Retail Giant Seven & i Mulls Major Divestment: Bain Capital Eyeing Non-Core Shares

Business

2025-03-05 09:19:36Content

In a potential landmark deal, Seven & i Holdings is reportedly preparing to offload a significant portion of its non-core business holding company shares to private equity giant Bain Capital. The transaction is expected to exceed 700 billion yen, which translates to approximately $4.69 billion, according to sources familiar with the negotiations.

Bloomberg News first broke the story on Wednesday, revealing insider details about the high-stakes transaction. The deal represents a strategic move by Seven & i Holdings to streamline its portfolio and focus on core business operations.

With the current exchange rate of 149.17 yen to the US dollar, this substantial transaction underscores the company's commitment to optimizing its corporate structure and potentially unlocking significant shareholder value.

While specific details remain confidential, the potential sale signals a noteworthy shift in the company's strategic direction and could have broader implications for its future business landscape.

Bain Capital's Strategic Acquisition: Seven & i Holdings' Non-Core Business Divestment Signals Major Corporate Restructuring

In the dynamic landscape of global corporate strategy, mergers and acquisitions continue to reshape business ecosystems, with recent developments highlighting the intricate dance of corporate restructuring and strategic asset management. The potential transaction between Seven & i Holdings and Bain Capital represents a significant moment in corporate financial maneuvering, signaling a profound shift in strategic asset allocation and corporate portfolio optimization.Transformative Corporate Realignment Poised to Redefine Market Dynamics

Strategic Asset Divestment: A Comprehensive Financial Maneuver

The potential sale of non-core business holding company shares represents a sophisticated financial strategy that extends far beyond simple asset liquidation. Seven & i Holdings appears to be executing a meticulously planned corporate transformation, leveraging Bain Capital's extensive financial expertise to streamline its corporate portfolio. This strategic move suggests a profound understanding of market dynamics, organizational efficiency, and long-term value creation. By considering the divestment of non-core assets, the company demonstrates a commitment to focusing on its primary business segments, potentially unlocking significant shareholder value. The transaction, reportedly valued at approximately 700 billion yen (equivalent to $4.69 billion), represents a substantial financial undertaking that could potentially reshape the company's strategic positioning in the global marketplace.Bain Capital's Strategic Investment Approach

Bain Capital's interest in acquiring these non-core business holding company shares underscores the private equity firm's sophisticated investment strategy. The potential acquisition reflects a nuanced approach to identifying undervalued assets and recognizing latent potential within complex corporate structures. The transaction suggests a comprehensive evaluation of the assets' intrinsic value, potential for future growth, and strategic alignment with Bain Capital's broader investment portfolio. Such strategic investments typically involve extensive due diligence, financial modeling, and a forward-looking perspective on market trends and potential value creation.Market Implications and Economic Significance

The proposed transaction between Seven & i Holdings and Bain Capital carries broader implications for the corporate landscape, potentially signaling emerging trends in corporate restructuring and asset management. This strategic move could influence investor sentiment, market perceptions, and future corporate strategy across various industries. The exchange rate consideration of 1 USD to 149.1700 yen provides additional context, highlighting the complex international financial dynamics underlying such significant corporate transactions. The precise financial engineering involved demonstrates the sophisticated nature of global corporate interactions and the intricate mechanisms of cross-border investments.Corporate Governance and Strategic Realignment

This potential divestment reflects a sophisticated approach to corporate governance, where companies continuously evaluate and optimize their asset portfolios. Seven & i Holdings appears to be proactively managing its corporate structure, potentially preparing for future growth, technological adaptation, and market competitiveness. The strategic partnership with Bain Capital suggests a forward-thinking approach to corporate development, where non-core assets are viewed not as liabilities but as potential opportunities for value generation and strategic repositioning. This perspective underscores the dynamic nature of modern corporate strategy and the importance of continuous organizational adaptation.RELATED NEWS

Business

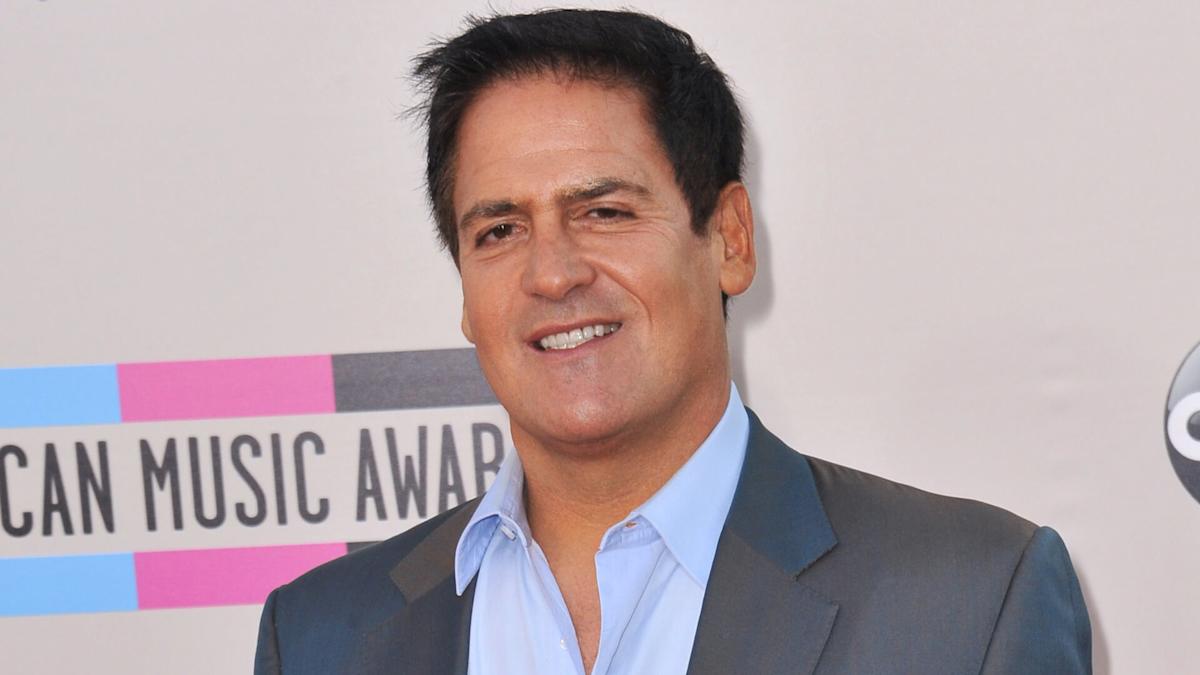

Shark Tank Billionaire Drops Game-Changing Playbook: Cuban's 2025 Small Business Survival Guide

2025-03-27 21:01:49

Business

Trade Turmoil: How Trump's Unpredictable Economic Moves Are Shaking Global Business Confidence

2025-03-06 15:02:02

Business

Trade War Escalates: China Slaps Hefty 34% Tariffs on US Imports in Sharp Economic Counterpunch

2025-04-04 10:21:54