Navigating the Insurance Maze: Your Ultimate Survival Guide

Health

2025-02-18 18:00:00Content

Navigating the Complex World of Health Insurance: A Patient's Journey

Health insurance can feel like an intricate maze that tests even the most patient individuals. What should be a straightforward process of accessing medical care often transforms into an emotional rollercoaster of complex paperwork, confusing billing statements, and the frustrating experience of navigating denied claims.

Patients find themselves caught in a web of administrative challenges that can quickly drain their emotional energy. Each form to fill out, each phone call to an insurance representative, and each unexpected bill becomes a potential source of stress and anxiety. The system that should support healthcare access can paradoxically become a barrier, leaving many feeling overwhelmed and discouraged.

From deciphering medical codes to understanding coverage details, individuals must become part-time experts in insurance bureaucracy. The mental toll of this process can be as exhausting as the medical conditions they're seeking treatment for, turning what should be a focus on healing into a battle with paperwork and bureaucratic hurdles.

Understanding and advocating for oneself becomes crucial in this complex landscape, where knowledge and persistence can make the difference between financial burden and manageable healthcare expenses.

Unraveling the Healthcare Insurance Maze: A Deep Dive into Patient Struggles

In the complex landscape of modern healthcare, patients find themselves navigating an increasingly challenging terrain where insurance bureaucracy often becomes a formidable obstacle to accessing essential medical services. The intricate web of claims, paperwork, and administrative hurdles has transformed what should be a straightforward healthcare experience into an emotionally and financially draining journey.Breaking Through the Barriers: Understanding Healthcare Insurance Complexities

The Psychological Toll of Insurance Navigation

Healthcare insurance has evolved into a labyrinthine system that systematically challenges patients' mental resilience. Individuals confronting chronic conditions or unexpected medical emergencies frequently encounter a gauntlet of administrative challenges that test their emotional fortitude. The constant negotiation between medical providers, insurance companies, and patients creates a high-stress environment where healing becomes secondary to bureaucratic compliance. The psychological impact of insurance complexities cannot be understated. Patients often experience heightened anxiety, feelings of helplessness, and emotional exhaustion while attempting to decipher intricate claim processes. Each denied claim represents not just a financial setback but a profound emotional burden that can significantly impede an individual's overall wellness journey.Decoding the Insurance Claims Landscape

Modern healthcare insurance operates within a sophisticated ecosystem characterized by complex algorithms, intricate documentation requirements, and seemingly arbitrary approval processes. Patients must become quasi-experts in medical billing, understanding nuanced terminology and developing strategic approaches to navigate claim submissions effectively. Insurance companies employ sophisticated risk assessment models that frequently prioritize financial considerations over patient care. This approach creates a systemic challenge where medical necessity becomes secondary to cost-containment strategies. Patients find themselves engaged in a perpetual negotiation, advocating for their right to comprehensive medical treatment while confronting institutional resistance.Technological Innovations in Insurance Claims Management

Emerging technological solutions are gradually transforming the insurance claims landscape. Advanced artificial intelligence and machine learning algorithms are being developed to streamline claim processing, reduce administrative overhead, and provide more transparent communication channels between patients, healthcare providers, and insurance companies. Digital platforms now offer patients unprecedented access to real-time claim tracking, personalized guidance, and automated support systems. These technological interventions aim to demystify the insurance process, empowering individuals with greater understanding and control over their healthcare financial management.Systemic Challenges and Potential Reforms

The current healthcare insurance framework reveals profound systemic inefficiencies that demand comprehensive reform. Policymakers and healthcare advocates are increasingly calling for transformative approaches that prioritize patient experience, reduce administrative complexity, and create more compassionate, patient-centered insurance models. Potential reforms include standardizing claim submission processes, implementing more transparent pricing mechanisms, and developing more flexible coverage options that adapt to diverse patient needs. These proposed changes represent a critical step towards reimagining healthcare insurance as a supportive ecosystem rather than an adversarial system.Patient Empowerment Strategies

Individuals can adopt proactive strategies to mitigate insurance-related challenges. This involves developing comprehensive documentation practices, maintaining meticulous medical records, understanding policy details comprehensively, and cultivating assertive communication skills when interacting with insurance representatives. Patient advocacy groups and online resources are emerging as powerful support networks, providing guidance, sharing experiences, and collectively challenging systemic inefficiencies. By fostering community-driven knowledge exchange, patients can develop more effective strategies for navigating the complex insurance landscape.RELATED NEWS

