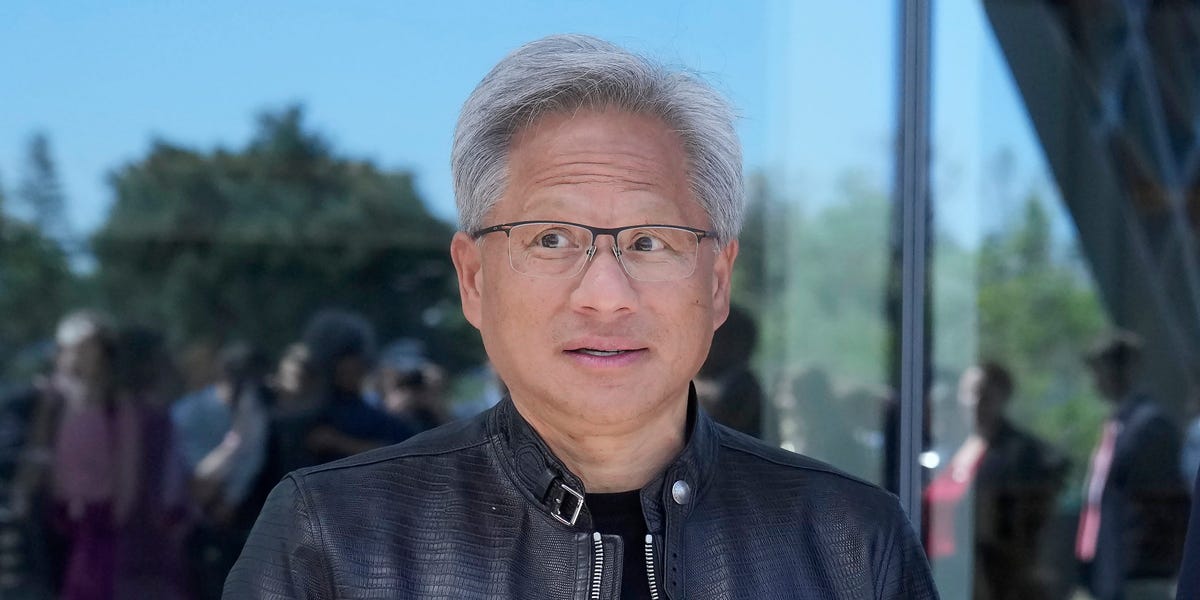

Wall Street Titan Paul Singer Declares War on AI's Golden Child: Nvidia's Bubble About to Burst?

Business

2025-02-18 16:23:13Content

Elliott Management, the renowned activist investment firm, reportedly held a substantial stake in Nvidia with potential downside exposure estimated at a staggering $600 million by the end of December, according to financial analysts. The significant position highlights the firm's strategic interest in one of the most dynamic technology stocks in the current market landscape.

The investment underscores Elliott Management's continued confidence in the semiconductor industry, particularly in Nvidia, which has been experiencing remarkable growth driven by artificial intelligence and advanced computing technologies. While the exact details of the investment remain closely guarded, the reported exposure suggests a calculated approach by the hedge fund to capitalize on Nvidia's potential market movements.

Investors and market watchers are closely monitoring Elliott's positioning, as the firm is known for its strategic investments and ability to influence corporate strategies. The substantial stake in Nvidia reflects the ongoing technological revolution and the increasing importance of graphics processing and AI-related technologies in the global tech ecosystem.

Wall Street's Billion-Dollar Bet: Elliott Management's Audacious Nvidia Gamble Unveiled

In the high-stakes world of financial investments, hedge fund titans like Elliott Management continue to make strategic moves that capture the attention of market watchers and investors alike. The firm's substantial positioning in technology stocks represents a calculated risk that could potentially reshape investment strategies in the rapidly evolving tech landscape.Navigating the High-Voltage Tech Investment Frontier

The Strategic Landscape of Tech Investment

Elliott Management has emerged as a formidable player in the technology investment arena, demonstrating remarkable insight and strategic acumen. The firm's substantial exposure to Nvidia, estimated at a staggering $600 million, signals a profound confidence in the semiconductor giant's potential for growth and market dominance. This investment represents more than a mere financial transaction; it's a calculated bet on the future of technological innovation. The semiconductor industry has been experiencing unprecedented transformation, with artificial intelligence and machine learning driving exponential demand for advanced computing capabilities. Nvidia, positioned at the epicenter of this technological revolution, has become a beacon of potential for sophisticated investors seeking to capitalize on emerging technological trends.Decoding Elliott Management's Investment Philosophy

Hedge funds like Elliott Management are renowned for their meticulous research and forward-thinking investment strategies. Their substantial commitment to Nvidia reflects a deep understanding of the company's potential to revolutionize computing infrastructure. By allocating such a significant financial resource, the firm demonstrates its belief in Nvidia's capacity to generate substantial returns. The investment goes beyond traditional financial metrics, representing a nuanced assessment of technological potential. Nvidia's leadership in graphics processing units (GPUs) and artificial intelligence technologies makes it an attractive target for sophisticated investors seeking to position themselves at the forefront of technological innovation.Market Dynamics and Technological Convergence

The technology sector continues to experience rapid transformation, with artificial intelligence and advanced computing becoming increasingly critical across multiple industries. Nvidia's strategic positioning in these domains makes it an attractive investment target for forward-thinking financial institutions. Elliott Management's substantial investment suggests a comprehensive understanding of the broader technological ecosystem. By committing significant capital to Nvidia, the firm is not merely making a financial bet but positioning itself at the intersection of technological innovation and financial opportunity.Risk and Potential in Tech Investments

While the $600 million investment represents a significant financial commitment, it also underscores the potential rewards of strategic technological investments. Hedge funds like Elliott Management are uniquely positioned to identify and capitalize on emerging market trends, leveraging sophisticated analytical tools and deep industry insights. The technology sector's inherent volatility requires a nuanced approach to investment. Elliott Management's substantial exposure to Nvidia demonstrates a calculated risk management strategy that balances potential rewards with comprehensive market analysis.Future Implications and Market Speculation

As the technological landscape continues to evolve, investments like Elliott Management's Nvidia position offer fascinating insights into the future of financial strategy. The semiconductor industry stands at a critical juncture, with artificial intelligence and advanced computing driving unprecedented innovation. Investors and market analysts will undoubtedly continue to monitor this strategic investment, recognizing it as a potential bellwether for future technological and financial trends. Elliott Management's bold move serves as a testament to the complex and dynamic nature of modern investment strategies.RELATED NEWS

Business

Local Entrepreneur Transforms Hometown Roots into Educational Partnership

2025-03-26 00:00:00

Business

AI Shopping Revolution: Amazon's Rufus Set to Unleash $700M Revenue Windfall

2025-04-03 17:06:47

Business

Bracket Fever: How NCAA Tournament Turns UP Bars into Economic Hotspots

2025-03-21 23:38:48