Beyond Tech Titans: How the 2025 Market Rally Is Reshaping Investment Landscapes

Finance

2025-02-18 16:02:33Content

As the new year unfolds, investors are witnessing an exciting transformation in the stock market landscape. What was once a narrow rally dominated by a handful of tech giants has now blossomed into a more inclusive and diverse market rally.

The early days of 2025 are revealing a promising trend: market gains are spreading across multiple sectors, signaling a robust and healthier investment environment. No longer are a few mega-cap technology stocks carrying the entire market's momentum. Instead, a broader range of companies and industries are participating in the upward trajectory.

This broadening market participation is a positive sign for investors, suggesting increased economic confidence and a more balanced investment ecosystem. Sectors like healthcare, industrials, and emerging technologies are now joining the rally, creating more opportunities for diversified investment strategies.

Analysts are optimistic about this development, viewing it as a potential indicator of sustained economic growth and market resilience. The shift from a concentrated to a more distributed market rally could mean more stable and sustainable returns for investors in the coming months.

As always, prudent investors should continue to monitor market trends, diversify their portfolios, and remain adaptable to the ever-changing financial landscape.

Market Momentum: Unveiling the Expansive Landscape of 2025's Investment Horizon

In the dynamic realm of financial markets, 2025 emerges as a pivotal year of transformation, where investment strategies are rapidly evolving and traditional paradigms are being challenged by unprecedented economic shifts and technological disruptions.Navigating the Complex Terrain of Financial Growth and Opportunity

The Emerging Diversification Phenomenon

The contemporary financial ecosystem is experiencing a remarkable metamorphosis, characterized by an unprecedented breadth of market participation. Investors are no longer confined to traditional investment vehicles, but are exploring a multifaceted landscape that encompasses emerging technologies, sustainable sectors, and innovative financial instruments. This expansive approach represents a fundamental reimagining of portfolio construction, where risk mitigation and potential growth are strategically balanced. Sophisticated investors are increasingly recognizing the importance of holistic investment strategies that transcend conventional sector-specific approaches. The market's current trajectory suggests a more nuanced understanding of interconnected economic systems, where technological innovation, geopolitical dynamics, and environmental considerations converge to create complex yet potentially lucrative investment opportunities.Technological Disruption and Market Expansion

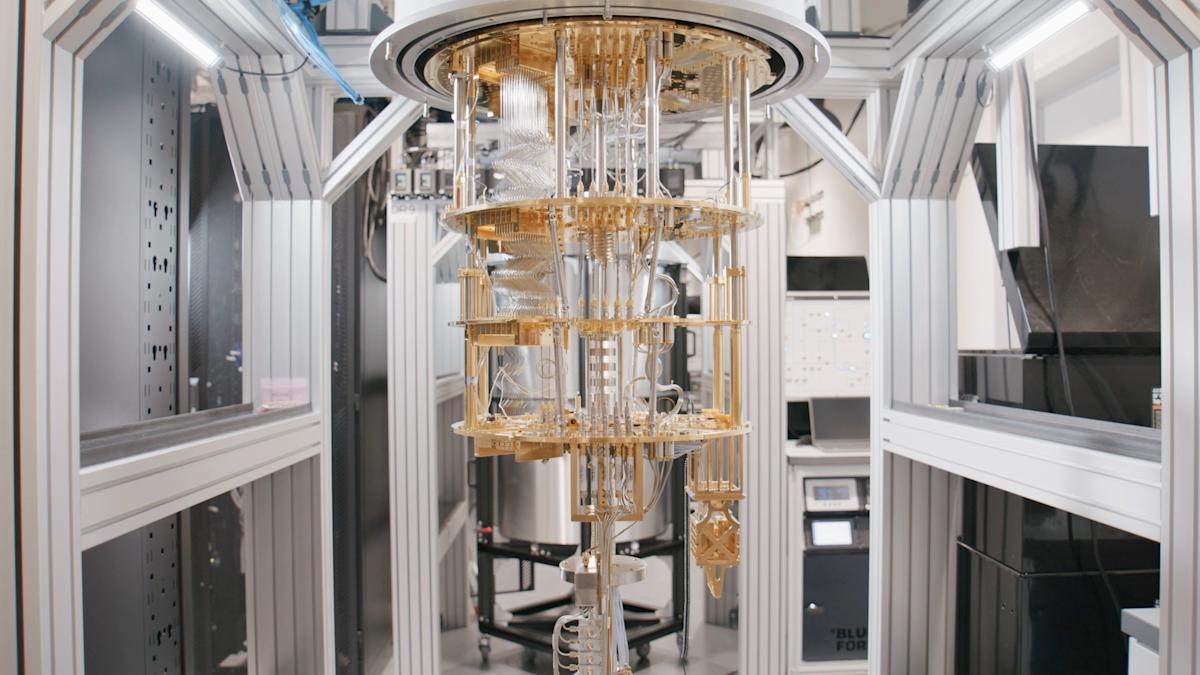

The technological revolution continues to reshape financial markets, introducing unprecedented levels of accessibility and sophistication. Artificial intelligence, blockchain technologies, and advanced data analytics are transforming how investors perceive and interact with financial ecosystems. These technological advancements are not merely tools but fundamental catalysts driving market expansion and redefining traditional investment paradigms. Machine learning algorithms and predictive analytics are enabling more granular market insights, allowing investors to make more informed decisions with greater precision. The democratization of financial information means that sophisticated investment strategies are no longer the exclusive domain of institutional investors but are increasingly accessible to a broader range of market participants.Sustainable Investment: Beyond Traditional Metrics

The investment landscape of 2025 is fundamentally characterized by a profound shift towards sustainable and socially responsible investing. Environmental, social, and governance (ESG) considerations are no longer peripheral considerations but central components of comprehensive investment strategies. Investors are increasingly evaluating potential opportunities through a multidimensional lens that considers long-term societal impact alongside financial performance. This holistic approach represents a significant departure from traditional investment methodologies, where financial returns were the sole determinative factor. The emerging investment paradigm recognizes the intrinsic interconnectedness of economic systems, environmental sustainability, and social responsibility.Global Economic Recalibration

The global economic landscape is experiencing a profound recalibration, with emerging markets playing an increasingly significant role in shaping investment opportunities. Geopolitical dynamics, technological innovations, and shifting demographic patterns are creating a complex yet potentially rewarding investment environment. Investors must develop adaptive strategies that can navigate the nuanced and often unpredictable global economic terrain. This requires a sophisticated understanding of international markets, technological trends, and the complex interplay of economic, social, and technological factors.Risk Management in a Dynamic Environment

Contemporary risk management strategies have evolved beyond traditional hedging techniques. The modern investor must develop a comprehensive approach that integrates advanced predictive modeling, scenario analysis, and adaptive strategic frameworks. This requires a holistic understanding of potential risks across technological, environmental, and geopolitical domains. The ability to anticipate and strategically respond to potential disruptions has become a critical competency for investors seeking to maintain competitive advantage in an increasingly complex global marketplace.RELATED NEWS

Finance

Conflict of Interest? Campaign Finance Board Member Steps Back from Adams Case After Critical Op-Ed

2025-04-15 17:39:58

Finance

Dogecoin's Brutal Blow: The Unexpected Sector Crumbling Under Crypto Cuts

2025-02-22 16:10:53