Green Money Revolution: How $2.58 Trillion Will Reshape Sustainable Finance by 2030

Finance

2025-03-14 09:14:00Content

Sustainable Finance Market Poised for Explosive Growth, Projected to Reach $2.58 Trillion by 2030

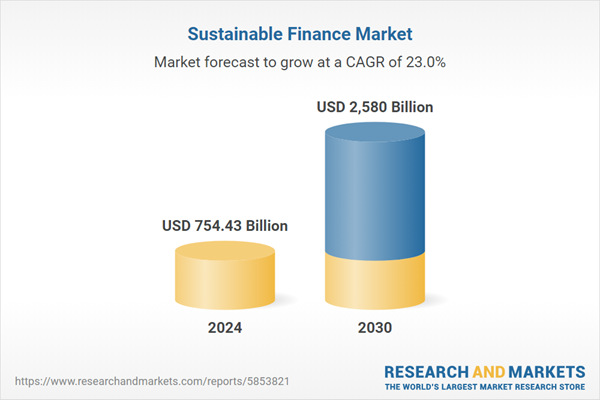

In a groundbreaking market analysis released today, the sustainable finance sector is set to undergo a remarkable transformation, with projections indicating a staggering leap from $754.43 billion in 2024 to an impressive $2.58 trillion by 2030.

Market Dynamics and Key Players

The comprehensive report, now available through ResearchAndMarkets.com, offers an in-depth exploration of the sustainable finance landscape, featuring detailed profiles of industry powerhouses including:

- BlackRock

- State Street Corporation

- Morgan Stanley

- UBS

- JPMorgan Chase & Co.

These financial giants are at the forefront of driving sustainable investment strategies, reshaping the global financial ecosystem with innovative approaches to environmentally and socially responsible investing.

Market Outlook

The report highlights a robust compound growth trajectory, signaling unprecedented opportunities for investors, financial institutions, and sustainability-focused organizations. As global awareness of environmental and social governance (ESG) continues to grow, the sustainable finance market is positioned for transformative expansion.

Investors and industry stakeholders can access the full "Sustainable Finance Market Size, Share & Trends Analysis Report 2025-2030" for comprehensive insights into this dynamic and rapidly evolving market.

Green Finance Revolution: Transforming Global Investment Landscapes

In an era of unprecedented environmental challenges and shifting economic paradigms, the sustainable finance sector emerges as a critical catalyst for global economic transformation. As investors, corporations, and governments increasingly recognize the imperative of aligning financial strategies with environmental sustainability, a profound revolution is unfolding that promises to reshape how capital is deployed and valued in the 21st century.Unleashing the Power of Sustainable Investment: A Financial Frontier Redefined

The Emerging Sustainable Finance Ecosystem

The sustainable finance landscape represents a sophisticated convergence of financial innovation, environmental consciousness, and strategic investment approaches. Unlike traditional financial models, this emerging ecosystem integrates comprehensive environmental, social, and governance (ESG) considerations into investment decision-making processes. Major financial institutions like BlackRock, JPMorgan Chase, and Morgan Stanley are pioneering transformative strategies that transcend conventional profit-driven methodologies. Financial experts are witnessing an unprecedented paradigm shift where sustainability is no longer a peripheral consideration but a core strategic imperative. Institutional investors are increasingly recognizing that long-term financial performance is intrinsically linked to environmental stewardship and social responsibility.Market Dynamics and Growth Projections

Sophisticated market analysis reveals a remarkable trajectory for sustainable finance. Projections indicate an extraordinary expansion from approximately $754 billion in 2024 to an anticipated $2.58 trillion by 2030, representing a compound annual growth rate that underscores the sector's immense potential. This exponential growth reflects a fundamental restructuring of global investment philosophies. The driving forces behind this remarkable expansion include heightened environmental awareness, regulatory frameworks promoting sustainable practices, and increasing investor demand for responsible investment vehicles. Technological advancements and innovative financial instruments are further accelerating this transformative trend.Technological Innovation and Sustainable Investment

Cutting-edge technologies are playing a pivotal role in advancing sustainable finance. Artificial intelligence, blockchain, and advanced data analytics are enabling more sophisticated ESG assessment methodologies, providing unprecedented transparency and precision in evaluating investment opportunities. Financial technology platforms are developing increasingly complex algorithms capable of measuring and quantifying sustainability metrics with remarkable accuracy. These technological innovations are dismantling traditional barriers and creating more accessible, comprehensive sustainable investment ecosystems.Global Institutional Perspectives

Leading financial institutions are recalibrating their strategic approaches to embrace sustainable finance. Companies like State Street Corporation and UBS are developing comprehensive frameworks that integrate rigorous sustainability criteria into their investment portfolios. These institutional strategies extend beyond mere compliance, representing a holistic reimagining of financial value creation. By prioritizing long-term environmental and social impacts, these organizations are demonstrating that sustainable investments can deliver competitive financial returns while contributing to global sustainability objectives.Regulatory Landscape and Future Outlook

Global regulatory environments are rapidly evolving to support and incentivize sustainable finance initiatives. Governments worldwide are implementing progressive policies that encourage green investments, carbon pricing mechanisms, and stringent environmental reporting standards. The convergence of regulatory support, technological innovation, and shifting investor sentiments suggests that sustainable finance is not merely a transient trend but a fundamental restructuring of global financial systems. As awareness grows and technologies advance, the potential for transformative impact becomes increasingly apparent.Challenges and Opportunities

Despite remarkable progress, the sustainable finance sector confronts significant challenges. These include standardizing ESG measurement methodologies, addressing potential greenwashing concerns, and developing more sophisticated financial instruments. However, these challenges also represent extraordinary opportunities for innovation, collaboration, and strategic differentiation. Forward-thinking organizations that can effectively navigate these complexities are positioned to become leaders in this emerging financial frontier.RELATED NEWS

Budget Battle Ignites: Smotrich's US Trip Amid Israeli Financial Tensions