameworks.The Broader Context of Financial Diplomacy

Japan's strategy illuminates the evolving nature of international economic interactions. In an era of increasing global economic complexity, financial assets are no longer viewed as static investments but as dynamic tools of soft power and strategic influence. The intricate dance of international finance requires nuanced understanding, strategic thinking, and a willingness to view economic instruments through a multidimensional lens. Japan's approach exemplifies this sophisticated perspective, revealing how nations can leverage financial resources to achieve broader strategic objectives. By positioning its Treasury holdings as a potential negotiation tool, Japan sends a clear message: in the complex world of global economics, financial assets are far more than mere numbers on a balance sheet—they are powerful instruments of diplomatic engagement.RELATED NEWS

Finance

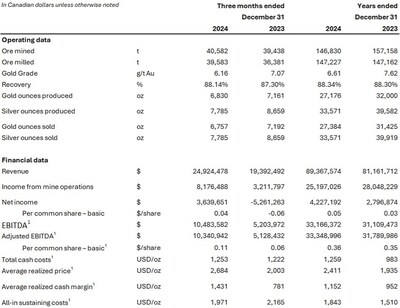

Soma Gold Unveils Stellar Financial Performance: Breaking Down 2024's Fiscal Triumph

2025-05-01 08:30:00

Finance

Campaign Cash Controversy: Ex-School Board Member Aisha Carr Confronts Fraud Allegations

2025-04-22 20:04:00

Finance

Wall Street Breathes Sighs of Relief: Fed Maintains Steady Course, Signals Strategic Rate Cuts Ahead

2025-03-19 18:02:39