Energy Giants Collide: Chevron Stakes Significant Claim in Hess with Strategic 5% Stock Purchase

Finance

2025-03-17 14:02:57Content

In a bold move signaling unwavering confidence, Chevron has strategically increased its stock purchase of Hess, reinforcing its commitment to the pending $53 billion acquisition. The landmark all-stock deal, announced in October 2023, promises to be a game-changing transaction for the energy giant.

By acquiring Hess, Chevron is set to secure a lucrative stake in Guyana's prolific Stabroek block, a region renowned for its substantial oil reserves. Beyond this strategic offshore asset, the merger will also significantly expand Chevron's footprint in the competitive U.S. shale market, positioning the company for robust growth and enhanced operational diversity.

The stock purchase not only underscores Chevron's financial strength but also demonstrates its long-term vision in navigating the complex and dynamic global energy landscape. Investors and industry observers are closely watching this transformative deal, which could reshape the company's exploration and production capabilities.

Chevron's Strategic Leap: Hess Acquisition Signals Bold Energy Transformation

In the dynamic landscape of global energy markets, corporate strategic moves often reshape industry paradigms. Chevron's ambitious acquisition of Hess represents a pivotal moment in the petroleum sector, signaling a calculated expansion strategy that could potentially redefine the company's long-term growth trajectory and market positioning.Powering Future Growth: A Transformative Energy Partnership

The Strategic Rationale Behind the Merger

Chevron's proposed acquisition of Hess transcends mere corporate consolidation, representing a sophisticated strategic maneuver designed to amplify the company's global energy footprint. By targeting Hess's significant assets, particularly in the oil-rich Guyana's Stabroek block, Chevron is strategically positioning itself to capitalize on emerging hydrocarbon opportunities. The $53 billion all-stock transaction reflects a nuanced understanding of contemporary energy dynamics. Chevron's leadership recognizes that strategic asset acquisition is paramount in an increasingly competitive and volatile global energy marketplace. This merger isn't simply about expanding physical infrastructure but represents a calculated approach to securing future resource potential.Guyana's Stabroek Block: A Game-Changing Asset

The Stabroek block represents more than a geographical location; it embodies a transformative energy asset with immense potential. Spanning approximately 6.6 million acres, this offshore region has emerged as a significant hydrocarbon province, offering Chevron unprecedented exploration and production opportunities. Geological surveys and preliminary exploration data suggest substantial untapped reserves, positioning the Stabroek block as a critical component of Chevron's long-term strategic vision. By integrating Hess's existing infrastructure and exploration expertise, Chevron can accelerate development timelines and optimize resource extraction methodologies.Expanding Shale Footprint: A Domestic Strategy

Beyond international expansion, the Hess acquisition strategically enhances Chevron's domestic shale operations. The transaction provides immediate access to sophisticated extraction technologies and established production networks across key United States geological formations. This domestic expansion represents a calculated risk management strategy, allowing Chevron to diversify its energy portfolio while maintaining a robust presence in traditional hydrocarbon markets. The ability to seamlessly integrate Hess's shale assets demonstrates Chevron's commitment to technological innovation and operational efficiency.Financial and Market Implications

The $53 billion transaction signals profound confidence in future energy markets. By executing an all-stock deal, Chevron demonstrates financial prudence while maintaining flexibility in capital allocation. This approach minimizes immediate cash expenditure while providing shareholders with potential long-term value appreciation. Market analysts interpret this acquisition as a bold statement of Chevron's strategic vision. The move suggests anticipation of continued global energy demand, particularly in regions with emerging hydrocarbon potential. By securing assets in geographically diverse locations, Chevron is effectively hedging against potential market volatilities.Technological and Operational Synergies

The merger extends beyond physical asset consolidation, promising significant technological and operational synergies. Hess brings sophisticated exploration technologies, advanced geological mapping capabilities, and a proven track record of successful international energy development. Chevron's integration strategy focuses on leveraging complementary technological strengths, potentially accelerating innovation cycles and improving overall operational efficiency. This approach reflects a modern corporate philosophy that views mergers as opportunities for comprehensive organizational transformation.Environmental and Sustainability Considerations

While expanding hydrocarbon assets, Chevron simultaneously acknowledges growing environmental considerations. The acquisition includes potential investments in carbon capture technologies and sustainable energy transition strategies, demonstrating a nuanced approach to contemporary energy challenges. By strategically positioning itself across traditional and emerging energy domains, Chevron signals an adaptive strategy that balances immediate economic imperatives with long-term sustainability objectives. This holistic approach distinguishes the company in an increasingly complex global energy landscape.RELATED NEWS

