Inside the Storm: Consumer Watchdogs Battle Agency Dismantling Amid Workplace Turmoil

Politics

2025-03-06 00:08:09Content

Internal turmoil at the Consumer Financial Protection Bureau (CFPB) has been dramatically exposed through a recent court filing, revealing a workplace in disarray. Confidential emails and internal documents paint a stark picture of an agency struggling to maintain its operational integrity amid sudden personnel changes and unclear directives.

The leaked communications expose a workforce grappling with uncertainty, as recent staff reductions and shifting leadership have created an environment of confusion and operational paralysis. Employees appear to be navigating a complex landscape where their core responsibilities and permitted work activities have become increasingly ambiguous.

This unprecedented glimpse into the bureau's internal dynamics suggests a significant disruption to the agency's mission of protecting consumer financial interests. The documents hint at a potentially deliberate strategy to undermine the CFPB's effectiveness, with staff left scrambling to determine the boundaries of their professional responsibilities.

As the agency faces these unprecedented challenges, questions arise about its ability to continue its critical consumer protection mandate. The court filing serves as a revealing snapshot of an organization in transition, wrestling with internal chaos and external pressures that threaten its fundamental purpose.

Internal Turmoil Erupts: The Unraveling of Consumer Financial Protection Bureau's Operational Integrity

In the complex landscape of federal regulatory agencies, the Consumer Financial Protection Bureau (CFPB) finds itself at a critical crossroads, facing unprecedented internal challenges that threaten its fundamental operational effectiveness and institutional stability.Exposing the Hidden Crisis Behind Regulatory Walls

Organizational Disruption and Systemic Challenges

The recent court filing has unveiled a deeply troubling narrative of organizational dysfunction within the Consumer Financial Protection Bureau. Confidential email communications and internal documents paint a stark picture of an agency grappling with profound systemic challenges. Employees are navigating an increasingly complex and uncertain professional environment, characterized by sudden personnel reductions and ambiguous operational guidelines. The internal landscape reveals a workforce struggling to maintain productivity and purpose amid rapid organizational transformation. Senior staff members are confronting unprecedented uncertainty, with traditional workflow structures seemingly dismantled and institutional knowledge potentially at risk of permanent erosion.Workforce Destabilization and Operational Uncertainty

Critical examination of the internal communications suggests a deliberate strategy of organizational deconstruction. The systematic reduction of personnel appears calculated, potentially designed to fundamentally alter the bureau's investigative and regulatory capabilities. Employees find themselves in a precarious position, uncertain about permissible work parameters and long-term institutional objectives. The emerging narrative suggests more than routine bureaucratic restructuring. Instead, it points to a potentially strategic dismantling of regulatory infrastructure, with far-reaching implications for consumer financial protections. Each terminated position represents not just a human resource loss, but potentially a critical erosion of institutional expertise and regulatory oversight.Regulatory Implications and Institutional Resilience

The CFPB's current predicament extends beyond internal administrative challenges, representing a broader conversation about regulatory agency independence and effectiveness. The documented internal communications reveal a complex ecosystem of professional uncertainty, where established protocols and institutional memory are being systematically challenged. Professionals within the organization are demonstrating remarkable adaptability, attempting to maintain operational continuity despite significant structural disruptions. Their resilience becomes a critical factor in preserving the bureau's fundamental mission of consumer financial protection, even as external pressures mount and internal resources diminish.Transparency and Institutional Accountability

The court filing's revelations underscore the critical importance of institutional transparency. By exposing the internal dynamics of the Consumer Financial Protection Bureau, these documents provide unprecedented insight into the complex mechanisms of federal regulatory agencies. They challenge traditional narratives of bureaucratic stability and reveal the human dimensions of institutional transformation. Legal experts and policy analysts are closely examining these developments, recognizing them as potential indicators of broader systemic challenges within federal regulatory frameworks. The CFPB's current situation serves as a compelling case study in organizational resilience, regulatory adaptation, and the delicate balance between institutional restructuring and maintaining core operational objectives.Future Trajectory and Potential Outcomes

As the Consumer Financial Protection Bureau navigates this tumultuous period, the ultimate trajectory remains uncertain. The agency stands at a critical juncture, with potential outcomes ranging from comprehensive restructuring to potential fundamental reimagination of its operational mandate. The documented internal struggles represent more than an isolated administrative challenge. They symbolize a broader narrative of institutional adaptation in an increasingly complex regulatory landscape, where traditional bureaucratic models are being fundamentally reevaluated and reconstructed.RELATED NEWS

Politics

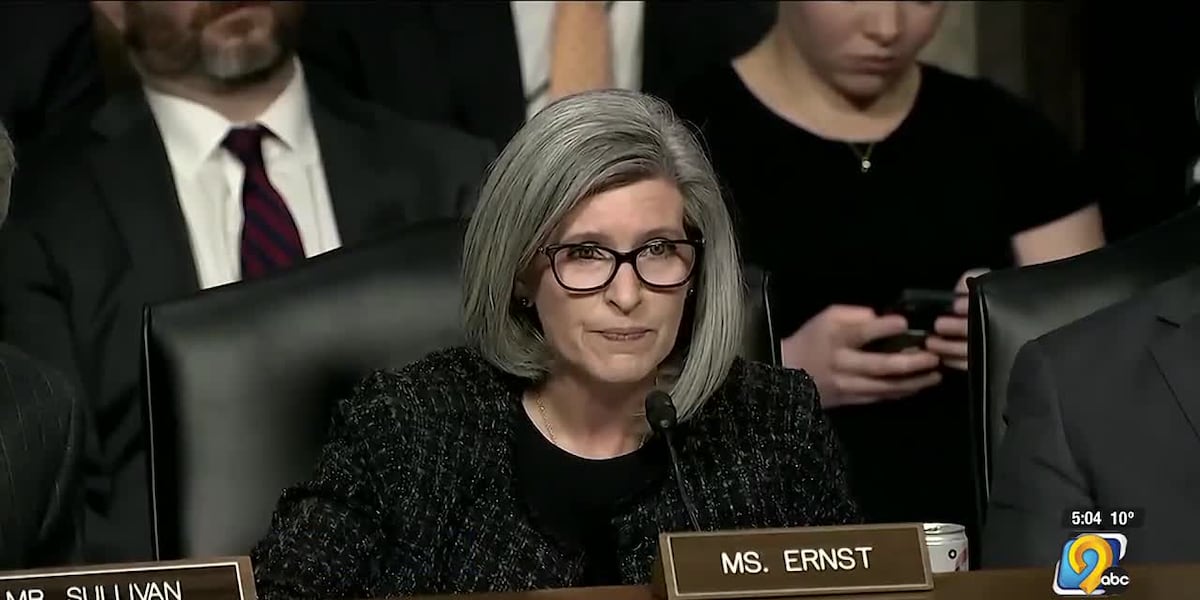

Senator Ernst Launches Bold Bid to Cut Political Funding and Presidential Perks

2025-02-17 22:15:35

Politics

Political Tensions Strain Diplomatic Bonds: A Canadian MP's Unexpected Clash with U.S. Vice President

2025-03-12 23:58:11

Politics

Alzheimer's Advocates Sound Alarm: Budget Cuts Threaten Critical Health Services

2025-04-15 03:30:00