Financial Overhaul: Beijing's Bold Strategy to Reshape Economic Landscape

Finance

2025-02-17 05:13:34Content

China is embarking on an ambitious strategic overhaul of its financial landscape, targeting the creation of world-class investment banks through a comprehensive industry consolidation effort. Financial experts predict this move will significantly strengthen China's global financial competitiveness and reshape its banking sector.

The planned consolidation represents a calculated approach to elevate domestic investment banks, positioning them to compete more effectively on the international stage. By strategically merging and restructuring existing financial institutions, China aims to develop robust, internationally recognized banking powerhouses that can rival global financial leaders.

Analysts suggest this initiative is part of a broader national strategy to enhance China's financial infrastructure and global economic influence. The consolidation process is expected to create more resilient, technologically advanced, and strategically positioned investment banks capable of supporting China's expanding economic interests worldwide.

This transformative approach signals China's commitment to financial innovation and its determination to establish a more prominent role in the global financial ecosystem. As the consolidation unfolds, the banking sector is poised for a significant and potentially game-changing transformation.

Financial Revolution: China's Strategic Transformation of Investment Banking Landscape

In the rapidly evolving global financial ecosystem, China is positioning itself at the forefront of a transformative banking strategy that promises to reshape international investment paradigms. The nation's calculated approach to industry consolidation signals a profound commitment to establishing world-class financial institutions that can compete on the global stage.Redefining Global Financial Dynamics Through Strategic Consolidation

The Emerging Landscape of Chinese Investment Banking

The Chinese financial sector stands on the cusp of a monumental transformation, driven by an intricate blend of strategic vision and economic pragmatism. Unlike traditional consolidation models, China's approach represents a holistic reimagining of investment banking infrastructure. Policymakers and financial strategists are meticulously crafting an ecosystem that transcends mere institutional mergers, focusing instead on creating robust, technologically advanced financial entities capable of navigating complex global markets. Financial experts suggest this consolidation isn't merely about size, but about developing institutions with sophisticated risk management capabilities, advanced technological integration, and a deep understanding of both domestic and international investment landscapes. The strategic blueprint involves creating synergies between state-owned enterprises, emerging fintech platforms, and traditional banking structures.Technological Innovation as a Catalyst for Banking Transformation

China's investment banking consolidation strategy is fundamentally intertwined with technological innovation. Artificial intelligence, blockchain technologies, and advanced data analytics are being seamlessly integrated into the new financial architectures. These technological interventions are not just supplementary features but core components of the emerging banking models. The convergence of cutting-edge technology with financial services represents a paradigm shift. Machine learning algorithms are being deployed to enhance risk assessment, while blockchain technologies promise unprecedented transparency and security in transaction processes. This technological renaissance positions Chinese investment banks as potential global leaders in financial innovation.Geopolitical Implications of Banking Restructuring

The ongoing banking consolidation carries significant geopolitical undertones. By creating more robust, internationally competitive financial institutions, China is strategically positioning itself to challenge the traditional dominance of Western financial centers. This isn't merely an economic strategy but a sophisticated soft power projection that could fundamentally alter global financial dynamics. International observers note that these restructuring efforts go beyond domestic considerations. The emerging Chinese investment banking model seems designed to support the Belt and Road Initiative, providing sophisticated financial infrastructure for international economic collaborations. Each consolidated institution is potentially a conduit for China's broader economic diplomacy.Regulatory Framework and Future Outlook

The Chinese government's role in this transformation cannot be overstated. Carefully crafted regulatory frameworks are providing the scaffolding for this ambitious restructuring. Regulatory bodies are simultaneously acting as architects and guardians, ensuring that the consolidation process maintains financial stability while fostering innovation. Economists predict that this strategic consolidation could yield institutions with unprecedented scale, technological sophistication, and global reach. The potential emergence of Chinese investment banks as major global players represents a significant shift in the international financial order, challenging long-established Western-centric models of banking and finance.RELATED NEWS

Finance

Housing Market Trembles: Builders Brace for Sluggish Spring Amid Mortgage Maze and Trade Tensions

2025-03-29 13:00:31

Finance

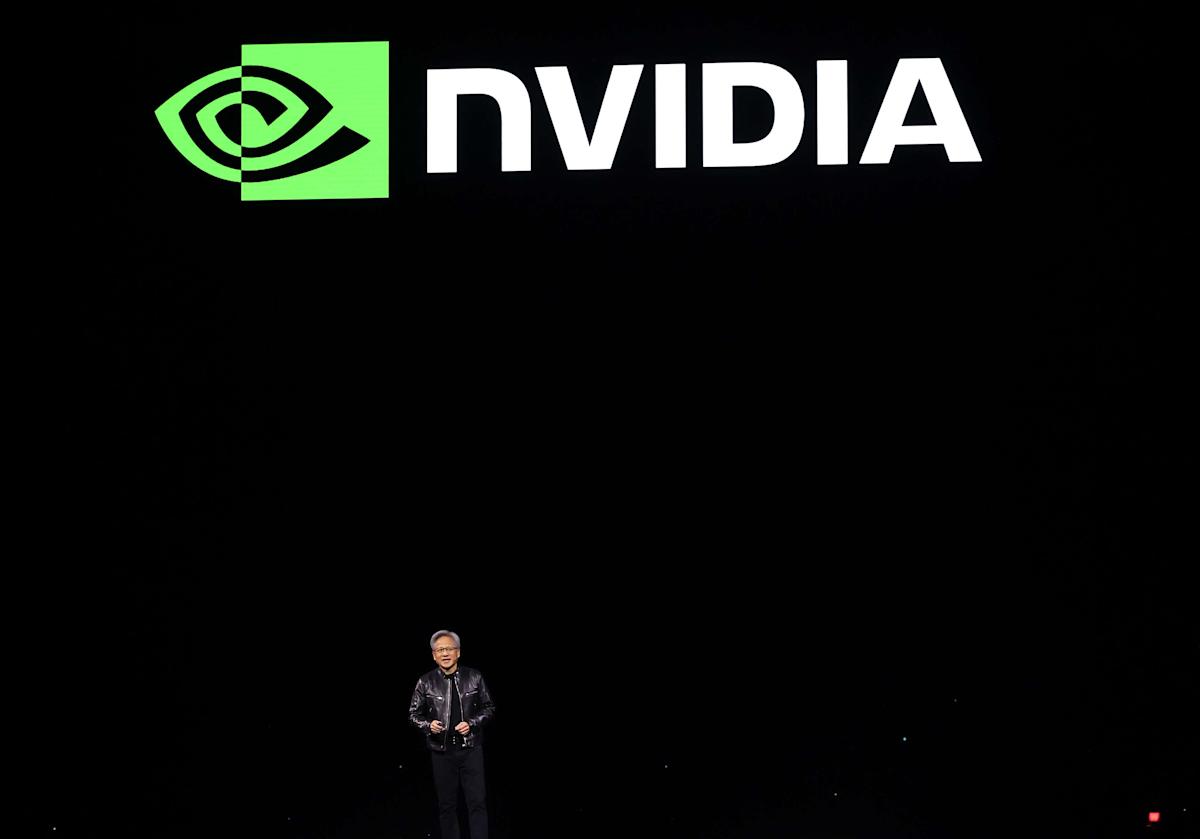

Nvidia's Bold Move: Supercharging US Tech Manufacturing with Massive Supply Chain Overhaul

2025-03-20 11:39:44

Finance

Steering Ahead: Southeast Toyota Finance Reshapes Leadership and Charts Bold Growth Strategy

2025-04-15 18:40:00