Skateboard Legend to Wall Street Guru: Tony Hawk's Radical Investment Playbook

Finance

2025-03-10 12:15:00Content

Soar to Financial Success: The Birdman's Guide to Wealth Mastery

Imagine transforming your financial landscape with the wisdom of a true investment maverick. The Birdman isn't just another financial advisor—he's a revolutionary thinker who sees wealth creation as an art form of strategic planning and bold action.

With decades of experience navigating complex market terrains, the Birdman has developed a unique approach that goes beyond traditional investment strategies. His philosophy is simple yet powerful: wealth isn't about following the crowd, but about understanding the subtle currents of opportunity that most investors overlook.

Key insights from the Birdman's playbook include:

• Identifying hidden market potential

• Developing a fearless investment mindset

• Creating multiple streams of passive income

• Turning financial challenges into strategic advantages

Whether you're a budding investor or a seasoned financial professional, the Birdman's strategies can help you break through traditional limitations and elevate your wealth to unprecedented heights. His methods aren't about quick fixes, but sustainable, long-term financial transformation.

Are you ready to spread your financial wings and soar beyond conventional boundaries? Let the Birdman be your guide to a more prosperous, empowered financial future.

Soaring to Financial Success: Mastering Wealth Creation Like a Pro

In the complex landscape of personal finance, navigating the path to wealth requires more than just traditional strategies. Today's financial warriors need innovative approaches, strategic thinking, and a mindset that transcends conventional wisdom to truly unlock their economic potential.Transform Your Financial Destiny with Proven Wealth-Building Strategies

Decoding the Psychology of Wealth Accumulation

Wealth creation is fundamentally a mental game that extends far beyond simple monetary transactions. Successful individuals understand that financial prosperity begins in the mind, with a robust psychological framework that embraces risk, cultivates resilience, and maintains an unwavering commitment to long-term goals. The most successful investors don't just calculate numbers; they develop a holistic perspective that integrates emotional intelligence with strategic financial planning. Psychological preparedness involves developing a growth mindset that views challenges as opportunities for learning and expansion. This approach requires individuals to reframe setbacks as valuable lessons, maintaining emotional equilibrium during market fluctuations and personal financial challenges. By cultivating mental fortitude, investors can make rational decisions that are not driven by fear or impulsive reactions.Strategic Investment Frameworks for Modern Wealth Builders

Contemporary wealth creation demands a multifaceted approach that goes beyond traditional investment models. Diversification is no longer just about spreading investments across different asset classes, but about creating a dynamic portfolio that adapts to rapidly changing economic landscapes. Successful investors now integrate technology-driven insights, predictive analytics, and emerging market trends into their strategic planning. Modern wealth builders leverage digital platforms, artificial intelligence, and data-driven insights to make informed investment decisions. They understand that technology has democratized financial information, providing unprecedented access to global markets and investment opportunities. By embracing these technological tools, individuals can develop more sophisticated, nuanced investment strategies that maximize potential returns while mitigating risks.Developing Multiple Income Streams in the Digital Economy

The contemporary financial ecosystem offers unprecedented opportunities for generating diverse income streams. Traditional employment models are rapidly evolving, with digital platforms enabling individuals to create multiple revenue channels beyond conventional job structures. Successful wealth creators recognize the importance of developing passive income sources that generate consistent financial returns with minimal ongoing effort. This approach might involve creating digital products, developing online courses, investing in dividend-generating stocks, exploring real estate investment trusts, or leveraging affiliate marketing strategies. The key is to build a flexible, adaptable income portfolio that can withstand economic fluctuations and provide consistent financial growth.Risk Management and Intelligent Financial Planning

Effective wealth creation is intrinsically linked to sophisticated risk management techniques. Modern financial strategists don't just avoid risks; they understand, analyze, and strategically navigate potential challenges. This involves developing comprehensive financial plans that account for various scenarios, maintaining emergency funds, and creating robust insurance protection mechanisms. Intelligent risk management also requires continuous learning and adaptation. Successful investors stay informed about global economic trends, technological disruptions, and emerging market dynamics. They maintain a flexible approach that allows them to pivot strategies quickly in response to changing economic conditions.Technological Innovation and Wealth Creation

The intersection of technology and finance has created unprecedented wealth-generation opportunities. Emerging technologies like blockchain, artificial intelligence, and machine learning are revolutionizing traditional investment paradigms. Forward-thinking investors are exploring cryptocurrency, decentralized finance platforms, and innovative digital investment vehicles that offer potentially higher returns. By understanding and strategically engaging with technological innovations, individuals can position themselves at the forefront of financial evolution. This requires a commitment to continuous learning, openness to new ideas, and the ability to critically evaluate emerging financial technologies.RELATED NEWS

