Small Business Voices Amplify: Texas Healthcare Reform Takes Center Stage

Health

2025-03-06 13:33:30Content

Small Business Owners Struggle with Mounting Health Insurance Costs, NFIB Report Reveals

A recent National Federation of Independent Business (NFIB) study has exposed a critical challenge facing small business owners across the United States: the escalating affordability crisis in health insurance. The report highlights the growing financial strain that healthcare costs are placing on small enterprises, threatening their ability to provide competitive employee benefits and maintain financial stability.

Key findings from the NFIB research paint a stark picture of the current landscape. Small business owners are experiencing unprecedented increases in health insurance premiums, with many struggling to balance rising costs against their operational budgets. This trend is forcing employers to make difficult decisions, ranging from reducing coverage to potentially cutting workforce sizes.

The affordability crisis is not just a numbers game—it represents a significant threat to the economic vitality of small businesses, which are often considered the backbone of the American economy. As health insurance costs continue to outpace inflation and wage growth, entrepreneurs are finding themselves caught in a challenging financial squeeze.

Business leaders and policymakers are now calling for comprehensive solutions that can help mitigate these escalating healthcare expenses and provide sustainable options for small business owners and their employees.

Small Business Survival: The Escalating Health Insurance Affordability Nightmare

In the complex landscape of American entrepreneurship, small business owners are facing an unprecedented challenge that threatens their very economic survival. The rising tide of health insurance costs has transformed from a mere financial burden into a potentially existential crisis, challenging the fundamental sustainability of small enterprises across the nation.Navigating the Perfect Storm of Healthcare Expenses

The Economic Pressure Cooker

Small business owners are experiencing a multifaceted economic challenge that extends far beyond traditional financial constraints. The health insurance marketplace has become an intricate maze of escalating premiums, complex regulations, and diminishing coverage options. Unlike large corporations with substantial financial buffers, small enterprises find themselves trapped in a relentless cycle of increasing healthcare expenditures that directly impact their operational sustainability. The economic landscape reveals a stark reality where entrepreneurs are forced to make increasingly difficult decisions. Many are confronting the harsh choice between providing comprehensive health coverage for their employees and maintaining their business's financial viability. This dilemma is not merely a theoretical economic discussion but a real-world challenge that threatens the very fabric of small business sustainability.Employee Retention and Healthcare Dynamics

The correlation between health insurance offerings and employee retention has never been more pronounced. In an era of competitive labor markets, health benefits have transformed from a peripheral consideration to a critical recruitment and retention strategy. Small businesses find themselves in a precarious position, attempting to attract and maintain top talent while navigating increasingly complex and expensive healthcare ecosystems. Talented professionals are increasingly evaluating potential employers through the lens of comprehensive health benefits. This shift has created a challenging environment where small businesses must innovate their compensation strategies, often stretching their financial capabilities to the absolute limit. The traditional paradigm of health insurance as an employee benefit has fundamentally shifted, becoming a critical component of overall workforce management.Regulatory Complexity and Financial Strain

The regulatory environment surrounding health insurance has become exponentially more complex, creating additional layers of financial and administrative burden for small business owners. Navigating the intricate web of federal and state healthcare regulations requires significant time, expertise, and resources that many small enterprises simply cannot afford. Each legislative change introduces new compliance requirements, forcing business owners to continuously adapt their healthcare strategies. This constant state of flux creates uncertainty and financial unpredictability, making long-term planning increasingly challenging. The administrative overhead associated with maintaining compliant health insurance programs has become a significant hidden cost that many entrepreneurs fail to fully anticipate.Technological Disruption and Healthcare Solutions

Emerging technological platforms are beginning to offer innovative solutions to the health insurance affordability crisis. Digital marketplaces, artificial intelligence-driven cost analysis tools, and alternative insurance models are providing small businesses with new strategies to manage healthcare expenses more effectively. These technological interventions represent a potential paradigm shift in how small businesses approach health insurance. By leveraging data analytics, machine learning, and sophisticated comparison platforms, entrepreneurs can now access more transparent and potentially more affordable healthcare options. The convergence of technology and healthcare administration offers a glimmer of hope in an otherwise challenging landscape.Strategic Adaptation and Future Outlook

Small business owners must adopt a proactive and strategic approach to managing healthcare costs. This involves a comprehensive evaluation of current insurance models, exploring alternative coverage options, and potentially restructuring employee compensation packages to create more flexible and sustainable healthcare solutions. The future of small business health insurance will likely be characterized by increased customization, technological integration, and a more holistic approach to employee wellness. Successful enterprises will be those that can effectively balance cost management with comprehensive employee care, transforming healthcare from a financial burden into a strategic advantage.RELATED NEWS

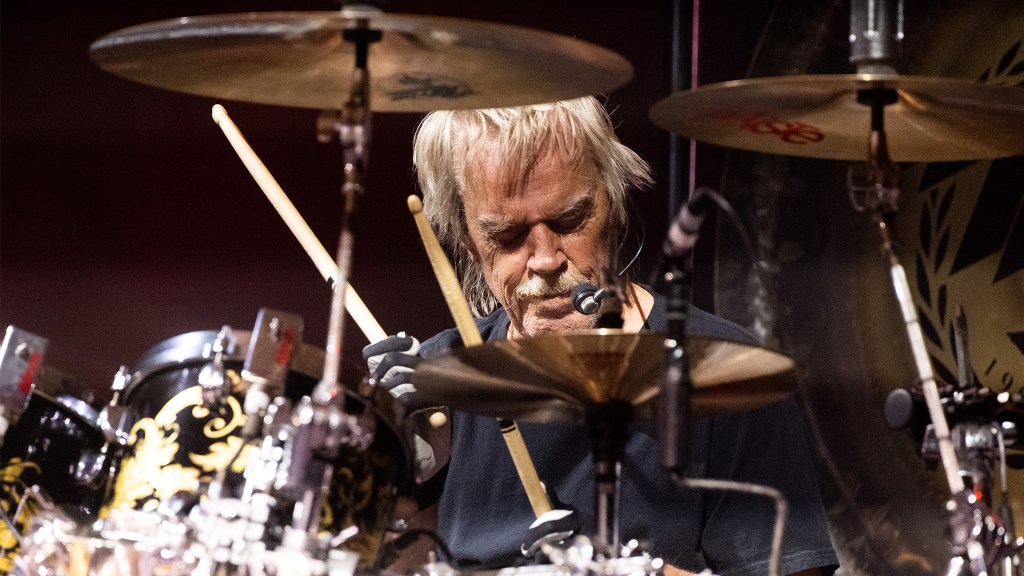

ZZ Top's Rhythmic Roadblock: Frank Beard Steps Back for Critical Health Pause