Dividend Boost Alert: Walmart Signals Strong Financial Health with Latest Payout Increase

Companies

2025-03-07 16:47:42Content

In the dynamic world of dividend investing, Walmart Inc. (NYSE:WMT) continues to stand out as a compelling player. Following our recent exploration of 10 companies that have boosted their dividend payouts, we're diving deeper into Walmart's dividend strategy and how it compares to other market leaders.

Dividend stocks have been capturing investors' attention with their consistent performance and attractive returns. Walmart, a retail giant known for its resilience and strategic growth, is making waves in the dividend landscape. By examining its recent dividend increase, we'll uncover what makes this stock an intriguing option for income-focused investors.

Our analysis will provide insights into Walmart's financial health, dividend track record, and how it stacks up against other companies in the current market. Whether you're a seasoned investor or just beginning to explore dividend investing, this breakdown offers valuable perspectives on Walmart's investment potential.

Stay tuned as we break down the numbers, explore the implications of Walmart's dividend raise, and help you understand why this stock might be a smart addition to your investment portfolio.

Dividend Dynamos: Walmart's Strategic Financial Maneuver in Corporate Landscape

In the ever-evolving world of corporate finance, dividend strategies have emerged as a critical battleground for investor attention and market credibility. Companies are increasingly leveraging their financial strength to signal confidence and attract sophisticated investment portfolios through strategic dividend adjustments.Unlock the Secrets of Corporate Financial Resilience and Investor Confidence!

The Dividend Ecosystem: Understanding Corporate Financial Signaling

Dividend increases represent far more than mere monetary distributions. They are sophisticated communication mechanisms through which corporations broadcast their financial health, strategic positioning, and long-term growth potential. Walmart, a global retail behemoth, exemplifies this nuanced approach to investor relations by strategically modulating its dividend framework. The complex interplay between corporate financial policy and market perception creates a dynamic environment where each dividend adjustment sends ripples through investment ecosystems. Sophisticated investors decode these signals, interpreting them as profound indicators of a company's underlying economic momentum and strategic vision.Walmart's Strategic Financial Architecture

Walmart's approach to dividend management transcends traditional corporate financial strategies. By consistently demonstrating financial robustness through calculated dividend increases, the retail giant communicates a narrative of stability and sustained growth potential to global investors. The company's dividend strategy reflects a meticulously crafted financial architecture that balances shareholder returns with strategic reinvestment. This delicate equilibrium requires profound understanding of market dynamics, internal operational efficiency, and macroeconomic trends that influence corporate financial decision-making.Comparative Market Analysis: Dividend Performance Landscape

Within the contemporary corporate landscape, dividend increases represent a competitive differentiator. Companies like Walmart are not merely distributing profits but strategically positioning themselves as attractive investment destinations. The nuanced art of dividend management involves complex calculations considering factors such as earnings stability, growth projections, and broader economic indicators. Investors scrutinize these financial signals with increasing sophistication, understanding that dividend increases reflect deeper organizational health beyond surface-level financial metrics. Walmart's consistent approach demonstrates a commitment to transparent, predictable financial communication that resonates with institutional and individual investors alike.Technological and Operational Innovations Driving Financial Strategy

Modern dividend strategies are increasingly intertwined with technological innovation and operational efficiency. Walmart's ability to generate consistent returns stems from its remarkable digital transformation, supply chain optimization, and data-driven decision-making processes. The company's financial strategy integrates cutting-edge technological capabilities with traditional retail strengths, creating a unique value proposition that extends beyond mere dividend distributions. This holistic approach positions Walmart as a forward-thinking organization capable of navigating complex economic landscapes.Global Economic Implications of Corporate Dividend Policies

Dividend increases like those implemented by Walmart carry broader economic implications. They serve as critical indicators of corporate confidence, potentially influencing investor sentiment, market dynamics, and macroeconomic trends. By maintaining a robust dividend policy, corporations contribute to economic stability, signaling resilience and potential for sustained growth. Walmart's strategic approach exemplifies how sophisticated financial management can transcend individual corporate interests, contributing to broader economic ecosystems.RELATED NEWS

Companies

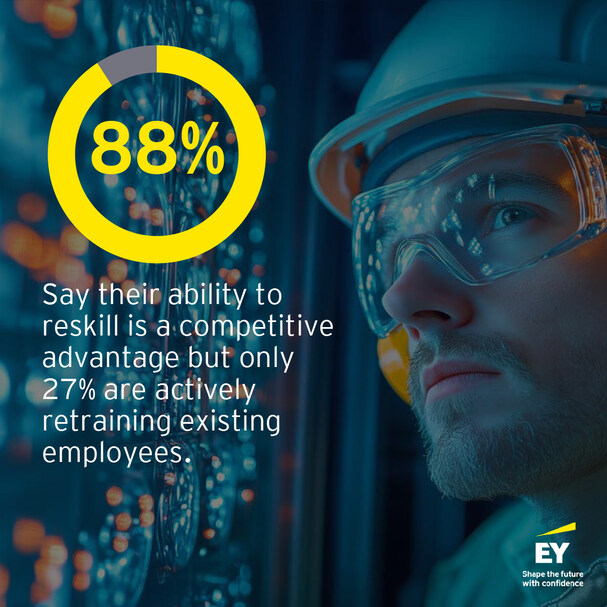

Digital Transformation Dilemma: Energy Sector's Massive Tech Leap Leaves Workforce Behind

2025-03-03 13:00:00

Companies

Wall Street Rebels: How Activist Investors Are Forcing Corporate Makeovers

2025-03-06 11:00:00

Companies

Inside Nvidia's Silicon Crucible: How Jensen Huang's Relentless Drive Forged a Tech Empire

2025-04-21 09:00:02