Yuan's Global Leap: How Hong Kong Is Reshaping China's Currency Destiny

Finance

2025-02-18 11:00:13Content

Hong Kong is set to solidify its position as the global epicenter for offshore yuan transactions, with experts predicting an even more significant role in the international financial landscape. As China continues to expand the yuan's global reach, the city is poised to become an increasingly critical hub for international financial exchanges.

Financial officials and market analysts anticipate substantial growth in yuan liquidity and diversified usage, highlighting Hong Kong's unique strategic advantage. The city's sophisticated financial infrastructure, combined with its deep connections to mainland China, positions it perfectly to facilitate cross-border financial activities and international yuan-denominated transactions.

With ongoing financial reforms and China's commitment to internationalizing its currency, Hong Kong stands ready to enhance its role as the premier offshore yuan center. The city's robust regulatory framework, world-class financial services, and proximity to mainland markets make it an unparalleled platform for global yuan-based financial operations.

As international investors and businesses increasingly seek alternative currency channels, Hong Kong's importance in the global financial ecosystem is expected to grow exponentially. The city's continued evolution as a yuan trading powerhouse underscores its critical role in bridging Chinese and international financial markets.

Hong Kong's Financial Frontier: Revolutionizing Offshore Yuan Trading in a Global Economic Landscape

In the intricate world of international finance, Hong Kong stands as a pivotal gateway, continuously reshaping its role as a critical financial hub. The city's strategic positioning and adaptive financial ecosystem have positioned it at the forefront of offshore yuan trading, presenting a compelling narrative of economic transformation and global financial innovation.Navigating the Future of Global Currency Dynamics

The Evolving Landscape of Offshore Yuan Trading

Hong Kong's financial ecosystem has long been a crucible of economic innovation, particularly in the realm of currency trading. The offshore yuan market represents a sophisticated dance of international monetary strategies, where the city serves as a critical intermediary between mainland China and global financial markets. Unlike traditional trading platforms, Hong Kong has developed a nuanced approach that transcends conventional boundaries, creating a unique environment for yuan-based transactions. The complexity of offshore yuan trading extends far beyond simple currency exchange. It involves intricate networks of financial institutions, regulatory frameworks, and sophisticated trading mechanisms that require deep understanding and strategic insight. Financial experts have observed that Hong Kong's ability to maintain flexibility while providing robust infrastructure has been instrumental in its success.Strategic Advantages in Global Financial Intermediation

The city's unique position stems from its exceptional regulatory environment and deep-rooted financial expertise. By leveraging its historical connections with mainland China and its international financial networks, Hong Kong has created a sophisticated ecosystem that attracts global investors and financial institutions. The offshore yuan market has become more than just a trading platform; it's a complex financial instrument that reflects broader economic trends and geopolitical dynamics. Liquidity in the offshore yuan market has been steadily increasing, driven by growing international confidence in Chinese financial instruments and Hong Kong's reputation for transparency and efficiency. This trend suggests a fundamental shift in global currency dynamics, with the yuan gradually emerging as a more significant player in international finance.Technological Innovation and Financial Infrastructure

Technological advancements have been pivotal in transforming Hong Kong's offshore yuan trading capabilities. Cutting-edge digital platforms, blockchain technologies, and advanced risk management systems have revolutionized how yuan transactions are conducted. These innovations provide unprecedented levels of security, speed, and transparency, making Hong Kong an increasingly attractive destination for international financial operations. The integration of artificial intelligence and machine learning into trading platforms has further enhanced the city's competitive edge. These technologies enable more sophisticated risk assessment, real-time market analysis, and predictive modeling, creating a more dynamic and responsive financial environment.Regulatory Landscape and Global Compliance

