Money Makeover: Dave Ramsey's Game-Changing Financial Strategies for 2025

Finance

2025-02-19 15:00:14Content

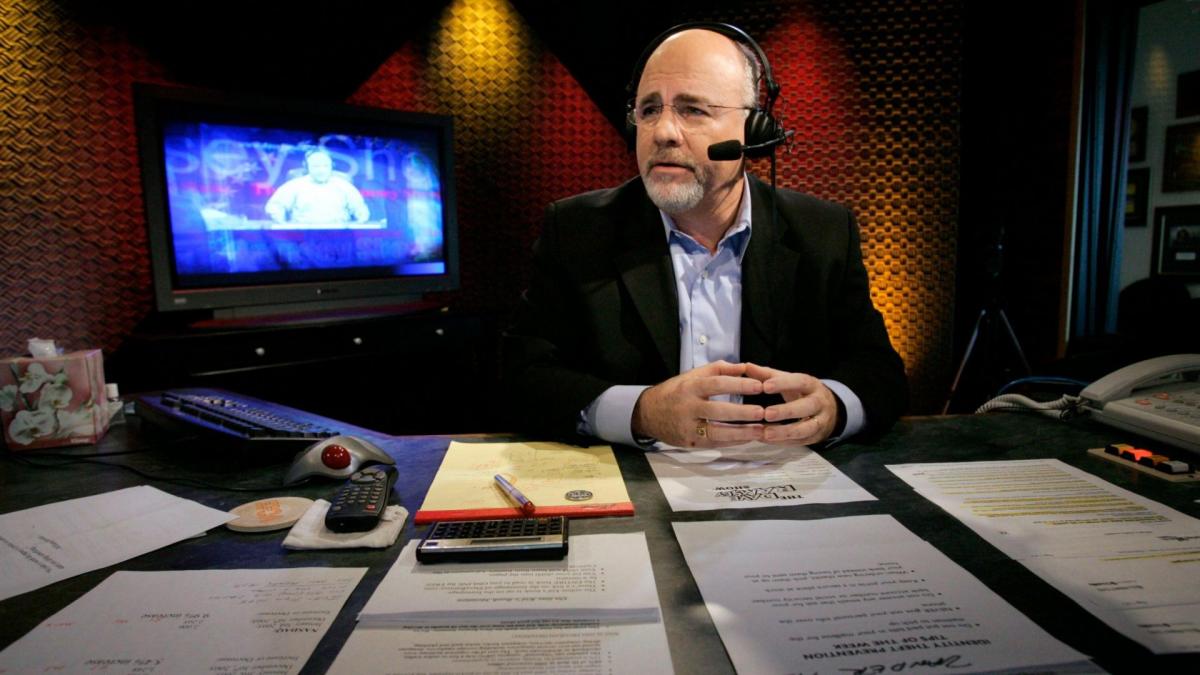

Dave Ramsey: Your Financial Freedom Guide

When it comes to mastering personal finance, few voices resonate as powerfully as Dave Ramsey. A beacon of financial wisdom, Ramsey has transformed the way countless Americans approach money management, offering practical, no-nonsense strategies that empower individuals to take control of their financial destiny.

Renowned for his straightforward advice and motivational approach, Ramsey has built a reputation as a trusted financial mentor. His comprehensive guidance goes beyond simple budgeting—he provides a holistic roadmap for financial recovery, debt elimination, and long-term wealth building.

From helping individuals break free from the chains of debt to creating sustainable budget plans, Ramsey's methods have helped millions reclaim their financial independence. His philosophy isn't just about numbers; it's about creating a life of financial peace and personal empowerment.

Whether you're struggling with overwhelming debt, looking to build an emergency fund, or dreaming of a debt-free future, Dave Ramsey offers the tools, strategies, and inspiration to turn your financial goals into reality.

Mastering Financial Freedom: Unveiling the Transformative Strategies of America's Money Guru

In the complex landscape of personal finance, navigating economic challenges requires more than just wishful thinking. Financial wisdom has become a critical skill in today's unpredictable economic environment, where individuals seek reliable guidance to transform their monetary trajectories and secure long-term financial stability.Unlock Your Financial Potential: Proven Strategies for Wealth and Security

The Financial Philosophy of Empowerment

Financial transformation begins with a fundamental mindset shift. Traditional approaches to money management often fail because they neglect the psychological barriers that prevent individuals from achieving financial success. By understanding the deep-rooted beliefs and emotional connections people have with money, financial experts like Dave Ramsey have developed revolutionary strategies that go beyond simple budgeting techniques. The core of this philosophy centers on personal accountability and intentional financial decision-making. Individuals must recognize that financial freedom is not about restricting spending, but about creating a purposeful relationship with money that aligns with long-term life goals. This approach requires a holistic understanding of personal finance that encompasses emotional intelligence, strategic planning, and consistent execution.Debt Elimination: A Strategic Approach to Financial Liberation

Debt represents more than just a numerical challenge; it's a psychological burden that constrains personal and professional potential. Comprehensive debt elimination strategies require a multifaceted approach that addresses both financial mechanics and psychological barriers. By developing a systematic method of debt reduction, individuals can progressively dismantle financial constraints and create pathways to economic freedom. The most effective debt elimination strategies involve creating structured repayment plans, negotiating with creditors, and implementing aggressive saving techniques. This process demands discipline, creativity, and a willingness to make challenging short-term sacrifices for long-term financial health. Successful debt management is not about perfection but consistent progress and strategic decision-making.Budgeting Beyond Spreadsheets: A Holistic Financial Framework

Modern budgeting transcends traditional spreadsheet calculations. It represents a comprehensive lifestyle approach that integrates financial planning with personal values and life objectives. Effective budgeting requires individuals to develop a nuanced understanding of their spending patterns, emotional triggers, and long-term financial aspirations. The most successful budgeting frameworks incorporate flexibility, allowing individuals to adapt to changing life circumstances while maintaining core financial principles. This approach recognizes that financial planning is not a static process but a dynamic journey of continuous learning and adaptation. By creating personalized budgeting strategies that align with individual goals, people can transform their relationship with money.Investment Strategies for Long-Term Wealth Creation

Wealth creation extends far beyond simple savings and requires a sophisticated understanding of investment principles. Successful investors develop comprehensive strategies that balance risk management with growth potential. This involves diversifying investment portfolios, understanding market dynamics, and maintaining a long-term perspective that transcends short-term market fluctuations. The most effective investment approaches combine rigorous research, calculated risk-taking, and a deep understanding of personal financial goals. By developing a nuanced investment strategy that aligns with individual risk tolerance and financial objectives, individuals can create sustainable pathways to long-term financial prosperity.Psychological Dimensions of Financial Success

Financial success is fundamentally a psychological journey that requires individuals to overcome deeply ingrained beliefs and behavioral patterns. Successful financial transformation involves developing emotional intelligence, cultivating resilience, and creating sustainable habits that support long-term economic goals. By understanding the psychological barriers that prevent financial growth, individuals can develop more effective strategies for wealth creation. This involves addressing underlying fears, challenging limiting beliefs, and creating a positive relationship with money that supports personal and professional aspirations.RELATED NEWS

Finance

Corruption Conviction: Ex-Austrian Finance Chief Karl-Heinz Grasser Faces Jail Time

2025-03-25 11:05:26

Finance

Customer Revolt: 20% of Financial Services Clients Slam Brands with Scathing Online Reviews

2025-05-04 23:01:00

Finance

Breaking Barriers: How Everyday Investors Can Now Access Elite Private Market Investments

2025-03-03 16:55:35