Fizzy Fury: Local Businesses Bubble Up Against Proposed Soda Tax Crackdown

Business

2025-03-07 07:30:40Content

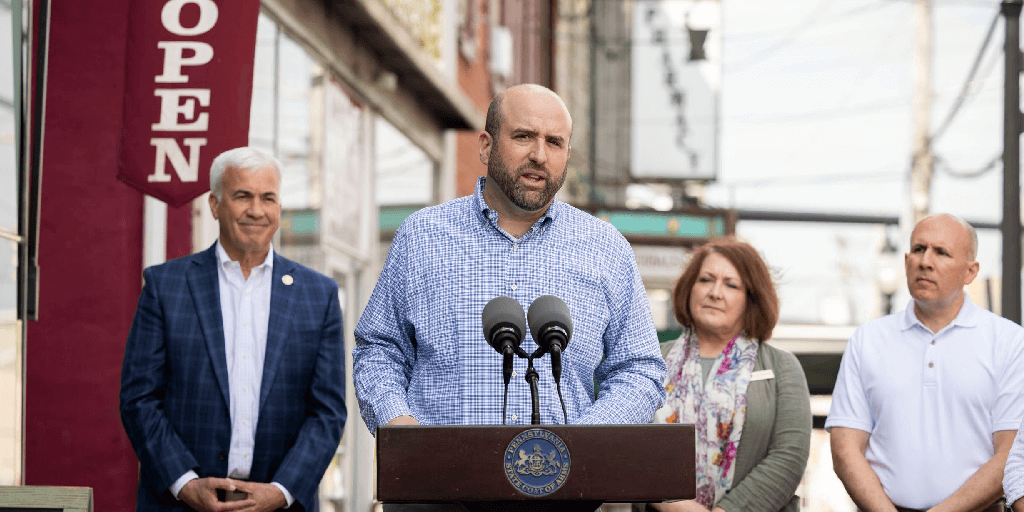

In a passionate plea before the House committee, advocates for a proposed sugary drink tax unveiled an ambitious plan that promises to transform public health and state finances. The proposed legislation could generate a staggering $500 million annually, offering a multi-pronged approach to addressing critical community needs.

Proponents argue that the tax would not only provide a significant financial boost but also tackle several pressing challenges. The proposed revenue would be strategically allocated to support healthier school lunch programs, provide child care scholarships, and help mitigate the state's impending budget deficit. Beyond the financial benefits, supporters emphasize the potential health advantages, suggesting that the tax could encourage reduced sugar consumption and promote healthier lifestyle choices.

By targeting sugary beverages, lawmakers hope to create a win-win scenario that improves both fiscal stability and public well-being. The proposed bill represents an innovative approach to addressing multiple societal challenges through a single, targeted policy initiative.

Sweet Controversy: How a Beverage Tax Could Revolutionize Maryland's Education and Budget Landscape

In the complex world of fiscal policy and public health, Maryland lawmakers are confronting a provocative solution that could simultaneously address multiple societal challenges. The proposed sugary drink tax represents more than just a revenue generation strategy—it's a multifaceted approach to transforming educational funding, childcare support, and state financial sustainability.Transforming Pennies into Possibilities: A Bold Fiscal Strategy Emerges

The Economic Anatomy of a Beverage Tax

The proposed legislation represents a nuanced approach to fiscal management that extends far beyond simple taxation. By implementing a targeted levy on sugar-sweetened beverages, policymakers aim to create a comprehensive financial ecosystem that addresses multiple critical societal needs. The potential $500 million annual revenue stream could fundamentally reshape Maryland's educational and budgetary infrastructure. Economists and public health experts have long recognized the dual potential of such taxation strategies. Not only do they generate substantial revenue, but they also create economic incentives for healthier consumer behavior. The proposed tax would strategically redirect funds from sugary drink consumption toward critical social investments, effectively turning individual purchasing decisions into broader community benefits.Educational Transformation through Innovative Funding

The proposed tax's most compelling aspect lies in its dedicated allocation toward school lunch programs and educational support. By channeling funds directly into nutritional and educational initiatives, lawmakers are attempting to break traditional funding cycles and introduce a more holistic approach to student welfare. School lunch programs represent more than mere meal provision—they are critical interventions in student health, academic performance, and socioeconomic equity. The proposed funding model suggests a comprehensive understanding that nutrition and education are intrinsically linked, with potential long-term impacts on student development and community well-being.Childcare Scholarships: Empowering Families and Workforce Development

Beyond educational infrastructure, the proposed tax aims to revolutionize childcare accessibility through targeted scholarship programs. By creating financial mechanisms that support working families, the legislation addresses a critical gap in current social support systems. Childcare scholarships represent strategic investments in human capital. They enable parents, particularly those from economically challenged backgrounds, to pursue professional opportunities while ensuring their children receive high-quality early education and care. This approach recognizes that workforce development and family support are interconnected societal goals.Budgetary Deficit Mitigation: A Proactive Fiscal Strategy

The proposed tax emerges as a sophisticated solution to Maryland's looming budgetary challenges. Rather than relying on traditional deficit reduction methods, this approach introduces a novel revenue stream that simultaneously addresses multiple policy objectives. By targeting sugar-sweetened beverages, policymakers are implementing a progressive fiscal strategy that encourages healthier consumer choices while generating substantial state revenue. The potential $500 million annual contribution could significantly mitigate budgetary pressures, providing financial flexibility for future investments and public service improvements.Public Health Implications: Beyond Fiscal Considerations

The taxation strategy extends its impact beyond pure economic metrics, presenting a robust public health intervention. By potentially discouraging excessive sugar consumption, the proposed legislation could contribute to long-term population health improvements. Numerous public health studies have demonstrated the correlation between sugary beverage consumption and various health challenges, including obesity, diabetes, and cardiovascular diseases. The proposed tax represents a proactive policy approach that recognizes taxation as a potential behavioral modification tool.Political and Social Dynamics of the Proposed Tax

The legislation navigates complex political terrain, balancing economic objectives with social responsibility. Stakeholders from diverse backgrounds—including beverage industry representatives, public health advocates, and educational professionals—are engaging in nuanced discussions about the proposal's potential impacts. This multifaceted approach underscores the sophisticated policy-making process, where economic, health, and social considerations are carefully weighed and integrated. The proposed sugary drink tax exemplifies a holistic governance model that seeks comprehensive solutions to interconnected societal challenges.RELATED NEWS

Business

Million-Dollar Minds: The Startup Secrets That Separate Success from Failure

2025-02-26 22:10:00

Business

Revving Up Infrastructure: Sault's I-75 Business Spur Breaks Ground Next Month

2025-05-06 08:03:22

Business

Deadly Collision Paralyzes Clayton's Main Thoroughfare: US Highway 70 Business Grinds to a Halt

2025-03-14 10:05:22