Open Finance Revolution: FDATA Urges Canada to Chart Bold Financial Future in Budget 2025

Finance

2025-03-12 15:58:16Content

In a passionate call for financial innovation, FDATA North America is pushing Canada's Department of Finance to accelerate the implementation of Open Finance. The organization has submitted a compelling response during the 2025 pre-budget consultation, emphasizing the urgent need to expedite the Open Finance framework.

By urging the government to "hasten" the delivery of Open Finance, FDATA North America highlights the critical importance of modernizing the financial ecosystem. The recommendation aims to create a more dynamic, interconnected, and consumer-friendly financial landscape that empowers Canadians with greater control over their financial data and services.

The organization's proactive stance underscores the potential transformative impact of Open Finance, which could revolutionize how Canadians interact with financial institutions, access services, and manage their personal finances. Their pre-budget consultation response serves as a strategic plea for progressive financial policy and technological advancement.

Accelerating Open Finance: FDATA North America's Bold Call to Canadian Policymakers

In the rapidly evolving landscape of financial technology, the push for Open Finance has become a critical catalyst for innovation, transparency, and consumer empowerment. As financial ecosystems worldwide continue to transform, organizations like FDATA North America are playing a pivotal role in advocating for progressive regulatory frameworks that can unlock unprecedented opportunities for economic growth and technological advancement.Transforming Financial Ecosystems: A Urgent Plea for Rapid Implementation

The Strategic Imperative of Open Finance

Open Finance represents a paradigm shift in how financial services are conceptualized, delivered, and experienced. By breaking down traditional data silos and enabling secure, consumer-authorized data sharing, this revolutionary approach promises to democratize financial services, enhance consumer choice, and foster unprecedented levels of innovation. The potential implications extend far beyond mere technological upgrades, representing a fundamental reimagining of financial interactions in the digital age. Financial institutions, technology providers, and regulatory bodies are increasingly recognizing that Open Finance is not just a trend, but a strategic necessity. The ability to seamlessly and securely exchange financial information creates opportunities for personalized financial products, more efficient risk assessment, and enhanced customer experiences that were previously unimaginable.Canada's Open Finance Landscape: Challenges and Opportunities

The Canadian financial ecosystem stands at a critical juncture, with significant potential for transformative change. FDATA North America's urgent communication to the Department of Finance underscores the growing momentum and necessity for accelerated Open Finance implementation. By expediting regulatory frameworks and creating supportive infrastructure, Canada has the opportunity to position itself as a global leader in financial innovation. The complexity of implementing Open Finance cannot be understated. It requires intricate coordination between multiple stakeholders, robust technological infrastructure, and comprehensive regulatory guidelines that balance innovation with consumer protection. FDATA's advocacy highlights the critical need for proactive, forward-thinking approaches that can navigate these multifaceted challenges.Technological and Regulatory Synergies

The successful implementation of Open Finance demands a holistic approach that integrates cutting-edge technological capabilities with sophisticated regulatory mechanisms. Advanced APIs, blockchain technologies, and sophisticated data governance frameworks will be instrumental in creating secure, transparent, and efficient financial ecosystems. Regulatory bodies must develop nuanced frameworks that protect consumer interests while simultaneously fostering an environment of innovation. This delicate balance requires ongoing dialogue, collaborative policymaking, and a willingness to adapt to rapidly changing technological landscapes.Global Context and Competitive Positioning

Internationally, countries are increasingly recognizing Open Finance as a critical driver of financial sector modernization. By responding to FDATA's recommendations, Canada has an opportunity to align itself with global best practices and potentially leapfrog competitors in creating a more dynamic, inclusive financial services environment. The economic implications are profound. Enhanced data sharing and interoperability can reduce friction in financial transactions, lower barriers to entry for innovative financial products, and create more personalized, responsive financial services that meet the evolving needs of consumers and businesses alike.Consumer Empowerment and Financial Inclusion

At its core, Open Finance is about empowering consumers. By providing individuals with greater control and transparency over their financial data, this approach can democratize access to financial services, support more informed decision-making, and create pathways for previously underserved populations to engage more effectively with financial systems. The potential for personalized financial products, more competitive pricing, and enhanced user experiences represents a fundamental shift in how financial services are conceptualized and delivered. FDATA's advocacy is not just about technological implementation, but about creating a more equitable, accessible financial ecosystem.RELATED NEWS

