AI Powerhouse DeepSeek Ignites $1.3 Trillion Chinese Market Surge

Finance

2025-02-16 00:00:00Content

China's AI Revolution Sparks Global Investment Surge

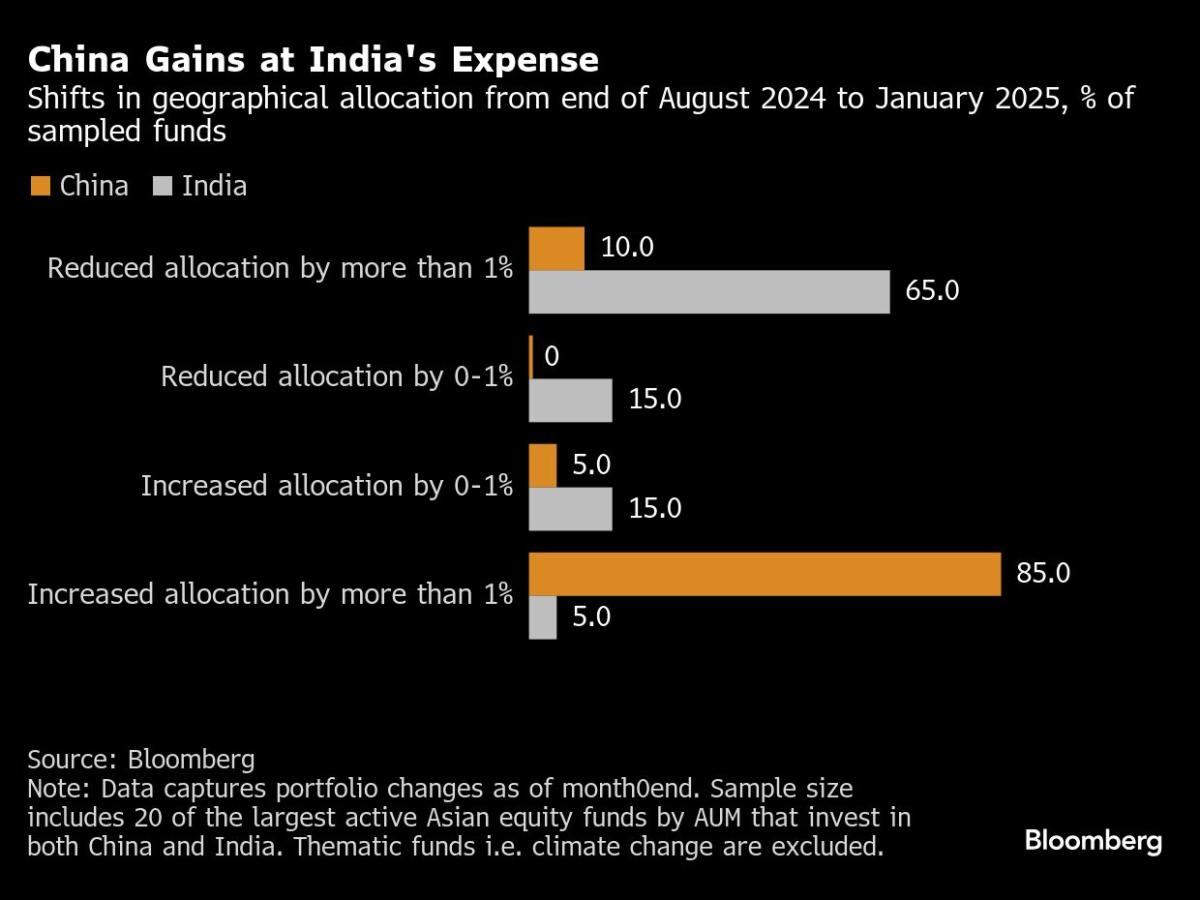

The rapid rise of DeepSeek, an innovative artificial intelligence company, is triggering a significant shift in international investment strategies, with hedge funds aggressively reallocating capital back into Chinese equities.

After months of cautious sentiment, investors are now moving swiftly to capitalize on China's burgeoning AI landscape. DeepSeek's groundbreaking technological advancements have become a key catalyst, signaling a potential renaissance in the country's tech sector.