Finance

Breaking Barriers: Latin America's Finance Queens Crowned in Groundbreaking Awards Ceremony

2025-03-07 04:13:27

Finance

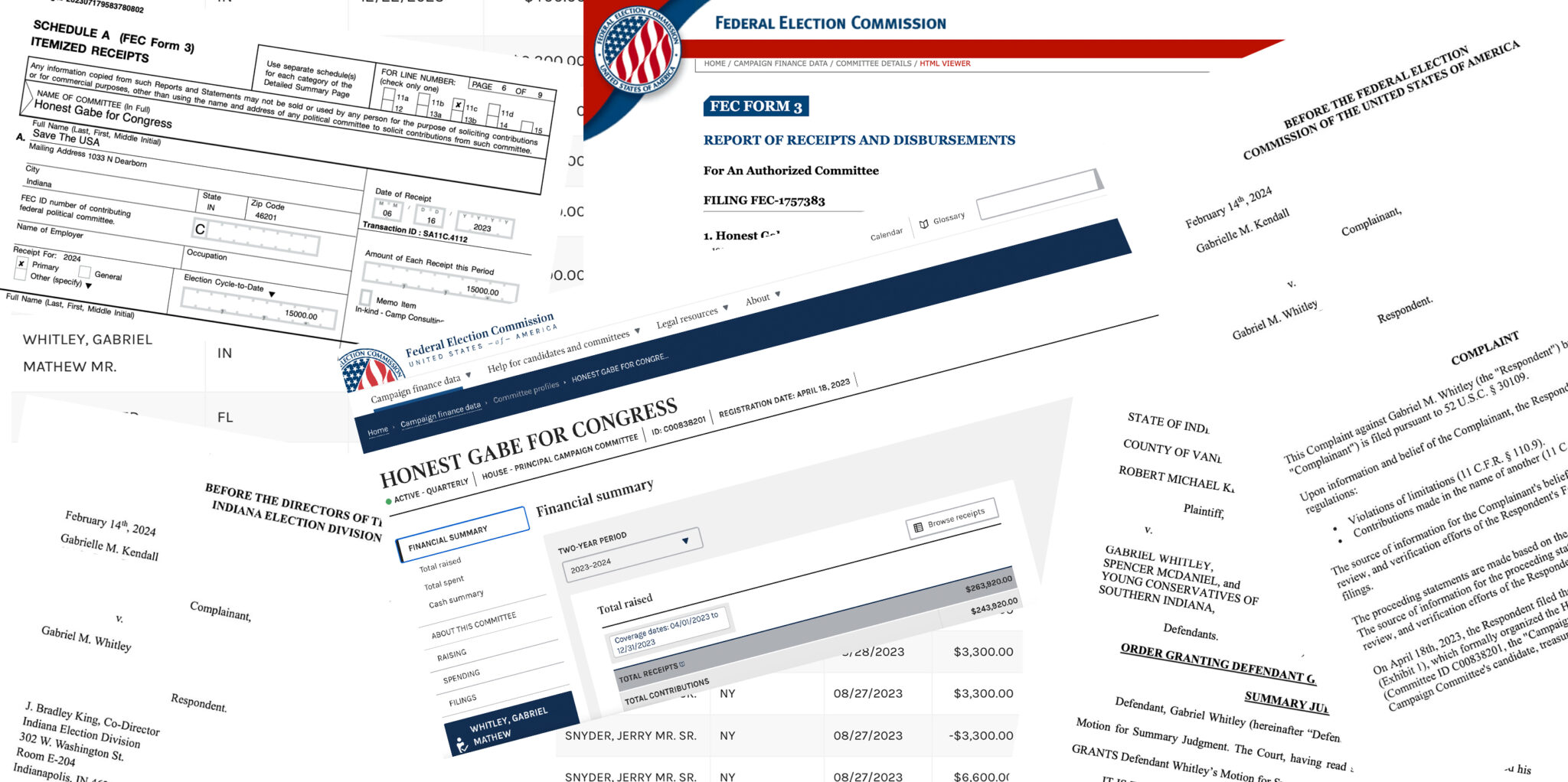

Campaign Cash Conspiracy: Ex-Indiana Candidate Faces Federal Prison for Financial Fraud

2025-04-29 22:36:03

Finance

Oil Production Stumbles: Mexico Falls Short of Crude Output Targets by Massive 129,000 Barrels Daily

2025-04-02 20:21:37