Small Business Owners Demand Healthcare Relief: NFIB Unveils Urgent Policy Roadmap

Health

2025-03-07 22:01:59Content

Small Business Owners Struggle with Mounting Health Insurance Costs, NFIB Report Reveals

A recent National Federation of Independent Business (NFIB) study has uncovered a troubling trend that is putting increasing financial pressure on small business owners and employers across the United States. The report highlights a deepening health insurance affordability crisis that threatens the economic stability of small enterprises.

As healthcare expenses continue to climb, small business owners are finding themselves caught in a challenging financial squeeze. The rising costs of providing health insurance are forcing many to make difficult decisions about employee benefits, potentially impacting their ability to attract and retain top talent.

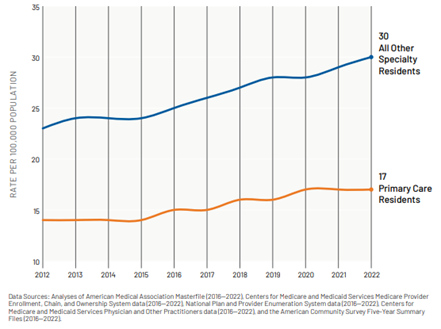

Key findings from the NFIB report indicate that health insurance premiums are outpacing business revenue growth, creating a significant burden for small employers. Many are struggling to balance the need to provide comprehensive healthcare coverage with the financial realities of running a competitive business in today's economic landscape.

The affordability crisis is not just a numbers game – it represents a critical challenge to the backbone of the American economy. Small businesses, which employ millions of workers nationwide, are finding themselves at a crossroads, forced to navigate increasingly complex and expensive health insurance markets.

As policymakers and business leaders continue to seek solutions, the NFIB report serves as a stark reminder of the ongoing challenges facing small business owners in providing essential healthcare benefits to their employees.

Small Business Health Insurance: The Silent Economic Threat Unraveled

In the intricate landscape of American entrepreneurship, small business owners are confronting an unprecedented challenge that threatens their operational sustainability and employee welfare. The escalating health insurance costs have emerged as a critical pressure point, transforming from a manageable expense to a potential economic breaking point that demands immediate strategic intervention.Navigating the Healthcare Cost Minefield: A Critical Challenge for Small Enterprises

The Economic Burden of Rising Healthcare Expenses

Small businesses are experiencing a seismic shift in healthcare affordability that goes far beyond simple numerical calculations. The financial strain represents a complex ecosystem of interconnected challenges that demand nuanced understanding. Employers are witnessing exponential increases in insurance premiums, creating a domino effect that impacts hiring practices, employee retention, and overall business strategy. The economic landscape reveals a stark reality where healthcare costs are outpacing revenue growth for many small enterprises. These escalating expenses are not merely line-item budget concerns but fundamental threats to business sustainability. Entrepreneurs find themselves trapped in a precarious balancing act, attempting to provide competitive employee benefits while maintaining fiscal responsibility.Systemic Challenges in Health Insurance Accessibility

The current health insurance marketplace presents a labyrinthine environment that overwhelms small business owners. Complex regulatory frameworks, opaque pricing structures, and limited competitive options create significant barriers to accessing affordable coverage. Many entrepreneurs report feeling trapped between providing inadequate insurance and risking financial instability. Insurance providers have developed increasingly sophisticated pricing models that disproportionately impact smaller organizations. These models often leverage risk assessment algorithms that penalize smaller groups with higher per-employee costs, creating a structural disadvantage that seems almost designed to marginalize small business interests.Employee Well-being and Competitive Talent Acquisition

Health insurance has transcended its traditional role as a mere employee benefit, becoming a critical component of talent attraction and retention strategies. Small businesses recognize that comprehensive health coverage serves as a powerful recruitment tool in an increasingly competitive labor market. However, the financial constraints imposed by escalating healthcare costs force many organizations to make difficult trade-offs. Some reduce coverage quality, while others shift more significant portions of premium costs onto employees. These decisions have profound implications for workforce morale, productivity, and long-term organizational stability.Innovative Solutions and Strategic Adaptations

Forward-thinking small businesses are developing creative approaches to mitigate healthcare cost challenges. Alternative insurance models, such as self-funded plans, health savings accounts, and strategic benefit design, are emerging as potential pathways to more sustainable healthcare management. Technology platforms and digital health solutions are also providing unprecedented opportunities for cost optimization. By leveraging data analytics, telemedicine, and preventative care strategies, businesses can potentially reduce long-term healthcare expenditures while maintaining robust employee support systems.Policy Implications and Future Outlook

The current healthcare affordability crisis demands comprehensive policy interventions. Policymakers must develop nuanced frameworks that recognize the unique challenges faced by small businesses. Potential solutions might include targeted tax incentives, risk-sharing mechanisms, and regulatory reforms designed to create more transparent and competitive insurance marketplaces. The economic resilience of small businesses depends on their ability to navigate these complex healthcare landscapes. As the entrepreneurial ecosystem continues to evolve, adaptability and strategic planning will be paramount in overcoming these systemic challenges.RELATED NEWS

Health

Grilling the Nominee: Trump's NIH Candidate Faces Tough Questions on Science Funding and Vaccine Stance

2025-03-05 21:31:15

Health

Breaking Barriers: Hailey Van Lith's Courageous Journey Through Mental Health Challenges

2025-03-25 15:42:56