Breaking Barriers: How Women Are Rewriting the Financial Playbook

Finance

2025-03-15 15:13:29Content

Breaking Barriers: Women Powering Financial Empowerment

In today's dynamic economic landscape, women are emerging as powerful forces of financial transformation. Our special Dollars & Sense segment celebrates the remarkable journey of women in finance, shining a spotlight on their incredible contributions and the critical importance of financial literacy.

Financial empowerment isn't just about numbers—it's about breaking glass ceilings, challenging traditional narratives, and creating pathways for economic independence. Women across industries are redefining success, demonstrating that financial knowledge is a fundamental tool for personal and professional growth.

From pioneering investment strategies to leading groundbreaking financial institutions, women are proving that financial expertise knows no gender boundaries. By prioritizing financial education, understanding investment opportunities, and developing robust financial strategies, women are not just participating in the economic conversation—they're leading it.

Our mission is to inspire, educate, and empower women to take control of their financial futures. Through knowledge, confidence, and strategic planning, every woman can unlock her potential and create a more secure, prosperous tomorrow.

Empowering Women: Breaking Financial Barriers and Redefining Economic Success

In the complex landscape of modern finance, women are emerging as powerful agents of economic transformation, challenging traditional narratives and reshaping the financial ecosystem with unprecedented determination and strategic insight. The journey of financial empowerment represents more than just monetary achievement—it's a profound narrative of personal agency, professional resilience, and systemic change.Unlocking Financial Potential: A Revolutionary Path to Women's Economic Independence

The Evolving Landscape of Women in Finance

The financial world has long been dominated by male perspectives, creating systemic barriers that have historically marginalized women's economic contributions. However, recent decades have witnessed a remarkable shift, with women increasingly occupying leadership roles in financial institutions, investment firms, and entrepreneurial spaces. This transformation isn't merely about representation—it's a fundamental reimagining of economic potential. Contemporary research demonstrates that women bring unique strategic approaches to financial decision-making. Their investment strategies often emphasize long-term stability, risk mitigation, and holistic economic considerations. By integrating emotional intelligence with analytical precision, women are fundamentally restructuring traditional financial paradigms.Educational Empowerment and Financial Literacy

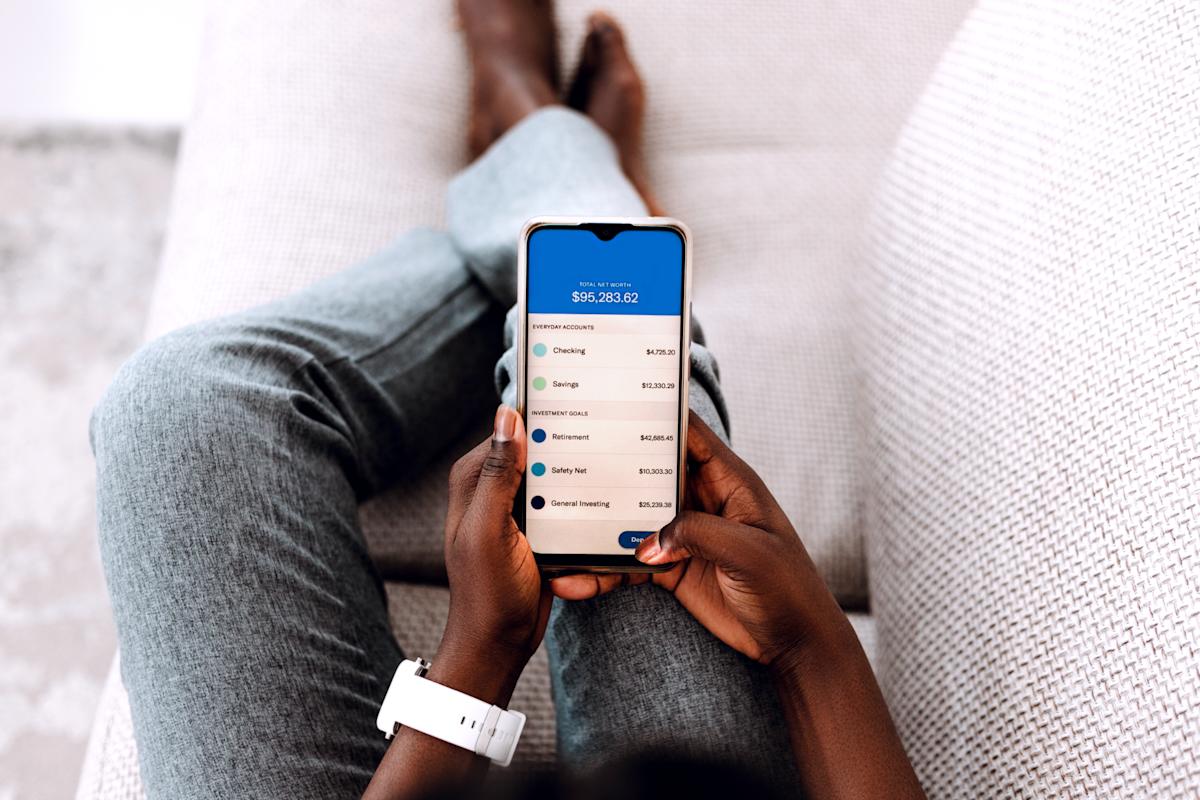

Financial literacy emerges as a critical cornerstone of women's economic empowerment. Educational initiatives are increasingly focusing on providing comprehensive financial education tailored specifically to women's unique economic experiences and challenges. These programs go beyond basic monetary management, exploring complex investment strategies, retirement planning, and entrepreneurial financing. Universities and professional organizations are developing specialized workshops, online courses, and mentorship programs designed to bridge knowledge gaps. By demystifying complex financial concepts and providing practical, actionable insights, these educational resources are creating pathways for women to gain confidence and competence in financial decision-making.Technological Innovation and Financial Access

Digital platforms and fintech innovations are dramatically transforming women's financial engagement. Mobile banking, investment apps, and online learning platforms are dismantling traditional barriers to financial participation. These technological tools provide unprecedented access to investment opportunities, financial education, and economic networks. Artificial intelligence and machine learning algorithms are also being developed with increased awareness of gender bias, creating more equitable financial assessment mechanisms. This technological evolution represents a significant step towards creating more inclusive and representative financial ecosystems.Entrepreneurial Resilience and Economic Impact

Women entrepreneurs are increasingly recognized as critical drivers of economic innovation and growth. Their businesses demonstrate remarkable resilience, often outperforming traditional male-led enterprises in sustainability and long-term strategic planning. By challenging conventional business models and introducing innovative approaches, women are reshaping economic landscapes across multiple sectors. Venture capital and investment platforms are progressively recognizing the immense potential of women-led businesses, with dedicated funding programs and support networks emerging to address historical funding disparities. These initiatives represent a fundamental reimagining of economic opportunity and potential.Psychological Dimensions of Financial Empowerment

Beyond monetary metrics, financial empowerment carries profound psychological implications. As women gain greater economic autonomy, they experience enhanced personal confidence, increased decision-making capabilities, and broader life opportunities. This holistic transformation extends far beyond individual economic achievements, creating ripple effects within families, communities, and broader societal structures. Psychological research highlights the transformative power of financial independence, demonstrating how economic agency correlates with improved mental health, increased personal satisfaction, and greater overall life resilience.RELATED NEWS

Finance

Wall Street's Hidden Blind Spot: Why Investors Might Be Underestimating Recession Risks

2025-04-19 12:30:20

Finance

Trade Tensions Thaw? Beijing Hints at Diplomatic Breakthrough with Washington

2025-04-16 09:21:35