Startup Funding Surge: $1B Milestone Signals Investor Confidence in Early 2024

Companies

2025-03-02 22:02:00Content

Private Equity Investors Spotlight Growth-Stage Companies in India's Vibrant Startup Ecosystem

Chennai is witnessing a significant surge of investor interest in 'growth-stage' companies, with private equity and venture capital firms increasingly focusing their investments on promising enterprises poised for substantial expansion.

These growth-stage companies, typically characterized by proven business models and demonstrated market potential, are attracting substantial attention from sophisticated investors seeking strategic opportunities in India's dynamic startup landscape. The trend reflects a maturing investment approach that prioritizes companies with clear growth trajectories and sustainable competitive advantages.

Investors are particularly drawn to startups that have already established market credibility and are ready to scale operations, offering a more calculated investment strategy compared to early-stage funding. This shift indicates a nuanced understanding of the Indian entrepreneurial ecosystem and a more targeted approach to venture capital deployment.

The current investment climate suggests a promising outlook for innovative companies that can demonstrate robust growth potential, operational efficiency, and scalable business models.

Private Equity's New Frontier: Growth-Stage Investments Reshaping Indian Business Landscape

In the dynamic world of venture capital and private equity, a transformative trend is emerging that promises to redefine investment strategies across India's burgeoning startup ecosystem. As traditional funding models evolve, investors are increasingly turning their attention to growth-stage companies, signaling a significant shift in the investment paradigm.Unlocking Potential: The Game-Changing Investment Revolution

The Emerging Landscape of Growth-Stage Investments

Private equity and venture capital firms are experiencing a remarkable transformation in their investment approach, with a pronounced focus on growth-stage enterprises. These companies, positioned at a critical juncture between early-stage startups and mature businesses, represent a compelling investment opportunity that combines innovation with proven market potential. The strategic pivot towards growth-stage investments reflects a nuanced understanding of the Indian entrepreneurial ecosystem. Investors are no longer content with mere financial injections; they seek companies demonstrating robust scalability, sustainable business models, and clear pathways to market dominance. This approach represents a sophisticated evolution from traditional investment methodologies.Decoding the Investment Attraction

What makes growth-stage companies so attractive to sophisticated investors? The answer lies in their unique positioning. These enterprises have already navigated the treacherous early startup landscape, establishing credible market presence and generating tangible revenue streams. They possess validated business models, experienced management teams, and demonstrated potential for exponential growth. Venture capitalists and private equity professionals are meticulously analyzing these companies, looking beyond surface-level metrics. They're examining technological innovation, market adaptability, competitive positioning, and potential for disruptive transformation. The Chennai investment ecosystem exemplifies this trend, becoming a microcosm of broader national investment strategies.Technological Innovation and Investment Dynamics

The convergence of technological innovation and strategic investment is creating unprecedented opportunities. Sectors like fintech, healthtech, edtech, and enterprise software are witnessing unprecedented investor interest. Growth-stage companies in these domains are not just attracting capital but are fundamentally reshaping industrial landscapes. Sophisticated investors are deploying advanced analytical tools and deep-dive due diligence processes to identify potential unicorns. Machine learning algorithms, predictive analytics, and comprehensive market research are becoming standard practices in evaluating investment opportunities. This data-driven approach ensures more calculated and potentially lucrative investment decisions.Economic Implications and Future Projections

The growing interest in growth-stage investments carries profound economic implications. By channeling capital into promising enterprises, investors are directly contributing to job creation, technological advancement, and economic diversification. These investments serve as catalysts for innovation, enabling companies to scale operations, expand market reach, and develop groundbreaking solutions. Experts predict this investment trend will continue gaining momentum, with potential annual growth rates suggesting a transformative impact on India's startup ecosystem. The symbiotic relationship between investors and growth-stage companies promises to unlock unprecedented economic potential, positioning India as a global innovation hub.Navigating Challenges and Mitigating Risks

Despite the optimistic outlook, investors remain cognizant of potential challenges. Market volatility, regulatory complexities, and global economic uncertainties necessitate a nuanced, adaptive investment strategy. Successful investors are those who combine rigorous analysis with flexible, forward-thinking approaches. Risk mitigation strategies now involve comprehensive due diligence, diversified investment portfolios, and ongoing strategic support for portfolio companies. This holistic approach ensures not just financial investment but meaningful, long-term partnerships that drive sustainable growth.RELATED NEWS

Companies

Ethical Excellence: John Deere Clinches Prestigious Global Integrity Award for 2025

2025-03-11 14:18:00

Companies

Climate Showdown: Rhode Island's Bold Bid to Make Big Oil Pay for Global Warming Damages

2025-03-03 10:10:55

Companies

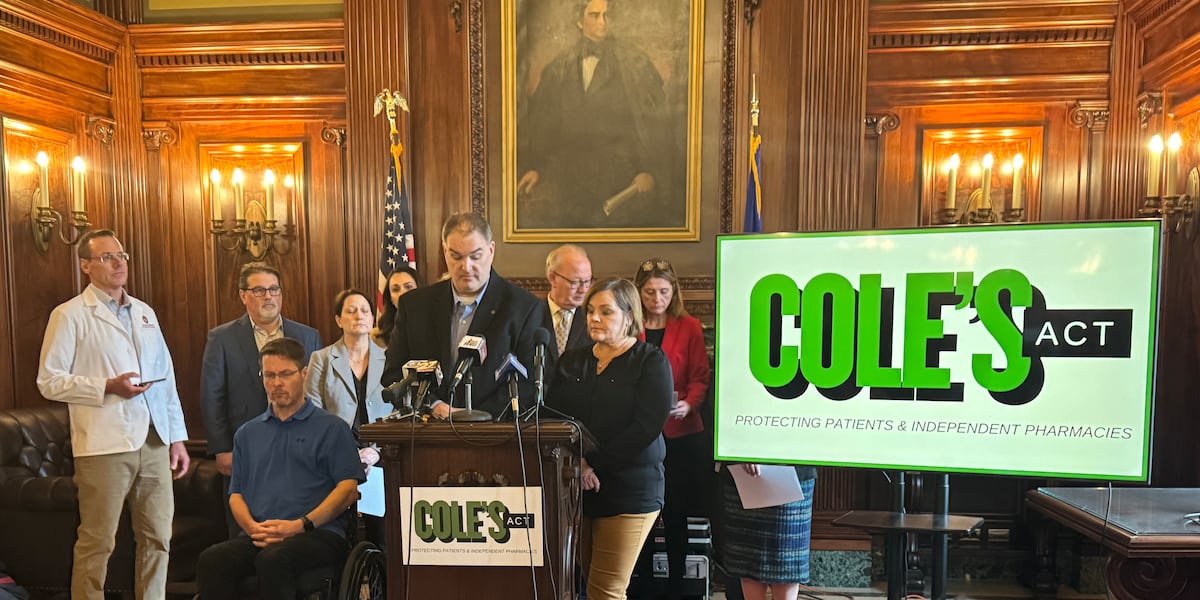

Rx Middlemen Beware: Wisconsin Lawmakers Unveil Bold Crackdown on Prescription Pricing Gatekeepers

2025-03-05 00:39:14