Suominen's 2024 Financial Reveal: Steady Gains Signal Corporate Resilience

Finance

2025-03-05 07:30:00Content

Suominen Corporation Reveals Promising Financial Performance for 2024

Suominen Corporation has released its comprehensive Financial Statements for the fiscal year 2024, showcasing a steady improvement in financial performance and operational efficiency.

Financial Highlights

For the full year 2024, the company demonstrated resilience with key financial metrics indicating positive momentum:

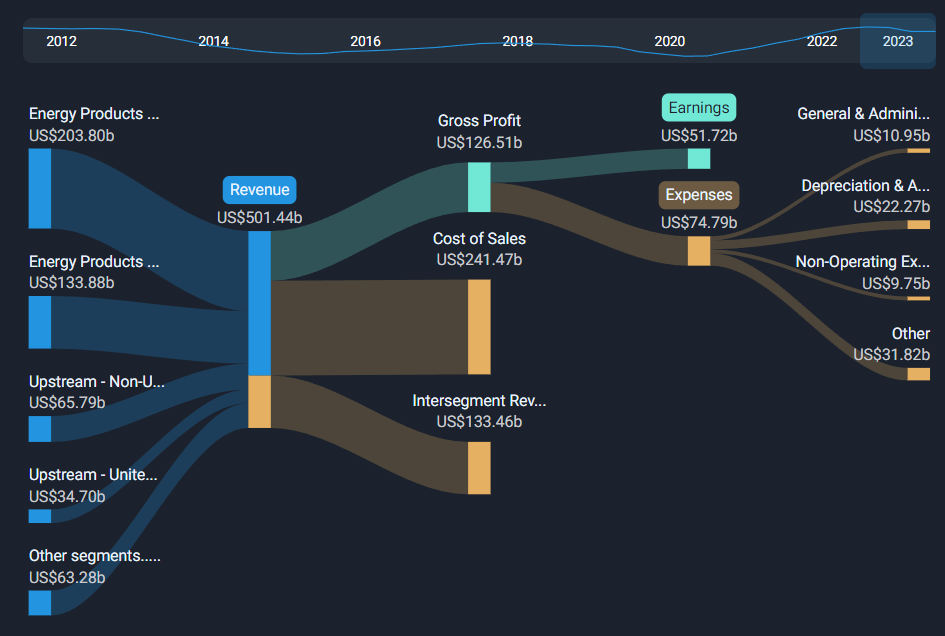

- Net sales reached €462.3 million, representing a notable increase from €450.9 million in 2023

- Comparable EBITDA grew to €17.0 million, up from €15.8 million in the previous year

- Comparable EBITDA margin improved to 3.7%, compared to 3.5% in 2023

Quarterly Performance

In the fourth quarter of 2024, Suominen maintained its strategic focus, with net sales of €118.5 million and a comparable EBITDA of €4.2 million. The company's ability to navigate challenging market conditions continues to be a testament to its robust business model.

Strategic Outlook

While the financial results show moderate improvement, Suominen remains committed to driving operational excellence and exploring opportunities for sustainable growth in the coming year.

Financial Statement Release Date: March 5, 2025, at 9:30 a.m. (EET)

Suominen Corporation's Financial Triumph: Navigating Economic Challenges with Strategic Resilience

In the dynamic landscape of corporate financial performance, Suominen Corporation emerges as a beacon of strategic adaptation, demonstrating remarkable resilience amid complex market conditions. The company's latest financial statements reveal a nuanced narrative of measured growth and strategic maneuvering, offering investors and stakeholders a compelling glimpse into its operational excellence.Transforming Challenges into Opportunities: A Financial Odyssey of Precision and Performance

Revenue Dynamics: Charting a Course of Steady Expansion

Suominen Corporation's financial trajectory presents an intriguing panorama of sustained growth. The organization's net sales experienced a calculated progression, climbing from €114.9 million in the comparable previous period to €118.5 million in the current quarter. This incremental advancement reflects a sophisticated approach to market penetration and revenue optimization. The underlying mechanics of this growth reveal a complex interplay of strategic initiatives, market positioning, and operational efficiency. By meticulously navigating economic headwinds, Suominen has demonstrated an exceptional ability to extract value from challenging environments, transforming potential obstacles into opportunities for expansion.Profitability Metrics: Decoding the EBITDA Performance

The company's comparable EBITDA emerges as a critical indicator of its financial health, presenting a nuanced story of strategic financial management. Declining marginally from €5.3 million to €4.2 million in the quarter, this metric nonetheless underscores Suominen's commitment to maintaining robust operational margins. A deeper exploration reveals the intricate balance between cost management and revenue generation. The EBITDA percentage, hovering around 3.6-4.6%, demonstrates a disciplined approach to financial stewardship. This precision in financial navigation suggests a mature, calculated strategy that prioritizes sustainable growth over short-term gains.Operational Insights: Beyond the Numbers

Suominen's financial narrative extends far beyond mere numerical representations. The company's ability to maintain a comparable operating profit, despite challenging market conditions, speaks volumes about its organizational resilience and strategic agility. The marginal fluctuations in financial metrics reflect a sophisticated understanding of market dynamics. By maintaining a delicate balance between investment, operational efficiency, and strategic adaptation, Suominen positions itself as a forward-thinking organization capable of weathering economic uncertainties.Strategic Implications: A Forward-Looking Perspective

The financial statements offer more than a retrospective view; they provide a window into the company's future potential. Each numerical shift represents a calculated decision, a strategic move in the complex chess game of corporate finance. Investors and market analysts will find particular interest in the company's ability to maintain consistent performance across challenging quarters. The subtle nuances in financial reporting suggest a depth of strategic planning that extends well beyond immediate financial periods.Market Positioning and Competitive Landscape

Suominen's financial performance must be contextualized within the broader market ecosystem. The company's measured growth and strategic financial management position it as a resilient player in a competitive landscape. The ability to generate stable revenues and maintain operational efficiency speaks to a sophisticated understanding of market dynamics. Each financial metric becomes a testament to the organization's strategic acumen, revealing a depth of corporate intelligence that transcends traditional financial reporting.RELATED NEWS