Hong Kong's regulatory framework has been instrumental in establishing its credibility as a premier offshore yuan trading hub. By maintaining stringent compliance standards while simultaneously fostering innovation, the city has struck a delicate balance that attracts both conservative institutional investors and forward-thinking financial entities. The regulatory environment continues to evolve, adapting to changing global financial landscapes and emerging economic challenges. This adaptive approach ensures that Hong Kong remains at the cutting edge of international financial intermediation, consistently offering sophisticated solutions to complex monetary challenges.Future Projections and Economic Implications

As global economic dynamics continue to shift, Hong Kong's role in offshore yuan trading is expected to become increasingly significant. Experts predict continued growth in liquidity, expanded trading volumes, and more diverse financial instruments emerging from this dynamic market. The potential for further internationalization of the yuan, coupled with Hong Kong's strategic positioning, suggests a promising trajectory for the city's financial ecosystem. This ongoing transformation represents not just a local economic phenomenon, but a broader narrative of global financial integration and innovation.RELATED NEWS

Finance

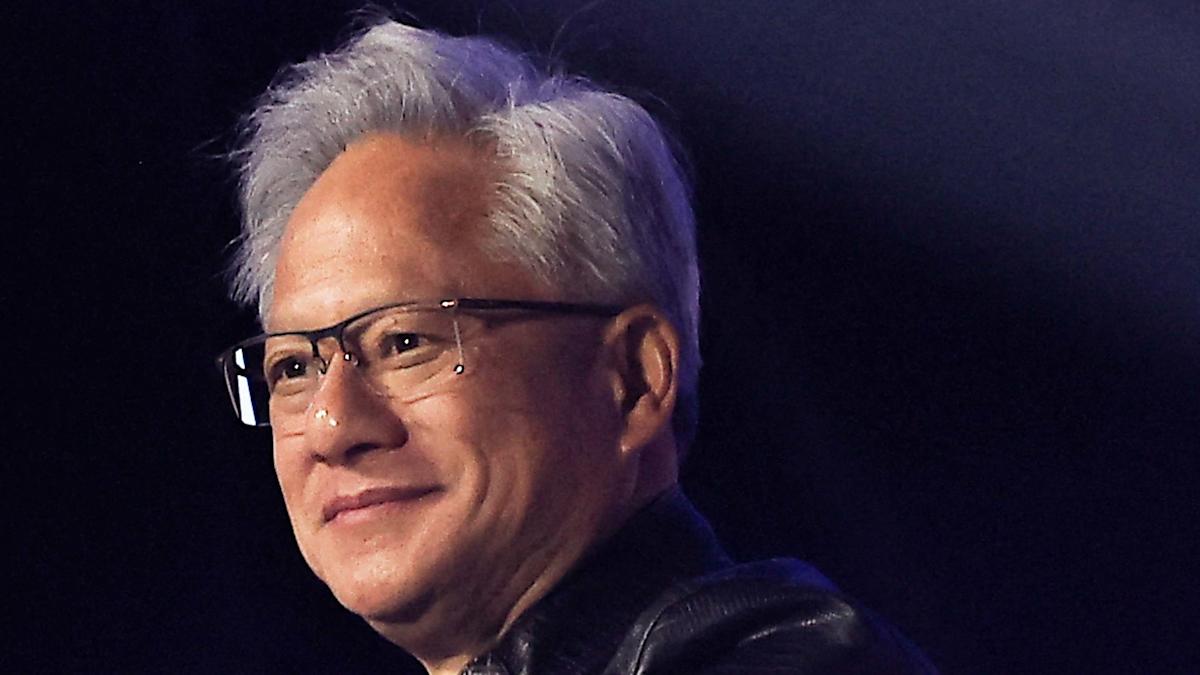

Quantum Leap: How Nvidia's Leader Proved the Skeptics Wrong About Computing's Next Frontier

2025-03-13 17:00:00

Finance

Broke After Swiping: How Holiday Spending Turned into America's Endless Debt Spiral

2025-02-16 15:00:57

Finance

Financial Forecast Alert: MINISO Group Gears Up to Unveil Q4 and 2024 Earnings Report

2025-03-07 08:57:00