Market analysts report that hedge funds are entering Chinese stocks at the most aggressive pace seen in recent months. This momentum suggests a growing confidence in China's ability to compete in the global artificial intelligence arena, potentially challenging previous investment preferences toward markets like India.

The surge reflects a broader recognition of China's technological potential, with DeepSeek emerging as a symbolic representation of the nation's innovative capabilities. Investors are increasingly viewing Chinese tech companies as compelling opportunities for strategic investment.

As the AI landscape continues to evolve, this investment rotation underscores the dynamic and rapidly changing nature of global financial markets, with technological innovation serving as a primary driver of investment decisions.

AI Revolution: How DeepSeek is Reshaping China's Investment Landscape

In the rapidly evolving world of technological innovation, artificial intelligence continues to disrupt traditional financial paradigms, with emerging players like DeepSeek transforming investment strategies and market dynamics across global financial ecosystems.The Cutting Edge of Technological Financial Transformation

The Rise of AI-Driven Investment Strategies

The technological landscape is witnessing an unprecedented transformation as artificial intelligence becomes increasingly sophisticated in analyzing complex market trends. DeepSeek's groundbreaking AI technologies are not merely incremental improvements but represent a fundamental shift in how financial institutions approach investment decision-making. By leveraging advanced machine learning algorithms, the company has developed sophisticated predictive models that can process vast amounts of financial data with remarkable precision and speed. Hedge funds and institutional investors are rapidly recognizing the potential of AI-powered investment strategies. These intelligent systems can identify nuanced market patterns that traditional analytical methods might overlook, providing a significant competitive advantage. DeepSeek's algorithms are particularly adept at navigating the intricate Chinese equity markets, offering investors unprecedented insights into emerging opportunities.Geopolitical and Economic Implications

The emergence of DeepSeek signals a broader trend of technological innovation driving financial market transformations. China's strategic investments in artificial intelligence are creating ripple effects across global investment landscapes, challenging traditional investment paradigms. The rotation of stock funds from India to China is not merely a financial movement but represents a complex interplay of technological capability, economic potential, and geopolitical positioning. Investors are increasingly viewing AI capabilities as a critical metric for evaluating market potential. DeepSeek's technological prowess demonstrates China's commitment to becoming a global leader in artificial intelligence, which extends far beyond mere technological achievement and into strategic economic positioning. This shift suggests a profound recalibration of international investment strategies, with technology serving as a primary driver of economic attractiveness.Technological Innovation and Market Dynamics

The integration of advanced AI technologies like those developed by DeepSeek is fundamentally reshaping how financial markets operate. Traditional investment models that relied primarily on human analysis and historical data are being rapidly supplemented and, in some cases, replaced by intelligent systems capable of processing complex, multidimensional datasets in real-time. These technological advancements are not just improving investment accuracy but are also democratizing access to sophisticated financial insights. Smaller investors and emerging market participants can now leverage AI-driven tools that were previously accessible only to large institutional players. This democratization represents a significant shift in the global financial ecosystem, potentially reducing information asymmetries and creating more transparent, efficient markets.Future Outlook and Potential Challenges

While the potential of AI in financial markets is immense, the technology also presents complex challenges. Regulatory frameworks must evolve to address the ethical and operational implications of AI-driven investment strategies. Questions surrounding algorithmic bias, data privacy, and the potential for systemic risks require careful consideration and proactive governance. DeepSeek's trajectory suggests that artificial intelligence will continue to be a critical differentiator in financial markets. As machine learning algorithms become more sophisticated, their ability to predict market trends, assess risk, and generate investment strategies will likely become increasingly refined. The companies and countries that can effectively harness these technologies will be best positioned to lead in the emerging global economic landscape.RELATED NEWS

Finance

Power Play: Southern Company Crushes Q1 Earnings Expectations with Robust Financial Momentum

2025-05-02 07:15:18

Finance

Global Finance Showdown: UWF Students Sweep Top Honors in Prestigious Portfolio Challenge

2025-04-09 13:30:00

Finance

Starlit Paths Unveiled: Sagittarius Faces Career Crossroads and Romantic Revelations on February 21st

2025-02-21 01:42:32