Finance

Treasury Truce: Japan Signals No Financial Warfare in US Trade Negotiations

2025-05-04 18:00:29

Finance

Breaking: How Milliken Revolutionized Finance with a Bold Business Planning Transformation

2025-04-01 09:20:00

Finance

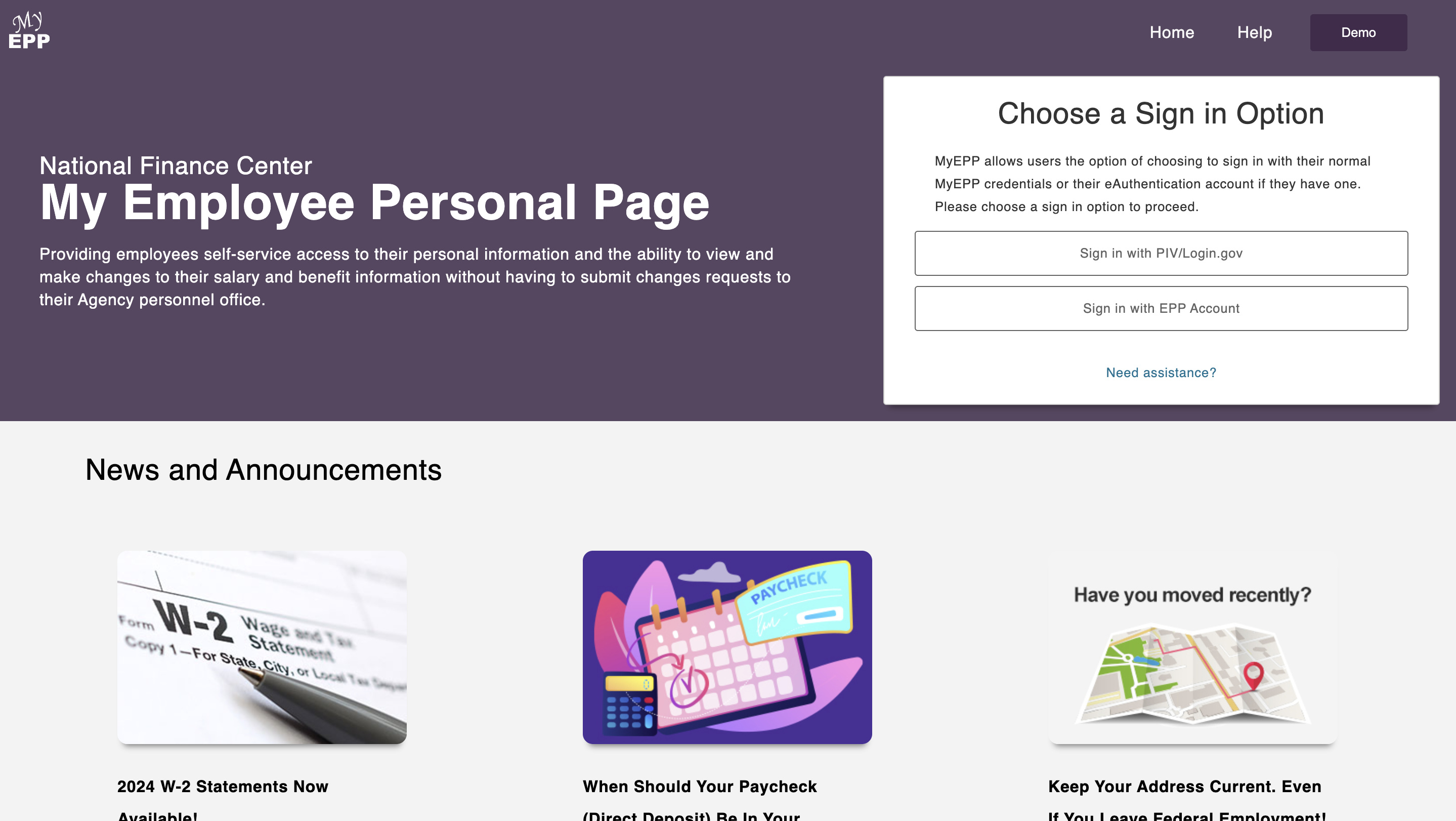

Phishing Scheme Exposes Massive Federal Employee Data Breach at National Finance Center

2025-03-21 17:11:01