Finance

Turbulent Waters: Lloyds CEO Reveals Motor Financing Saga's Ripple Effect

2025-02-20 09:31:29

Finance

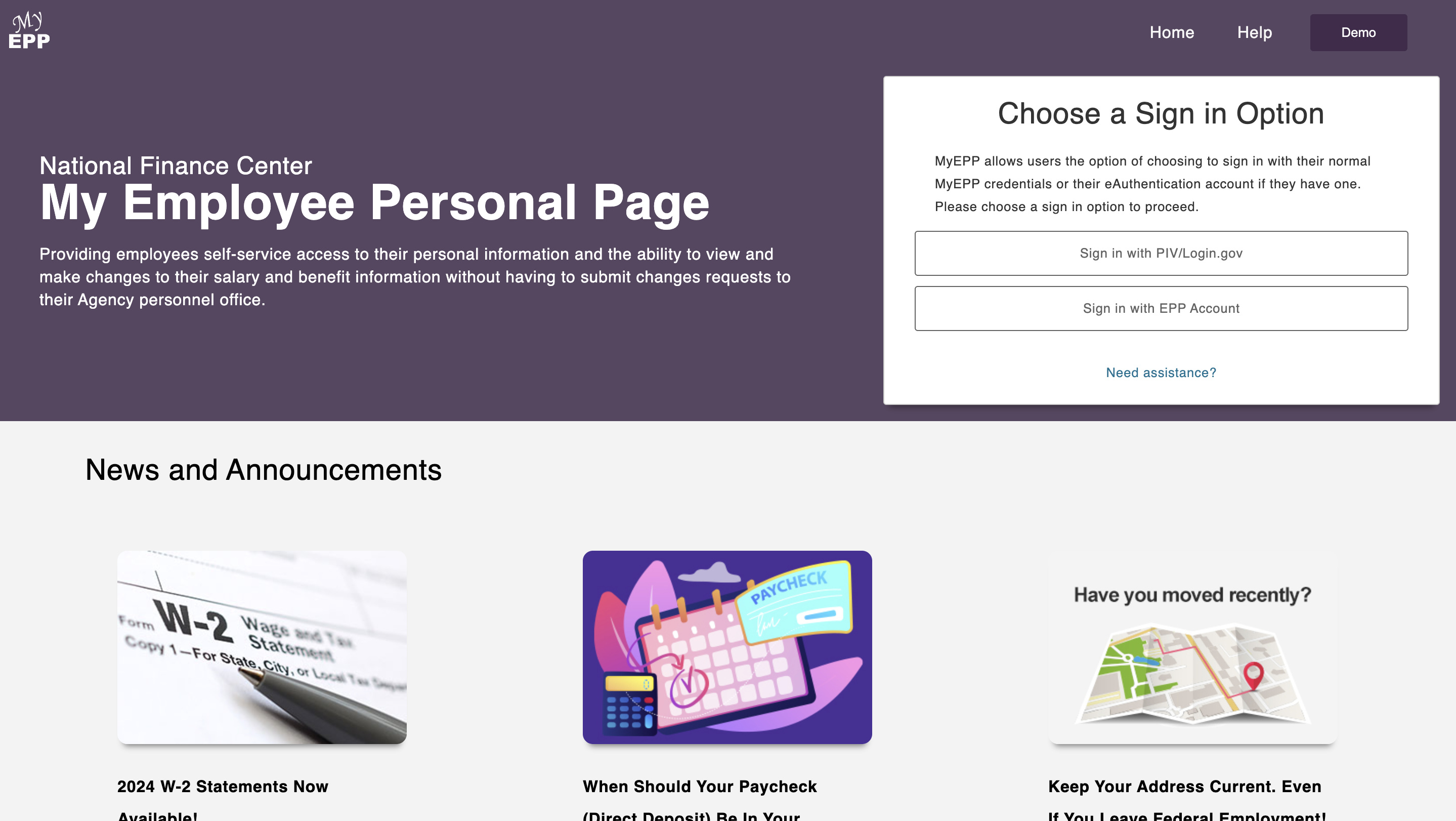

Phishing Scheme Exposes Massive Federal Employee Data Breach at National Finance Center

2025-03-21 17:11:01

Finance

Market Trembles: Geopolitical Tensions Drag Indian Stocks Down, Bajaj Finance Bears the Brunt

2025-04-30 04:00:19