Wall Street's Warning: Is the Bull Market Running on Fumes?

Finance

2025-03-07 16:00:00Content

Market Sentiment Shifts: Investors Pivot from Dip Buying to Sell-Off Strategy

The recent market turbulence, with the S&P 500 experiencing a significant 7% decline from its recent peaks, signals a dramatic change in investor psychology. According to JPMorgan's latest analysis, the financial landscape is transitioning from a "buy the dip" approach to a more cautious "sell the rally" mentality.

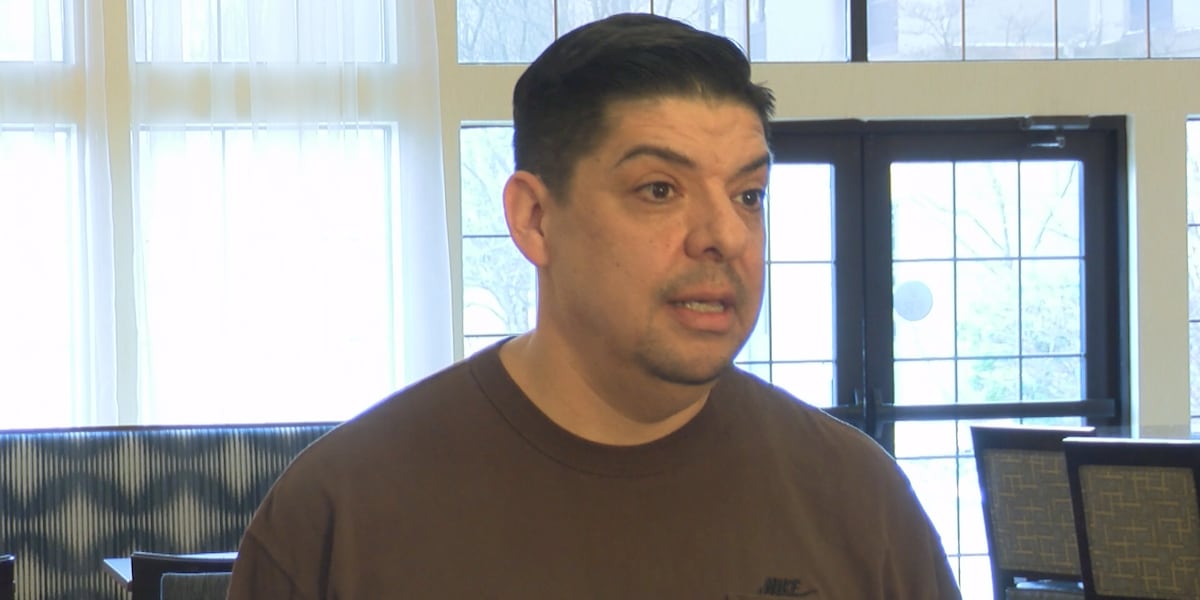

Yahoo Finance's Head of News, Myles Udland, joined Morning Brief host Seana Smith to unpack the complex challenges facing investors. The current market environment is characterized by a perfect storm of concerns, including:

• Intricate valuation challenges

• Nuanced economic data interpretations

• Strategic repositioning around high-profile tech stocks like Tesla and Nvidia

Investors are now carefully reassessing their portfolios, moving away from the previous optimistic buying strategies and adopting a more defensive stance. The shift reflects growing uncertainty and a more measured approach to market opportunities.

For deeper insights and expert analysis on the latest market dynamics, tune into more Morning Brief coverage.

Market Tremors: Investors Pivot from Optimism to Caution in Tech-Driven Landscape

In the ever-evolving world of financial markets, a seismic shift is underway as investors recalibrate their strategies, moving away from the previously dominant "buy the dip" mentality towards a more cautious "sell the rally" approach. This transformation is reshaping the investment landscape, driven by complex interplays of technological innovation, economic indicators, and strategic repositioning.Navigating Uncertain Waters: When Market Confidence Meets Strategic Hesitation

The Changing Investment Paradigm

The financial ecosystem is experiencing a profound metamorphosis, characterized by unprecedented volatility and strategic recalibration. Institutional investors and market analysts are witnessing a remarkable transition where traditional investment strategies are being challenged by emerging market dynamics. The S&P 500's recent 7% decline from its peak signals more than a temporary fluctuation—it represents a fundamental reassessment of risk and opportunity. Sophisticated investors are now scrutinizing portfolios with heightened precision, recognizing that past performance no longer guarantees future success. The technology sector, once considered an unassailable bastion of growth, is now under intense microscopic examination, with companies like Tesla and Nvidia becoming focal points of strategic repositioning.Tech Giants Under the Microscope

High-profile technology companies are experiencing unprecedented scrutiny, with investors meticulously evaluating their valuation models and future growth potential. Tesla and Nvidia, previously viewed as untouchable growth engines, are now subject to rigorous financial analysis that extends beyond traditional metrics. The market's perception is shifting from blind optimism to a more nuanced understanding of technological potential. Investors are demanding more than just innovative narratives; they seek concrete evidence of sustainable business models, robust revenue streams, and clear pathways to profitability.Economic Indicators and Market Sentiment

Complex economic indicators are playing a pivotal role in shaping investor sentiment. Macroeconomic data points are being interpreted with unprecedented depth, revealing intricate relationships between global economic trends and market performance. The current landscape demands a multifaceted approach to investment strategy. Professionals are integrating sophisticated analytical tools, leveraging big data and advanced predictive models to navigate the increasingly complex financial terrain. This approach transcends traditional investment methodologies, embracing a more holistic and dynamic perspective.Psychological Dynamics of Market Transformation

The psychological underpinnings of market behavior are undergoing significant transformation. Investors are no longer driven solely by quantitative metrics but are increasingly influenced by qualitative assessments of risk, potential, and broader economic narratives. This psychological shift manifests in a more measured, deliberate approach to investment decisions. The previous era of rapid, momentum-driven trading is giving way to a more contemplative strategy that prioritizes long-term sustainability over short-term gains.Strategic Repositioning and Future Outlook

Financial institutions and individual investors alike are strategically repositioning their portfolios, recognizing that adaptability is the key to survival in this volatile market environment. The traditional boundaries between sectors are blurring, creating opportunities for those willing to embrace complexity and uncertainty. Forward-thinking investors are diversifying their approaches, integrating technological insights with traditional financial analysis. This holistic strategy allows for more resilient investment portfolios capable of withstanding market fluctuations and capitalizing on emerging opportunities. The current market landscape is not a story of decline, but of transformation—a nuanced recalibration that promises to reshape investment strategies for years to come.RELATED NEWS

Finance

Wall Street Rollercoaster: Dow Surges, Tech Stocks Spark Midday Rally Before Dramatic Pullback

2025-04-23 20:02:58

Finance

Silver Rush: Andean Precious Metals Unveils Stellar Q1 2025 Financial Performance

2025-05-06 21:30:00

Finance

Green Finance Revolution: Major Players Unite to Rescue Palm Oil Sustainability

2025-03-24 02:00:00