Digital Payment Showdown: CFPB Backs Down in Zelle Fraud Battle Against Banking Giants

Finance

2025-03-05 13:17:01Content

In a surprising turn of events, the Consumer Financial Protection Bureau (CFPB) has withdrawn its lawsuit against Early Warning Services, the company behind Zelle, and three major U.S. banks. This development comes amid a broader trend of federal agencies scaling back enforcement actions since President Donald Trump's return to the political landscape.

The original lawsuit, filed in December, targeted banking giants JPMorgan Chase, Wells Fargo, and Bank of America. The CFPB had initially accused these financial institutions of failing to protect consumers from widespread fraud on the Zelle payment platform, alleging violations of consumer financial protection laws.

At the heart of the complaint was a critical assertion that the banks hastily launched the peer-to-peer payment service without robust fraud prevention mechanisms. Moreover, the CFPB claimed that when consumers reported being victims of scams, the banks largely dismissed their claims and denied them financial relief.

The sudden withdrawal of the lawsuit raises questions about the changing regulatory environment and the potential implications for consumer protection in digital financial services. While the reasons behind the CFPB's decision remain unclear, it signals a potential shift in how financial misconduct is being addressed under the current administration.

Financial Watchdog Retreats: The Zelle Fraud Controversy Unraveled

In the ever-evolving landscape of digital financial services, a dramatic shift is unfolding as regulatory bodies recalibrate their approach to consumer protection. The recent withdrawal of a significant lawsuit against major banking institutions reveals the complex interplay between financial innovation, consumer safety, and regulatory oversight.Uncovering the Hidden Truths of Digital Payment Platforms

