When Parents Can't Manage Money: 3 Red Flags Every Adult Child Should Know

Finance

2025-03-08 12:47:01Content

Navigating the Delicate Terrain of Parental Financial Management

Taking over a parent's financial responsibilities is never an easy journey. It's a complex emotional and practical challenge that can strain relationships and test family dynamics. Yet, as our loved ones age, this becomes an increasingly necessary step to ensure their financial security and well-being.

The process is rarely straightforward. Adult children often find themselves walking a fine line between protecting their parents' independence and providing essential financial oversight. It requires sensitivity, patience, and a carefully crafted approach that respects your parents' dignity while safeguarding their financial future.

Key considerations include:

• Open and honest communication

• Gradual involvement in financial matters

• Comprehensive understanding of their current financial situation

• Legal preparations like power of attorney

• Protecting against potential financial exploitation

The most successful transitions happen when families approach the topic with empathy, transparency, and mutual respect. Remember, this isn't about taking control, but about providing support and ensuring your parents' financial stability during their vulnerable years.

While challenging, this process can ultimately strengthen family bonds and provide peace of mind for everyone involved. The goal is to create a supportive environment that allows your parents to age with grace, security, and financial confidence.

Navigating the Delicate Terrain of Parental Financial Guardianship: A Comprehensive Guide to Compassionate Care

As families navigate the complex landscape of aging and financial responsibility, adult children increasingly find themselves in the challenging position of managing their parents' financial affairs. This transition represents more than just a logistical challenge—it's an emotional journey that requires sensitivity, strategic planning, and deep understanding of familial dynamics.Protecting Your Loved Ones: A Delicate Balance of Care and Financial Responsibility

Understanding the Emotional Complexity of Financial Transitions

The process of assuming financial management for aging parents is fraught with psychological nuances that extend far beyond mere monetary considerations. Adult children must approach this responsibility with extraordinary empathy and strategic insight. Recognizing the profound emotional vulnerability of parents who are relinquishing financial control is paramount. This transition often triggers complex feelings of loss, diminished independence, and potential embarrassment for elderly parents who have historically managed their own financial affairs. Successful navigation requires a multifaceted approach that prioritizes dignity, transparency, and mutual respect. Establishing open communication channels becomes critical, allowing for honest discussions about financial capabilities, potential limitations, and collaborative decision-making strategies that preserve the parent's sense of autonomy and self-worth.Legal and Ethical Frameworks for Financial Guardianship

Implementing comprehensive legal protections represents a crucial step in responsible financial management. Adult children must meticulously research and establish appropriate legal mechanisms such as power of attorney, healthcare proxies, and potential conservatorship arrangements. These legal instruments provide structured frameworks that protect both the parent's interests and the family's financial stability. Professional consultation with elder law attorneys can offer invaluable guidance in developing nuanced strategies tailored to specific family circumstances. These experts can help families navigate complex legal landscapes, ensuring compliance with regulatory requirements while maintaining familial harmony and respect.Technological Solutions and Financial Management Strategies

Modern technological innovations have revolutionized financial management for aging populations. Sophisticated digital platforms now offer robust tools for tracking expenses, monitoring investments, and implementing safeguards against potential financial exploitation. Advanced budgeting applications, secure banking interfaces, and comprehensive financial tracking systems empower families to maintain transparent and efficient financial oversight. Implementing multi-layered security protocols becomes essential in protecting vulnerable individuals from potential fraud or unauthorized financial transactions. This might include setting up transaction alerts, utilizing two-factor authentication, and establishing collaborative monitoring systems that involve trusted family members or financial advisors.Psychological Preparedness and Emotional Intelligence

Beyond technical competencies, successful financial guardianship demands exceptional emotional intelligence. Adult children must cultivate patience, empathy, and exceptional communication skills. Recognizing and addressing potential resistance, anxiety, or emotional turbulence becomes as important as managing financial documentation. Developing strategies for compassionate communication involves active listening, validating parental experiences, and creating collaborative decision-making environments. Professional counseling or family mediation services can provide additional support in navigating potentially challenging interpersonal dynamics.Long-Term Financial Planning and Risk Mitigation

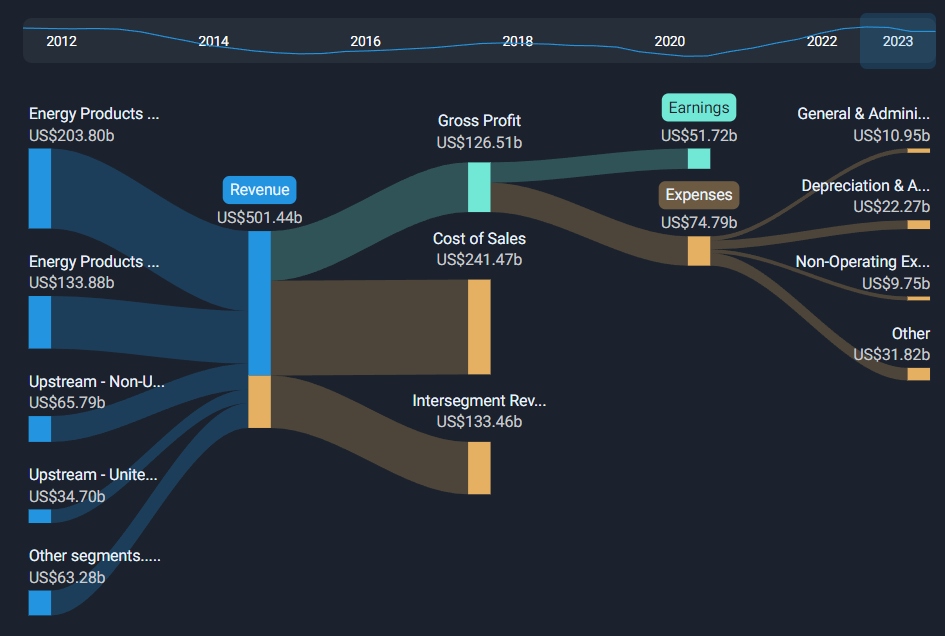

Comprehensive financial guardianship extends beyond immediate monetary management. Strategic long-term planning involves holistic assessments of retirement resources, potential healthcare expenses, estate planning, and potential lifestyle adjustments. Proactive risk mitigation strategies can help families anticipate and prepare for potential financial challenges. Engaging certified financial planners specializing in elder care can provide sophisticated insights into optimizing financial resources, exploring potential investment strategies, and developing resilient financial frameworks that adapt to changing familial circumstances.RELATED NEWS

Finance

Defying Buffett: How Steve Jobs' Maverick Instincts Trumped Wall Street Wisdom

2025-02-24 10:17:00

Finance

Fugro Sails Past Earnings Forecast: Investors Cheer Surprise Financial Triumph

2025-03-02 08:25:59

Finance

EHang Set to Unveil Financial Performance: Q4 and 2024 Fiscal Year Results Breakthrough Coming This March

2025-03-05 09:18:00