Heineken's Big Bet: Private Investors Score Big with 16% Stock Surge

Companies

2025-02-17 13:18:32Content

Unveiling the Power Dynamics: Heineken's Corporate Ownership Landscape

The intricate ownership structure of Heineken reveals a fascinating interplay of corporate influence and public engagement. With significant control held by private companies, the traditional narrative of corporate ownership is subtly reshaped.

While private entities maintain a strong grip on Heineken's strategic direction, this arrangement paradoxically opens up unique opportunities for broader stakeholder participation. The complex web of ownership suggests that public influence extends beyond mere shareholding, creating nuanced channels of corporate accountability.

Investors and consumers alike are discovering that corporate governance is not a monolithic concept, but a dynamic ecosystem where private interests and public expectations continually intersect. Heineken's ownership model demonstrates how transparency and strategic ownership can potentially empower shareholders and the general public to have a more meaningful voice in corporate decision-making.

This evolving landscape challenges traditional perceptions of corporate control, suggesting that power is not simply concentrated in boardrooms, but can be distributed through sophisticated ownership mechanisms that invite broader participation and scrutiny.

Unveiling the Corporate Landscape: Heineken's Ownership and Public Influence Dynamics

In the intricate world of global beverage corporations, ownership structures reveal fascinating insights into corporate governance and shareholder dynamics. The interplay between private entities and public stakeholders creates a complex narrative that extends far beyond simple business transactions, offering a nuanced perspective on corporate control and strategic decision-making.Decoding Corporate Power: When Private Interests Shape Market Strategies

The Ownership Ecosystem of Heineken

Heineken, a global brewing powerhouse, represents a compelling case study in corporate ownership complexity. The company's shareholding structure is characterized by a sophisticated network of private entities that wield significant influence over strategic decisions. Unlike traditional publicly traded corporations, Heineken's ownership model demonstrates a unique approach to corporate governance that challenges conventional market expectations. The intricate ownership landscape reveals multiple layers of control mechanisms. Private shareholders have strategically positioned themselves to maintain substantial decision-making power, effectively shaping the company's long-term trajectory. This arrangement creates a delicate balance between institutional control and potential public market influences.Implications of Concentrated Ownership

The concentration of ownership among private companies introduces profound implications for corporate strategy and operational autonomy. By maintaining tight control over key decision-making processes, these private entities can implement more agile and targeted strategic initiatives compared to widely dispersed shareholder models. Such concentrated ownership structures enable rapid strategic pivots, allowing Heineken to respond swiftly to market dynamics and emerging global trends. The ability to make quick, coordinated decisions provides a significant competitive advantage in the highly competitive global beverage market.Public Perception and Shareholder Dynamics

While private companies maintain substantial control, the relationship with public shareholders represents a nuanced and dynamic interaction. The perception of corporate governance becomes increasingly important as stakeholders demand greater transparency and accountability. Investors and market analysts closely scrutinize the balance between private control and public interests. This ongoing dialogue creates a complex ecosystem where corporate strategy must simultaneously address institutional objectives and broader market expectations.Strategic Implications of Corporate Control

The ownership structure of Heineken demonstrates how private entities can strategically leverage their control to drive long-term value creation. By maintaining a focused and aligned ownership approach, the company can implement more consistent and deliberate strategic initiatives. This model of corporate governance allows for more predictable and potentially more sustainable growth strategies. Private shareholders can invest in long-term development without the short-term pressures typically associated with public market expectations.Global Market Positioning and Competitive Advantage

Heineken's unique ownership structure contributes significantly to its global market positioning. The ability to make swift, coordinated decisions provides a substantial competitive advantage in the rapidly evolving global beverage landscape. By maintaining tight control and strategic alignment, private shareholders can more effectively navigate complex international markets, implement innovative strategies, and respond to emerging consumer trends with remarkable agility.Future Outlook and Potential Transformations

The ongoing evolution of corporate ownership models suggests that Heineken's current structure may continue to adapt. As global markets become increasingly interconnected and dynamic, the company's ownership approach will likely undergo further refinement and strategic recalibration. Emerging technologies, changing regulatory environments, and shifting global economic landscapes will undoubtedly influence future ownership strategies, presenting both challenges and opportunities for Heineken's continued growth and market leadership.RELATED NEWS

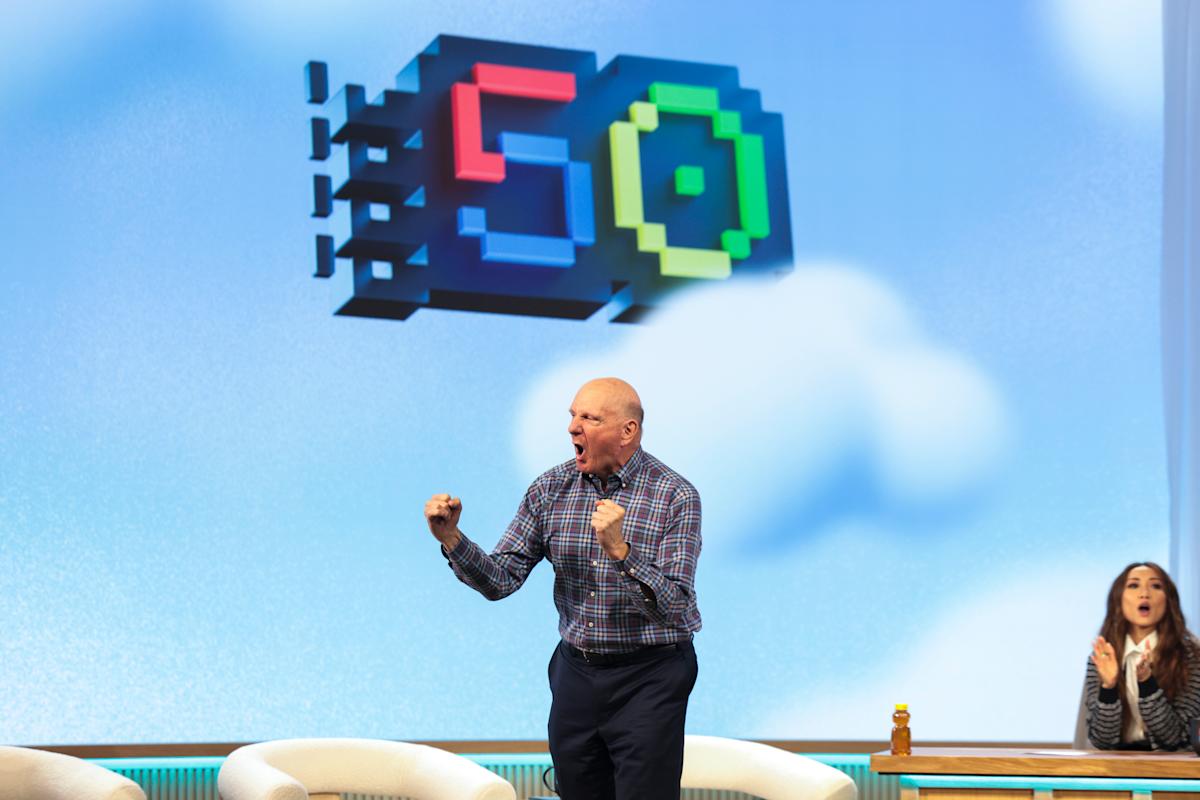

Tech Titan's Bold Advice: Ballmer Urges Firms to Double Down Despite Trade War Tensions