Credit Unions Get a Boost: FM PulsePoint Revolutionizes Member Connection Strategies

Finance

2025-03-05 17:52:00Content

Franklin Madison Launches Innovative Member Engagement Benchmarking Tool

BRENTWOOD, Tenn. - In a groundbreaking move to revolutionize credit union member engagement, Franklin Madison has unveiled FM PulsePoint, a cutting-edge benchmarking solution that promises to transform how financial institutions understand and connect with their members.

This sophisticated data-driven tool empowers credit unions to gain unprecedented insights into member interactions, engagement levels, and potential growth opportunities. By providing comprehensive analytics and comparative metrics, FM PulsePoint enables financial institutions to develop more targeted, personalized strategies that enhance member satisfaction and loyalty.

"Our new PulsePoint platform represents a significant leap forward in how credit unions can measure and improve their member relationships," said a senior executive at Franklin Madison. "We're giving financial institutions the intelligence they need to create more meaningful, responsive member experiences."

The innovative benchmarking solution leverages advanced data analytics to help credit unions identify strengths, address potential gaps, and develop more effective engagement strategies in an increasingly competitive financial landscape.

Revolutionizing Member Engagement: The Future of Credit Union Analytics Unveiled

In the rapidly evolving landscape of financial services, credit unions are constantly seeking innovative strategies to deepen their connection with members and transform traditional engagement approaches. The emergence of cutting-edge technological solutions is reshaping how financial institutions understand, interact with, and serve their communities, creating unprecedented opportunities for meaningful digital transformation.Unlock the Power of Intelligent Member Insights - Where Data Meets Strategy

The Digital Transformation of Credit Union Engagement

Financial institutions are experiencing a profound metamorphosis in how they approach member relationships. Traditional methods of understanding customer needs are rapidly becoming obsolete, replaced by sophisticated data-driven methodologies that provide granular insights into member behaviors, preferences, and potential future interactions. Modern credit unions recognize that true engagement transcends simple transactional relationships, requiring a holistic approach that combines technological innovation with genuine human understanding. The landscape of member interaction is becoming increasingly complex, demanding tools that can navigate intricate behavioral patterns and predictive analytics. Credit unions must now leverage advanced technological platforms that can translate raw data into actionable strategic insights, enabling more personalized and meaningful member experiences.Benchmarking: The Strategic Cornerstone of Modern Financial Services

Benchmarking has emerged as a critical strategic tool for credit unions seeking to understand their performance relative to industry standards and peer institutions. By implementing comprehensive analytical frameworks, financial organizations can identify strengths, diagnose potential weaknesses, and develop targeted strategies for improvement. The most sophisticated benchmarking tools go beyond mere comparative analysis, offering predictive capabilities that help credit unions anticipate member needs, optimize service delivery, and create more responsive organizational structures. These advanced platforms integrate multiple data streams, providing a 360-degree view of member interactions, preferences, and potential future engagement opportunities.Technology as a Catalyst for Member-Centric Innovation

Technological solutions are no longer peripheral support systems but fundamental drivers of organizational strategy. Credit unions that embrace data-driven technologies position themselves at the forefront of financial service innovation, capable of delivering personalized experiences that resonate deeply with modern members. Advanced analytical platforms enable credit unions to move beyond generic service models, creating highly tailored interactions that reflect individual member profiles. By understanding nuanced behavioral patterns, financial institutions can develop proactive engagement strategies that anticipate member needs before they are explicitly expressed.The Evolving Landscape of Financial Data Intelligence

The convergence of artificial intelligence, machine learning, and sophisticated data analytics is fundamentally restructuring how credit unions conceptualize member relationships. These technologies provide unprecedented insights into complex behavioral ecosystems, allowing for more nuanced and intelligent engagement strategies. Modern benchmarking tools represent more than simple comparative metrics; they are sophisticated intelligence platforms that transform raw data into strategic narratives. Credit unions can now access comprehensive insights that illuminate member journey maps, revealing intricate patterns of interaction, preference, and potential future engagement.Strategic Implications of Advanced Member Analytics

By implementing next-generation analytical frameworks, credit unions can develop more responsive, adaptive organizational models. These platforms enable real-time strategic adjustments, ensuring that member services remain dynamically aligned with evolving expectations and technological capabilities. The future of financial services lies in the ability to create seamless, intelligent interactions that feel simultaneously personalized and effortless. Credit unions that invest in advanced analytical technologies are positioning themselves as innovative leaders in a rapidly transforming industry landscape.RELATED NEWS

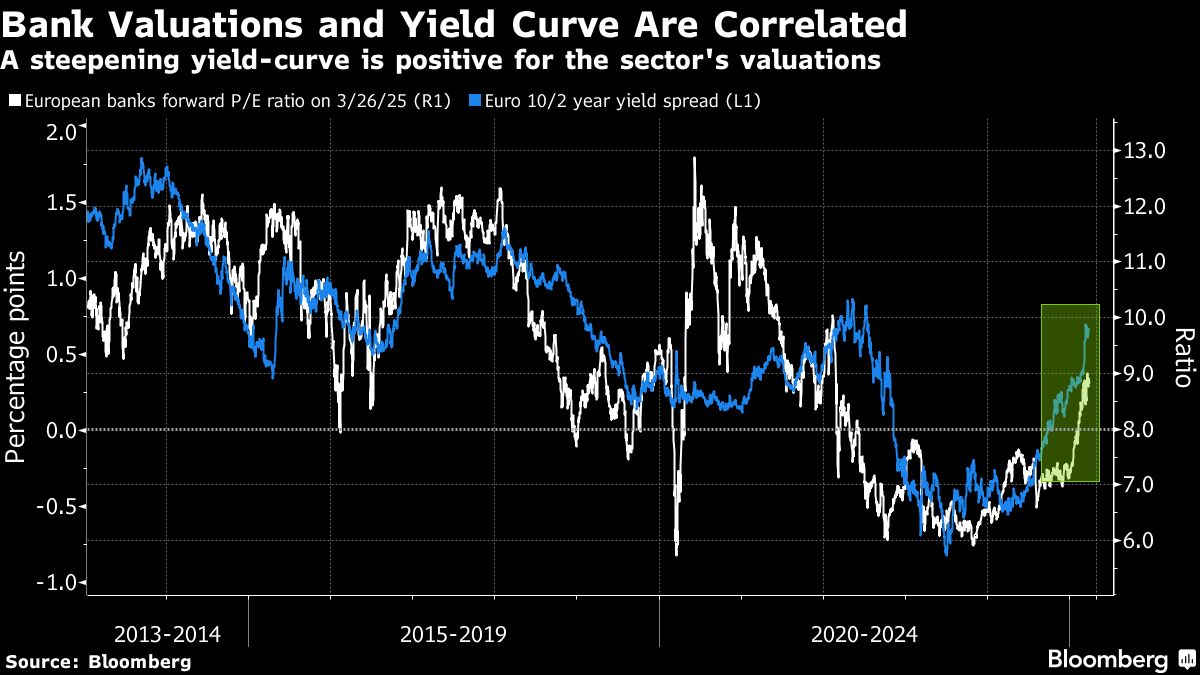

Banking Boom: European Lenders Ride Highest Wave of Success Since 2008 Crash