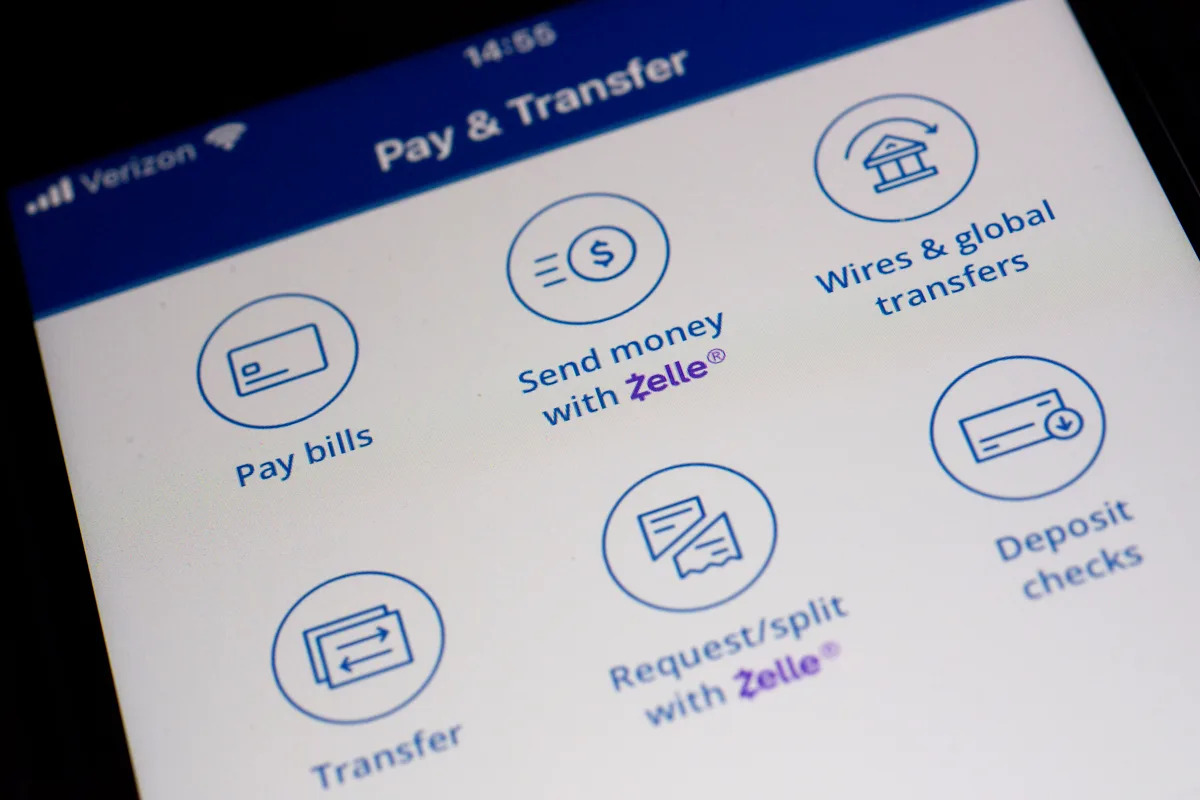

The Zelle Ecosystem: A Digital Payment Revolution

The peer-to-peer payment platform Zelle has emerged as a transformative force in digital financial transactions, revolutionizing how consumers transfer money instantaneously. Developed through a collaborative effort between major banking institutions, the platform promised unprecedented convenience and speed. However, beneath the surface of this technological marvel, a troubling narrative of vulnerability and potential exploitation began to take shape. Financial experts have long warned about the inherent risks associated with rapid digital payment technologies. The platform's meteoric rise brought with it complex challenges that traditional banking security frameworks struggled to address. Sophisticated fraudsters quickly identified and exploited potential weaknesses, targeting unsuspecting users with increasingly complex scam methodologies.Regulatory Dynamics and Institutional Accountability

The Consumer Financial Protection Bureau's initial lawsuit represented a significant moment of regulatory intervention. By challenging JPMorgan Chase, Wells Fargo, and Bank of America, the agency sought to hold financial institutions accountable for systemic vulnerabilities in their digital payment infrastructure. The legal action highlighted critical gaps in fraud prevention mechanisms and consumer protection protocols. Banking executives found themselves navigating a precarious landscape where technological innovation collided with regulatory expectations. The rapid deployment of Zelle had prioritized user experience and market penetration over comprehensive security frameworks. This approach left millions of consumers potentially exposed to sophisticated financial fraud schemes.The Political Dimension of Financial Regulation

The sudden withdrawal of the lawsuit coincides with broader political shifts in regulatory approaches. The changing administrative landscape has profound implications for how financial institutions are monitored and held accountable. This development suggests a potential recalibration of enforcement strategies, raising critical questions about consumer protection in the digital age. Political transitions often bring nuanced changes to regulatory philosophies. The current scenario demonstrates how leadership transitions can dramatically impact enforcement priorities, potentially creating windows of opportunity for financial institutions to reassess their compliance strategies.Consumer Protection in the Digital Financial Frontier

Despite the lawsuit's withdrawal, fundamental questions remain about digital payment platform security. Consumers continue to face significant risks when engaging with peer-to-peer payment technologies. The incident underscores the critical need for ongoing vigilance, robust security protocols, and transparent communication between financial institutions and their customers. Financial technology continues to evolve at an unprecedented pace, challenging traditional regulatory frameworks. The Zelle controversy represents a microcosm of larger debates surrounding technological innovation, consumer protection, and institutional responsibility in the digital financial ecosystem.Future Implications and Industry Adaptation

The resolution of this legal challenge will likely prompt significant introspection within the banking and financial technology sectors. Financial institutions must proactively develop more sophisticated fraud detection and prevention mechanisms. This requires substantial investments in technological infrastructure, machine learning algorithms, and comprehensive user education programs. Emerging technologies like artificial intelligence and blockchain offer promising avenues for enhancing digital payment security. Financial institutions that prioritize innovative security solutions will likely gain competitive advantages in an increasingly complex digital landscape.RELATED NEWS

Finance

Cancelled and Broke: How Celebrity Cancellations Drain Fortunes Overnight

2025-03-16 07:22:30

Finance

Tariff Tango: Expert Tips to Shield Your Finances from Trump-Era Trade Tensions

2025-04-03 23:55:18

Finance

Trade War Escalates: Trump Slaps Massive 145% Tariff Hammer on Chinese Imports

2025-04-10 16:17:33