Global Markets Revolution: Nasdaq Unveils Round-the-Clock Trading Strategy

Finance

2025-03-07 15:05:18Content

Global Investors Flock to U.S. Equity Markets: A Growing Trend

The U.S. equity market has experienced a remarkable surge in international demand, fueled by several key factors transforming the investment landscape. Rising retail participation, enhanced financial literacy, and the proliferation of user-friendly digital trading platforms have democratized market access for global investors.

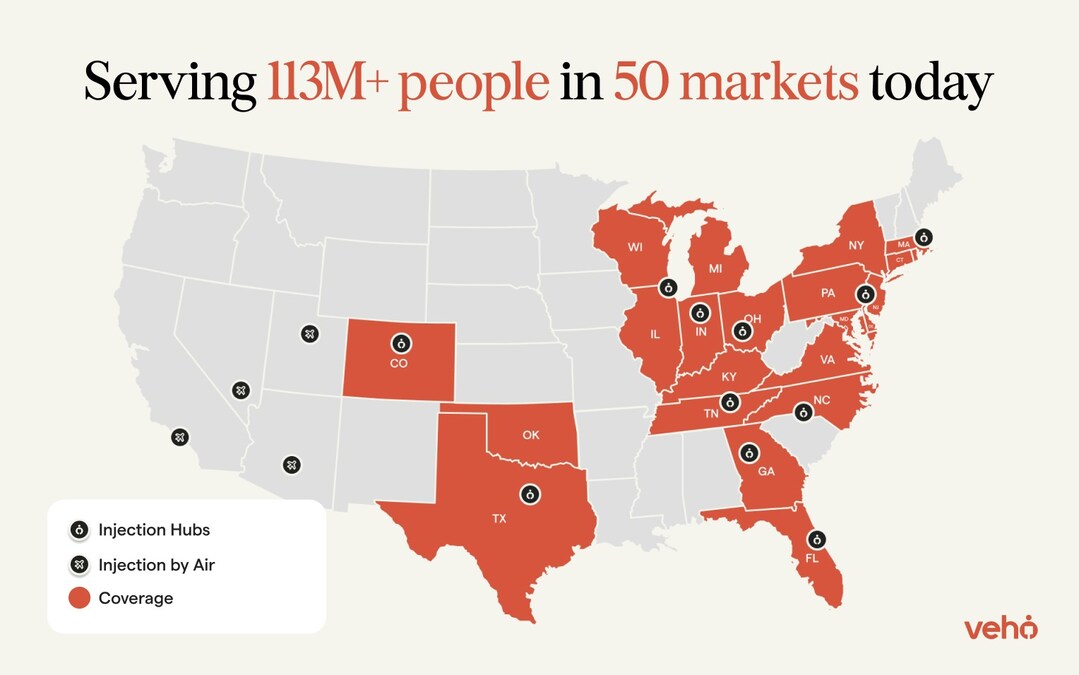

Nasdaq President Tal Cohen recently shared exciting developments, revealing ongoing discussions with regulators about expanding market opportunities. The exchange operator anticipates launching new initiatives in the second half of 2026, signaling a strategic approach to market expansion.

The allure of U.S. financial markets remains strong, underpinned by their exceptional depth, robust liquidity, and comprehensive regulatory framework. Exchanges and financial institutions are actively exploring innovative methods to broaden market accessibility, with a particular focus on extending trading hours and creating more flexible investment environments.

These strategic efforts aim to attract a diverse range of international investors, making the U.S. equity market increasingly attractive and accessible on a global scale.

Global Investors Revolutionize U.S. Financial Markets: The Digital Trading Transformation

In an era of unprecedented technological advancement and global financial connectivity, the landscape of international investment is undergoing a remarkable metamorphosis. The United States equity market stands at the epicenter of this transformative journey, attracting unprecedented global attention and reshaping traditional investment paradigms.Breaking Barriers: The New Frontier of Global Financial Engagement

The Digital Trading Revolution

The emergence of sophisticated digital trading platforms has fundamentally disrupted traditional investment mechanisms. Technological innovations have democratized financial markets, enabling investors from diverse geographical backgrounds to seamlessly access complex investment ecosystems. Advanced algorithmic trading systems, coupled with intuitive mobile applications, have dramatically lowered entry barriers for international investors seeking exposure to the robust U.S. financial landscape. Sophisticated investors are now leveraging cutting-edge technological infrastructure that provides real-time market insights, comprehensive analytical tools, and instantaneous transaction capabilities. These platforms transcend geographical limitations, offering unprecedented transparency and accessibility that was inconceivable merely a decade ago.Driving Forces Behind International Market Participation

Multiple interconnected factors are propelling international investors towards U.S. equity markets. Enhanced financial literacy programs, coupled with increasingly sophisticated educational resources, have empowered global investors to make more informed investment decisions. Universities, online learning platforms, and financial institutions are collaborating to develop comprehensive training modules that demystify complex investment strategies. The regulatory framework of U.S. financial markets represents a significant attraction for international investors. Stringent compliance mechanisms, transparent reporting standards, and robust investor protection protocols create an environment of trust and reliability. This institutional credibility serves as a powerful magnet for global capital seeking stable and predictable investment opportunities.Technological Infrastructure and Market Expansion

Nasdaq's strategic initiatives underscore the evolving dynamics of global financial markets. The exchange operator's discussions with regulators about expanding trading hours reflect a nuanced understanding of international investor preferences. By extending operational windows, financial institutions can accommodate diverse time zones and provide more flexible investment opportunities. The convergence of technological innovation, regulatory adaptability, and global investor sentiment is reshaping the financial landscape. Machine learning algorithms, artificial intelligence, and blockchain technologies are progressively integrating into trading platforms, offering unprecedented levels of efficiency and security.Economic Implications and Future Projections

The surge in international market participation carries profound economic implications. Increased foreign investment stimulates capital flow, enhances market liquidity, and contributes to overall economic dynamism. Emerging markets are increasingly viewing U.S. equity markets as strategic investment destinations, recognizing the potential for substantial long-term returns. Institutional investors, sovereign wealth funds, and individual investors are recalibrating their investment strategies to capitalize on the evolving global financial ecosystem. The convergence of technological innovation, regulatory frameworks, and investor education is creating a more inclusive and interconnected financial environment.Challenges and Opportunities

Despite the promising landscape, international investors must navigate complex regulatory environments, currency fluctuations, and geopolitical uncertainties. Successful market engagement requires sophisticated risk management strategies, comprehensive market research, and adaptable investment approaches. Financial institutions and technology companies are continuously developing more sophisticated tools to mitigate potential risks and enhance investor experiences. Advanced predictive analytics, real-time risk assessment algorithms, and personalized investment recommendations are becoming standard features of modern trading platforms.RELATED NEWS

Carney in Crosshairs: Freeland's Bold Leadership Bid Signals Potential Cabinet Shake-Up