Health

Breaking: Compassionate Alternatives Emerge to Challenge Forced Mental Health Interventions

2025-03-31 08:35:00

Health

Deadly Measles Strikes West Texas: First Fatality Confirmed in Ongoing Outbreak

2025-02-26 15:22:30

Health

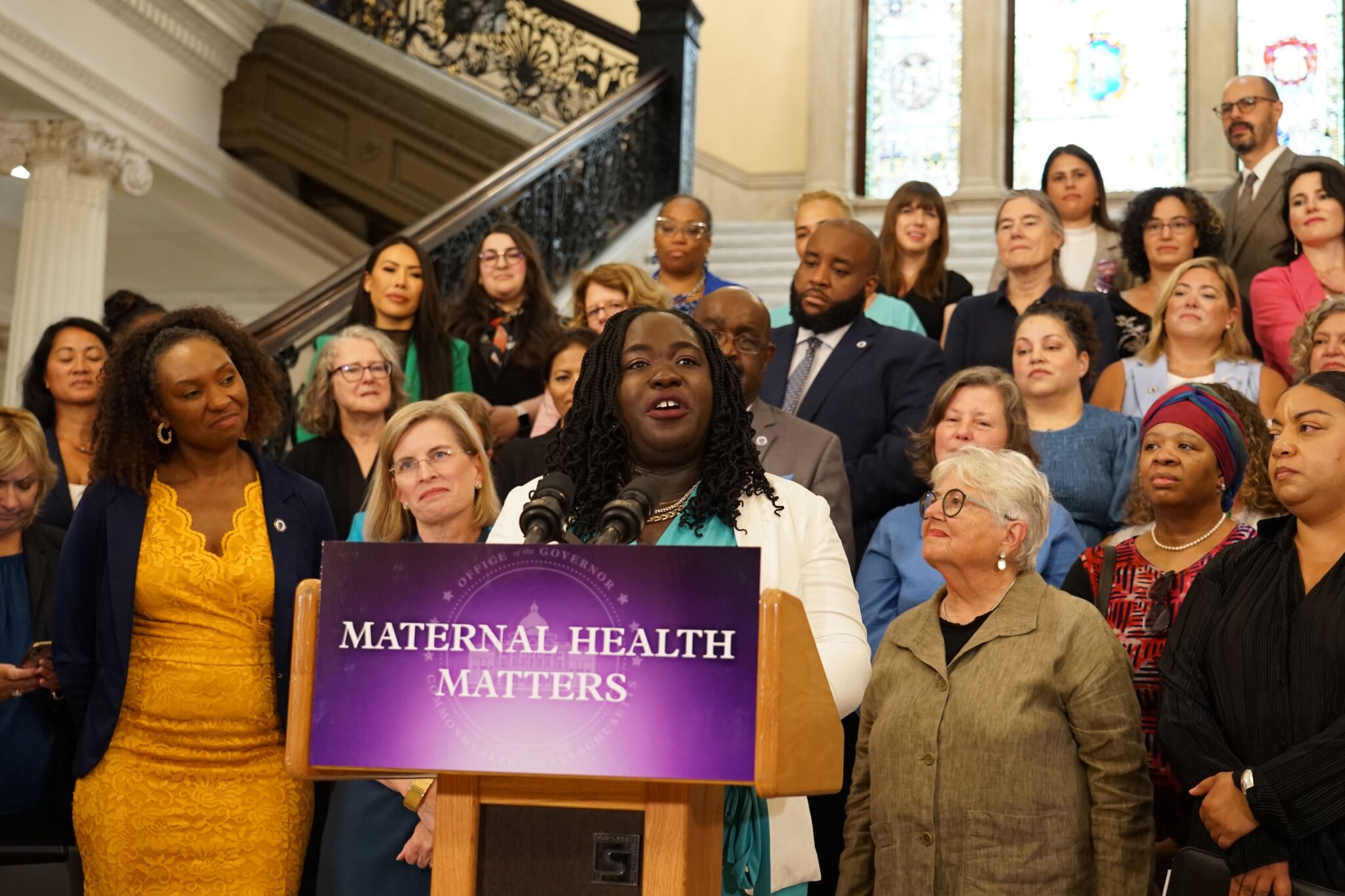

Battling Silence: Black Maternal Health Warriors Defy Funding Cuts to Save Lives

2025-04-18 23:27:44