Buy Now, Pay Later Revolution: Chile's $651M Market Boom Reveals Explosive Consumer Trends

Business

2025-02-17 12:19:00Content

Chile's Buy Now, Pay Later Market Poised for Significant Growth in 2025

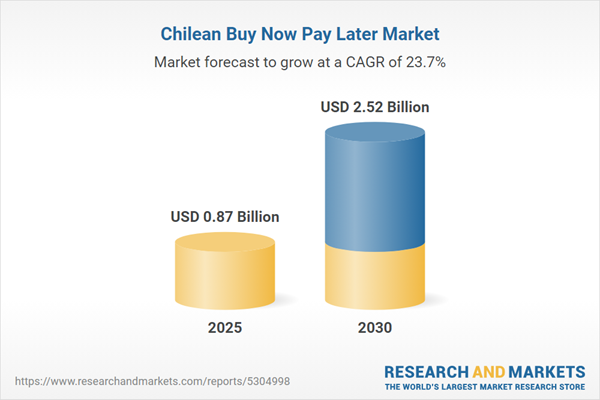

In a groundbreaking market analysis released today, researchers predict a remarkable expansion of the Buy Now, Pay Later (BNPL) sector in Chile. The latest report from ResearchAndMarkets.com reveals an impressive projected growth trajectory that signals exciting opportunities for financial technology and consumer spending.

Market Outlook

The Chilean BNPL payment market is set to experience a robust 33.9% annual growth, with total market value expected to reach US$871.7 million by the end of 2025. This substantial increase highlights the growing consumer appetite for flexible payment solutions in the country.

Key Insights

- Projected market value: US$871.7 million

- Annual growth rate: 33.9%

- Comprehensive analysis covering 75+ key performance indicators

- Detailed examination of market size, end-use sectors, and demographics

The report, titled "Chile Buy Now Pay Later Business and Investment Opportunities Databook - Q1 2025 Update", provides an in-depth look at the evolving financial landscape, offering valuable insights for investors and industry professionals.

As digital payment solutions continue to transform consumer behavior, Chile stands at the forefront of this financial innovation, demonstrating significant potential for BNPL services.

Chile's Buy Now, Pay Later Revolution: A Financial Transformation Unfolding

In the dynamic landscape of financial technology, Chile stands at the forefront of a remarkable economic transformation, with the Buy Now, Pay Later (BNPL) market emerging as a game-changing financial innovation that is reshaping consumer spending and digital commerce strategies across the nation.Revolutionizing Consumer Finance: The Future of Flexible Payments

Market Dynamics and Economic Potential

The Chilean financial ecosystem is experiencing an unprecedented surge in alternative payment methodologies, with the Buy Now, Pay Later sector demonstrating extraordinary growth potential. Analysts project a staggering 33.9% annual expansion, indicating a robust trajectory that signals profound changes in consumer financial behavior. This remarkable growth isn't merely a statistical anomaly but represents a fundamental shift in how Chileans approach purchasing and credit consumption. The BNPL market's exponential growth reflects deeper socioeconomic transformations, where traditional banking models are being challenged by more flexible, user-friendly financial solutions. Young consumers, particularly millennials and Gen Z, are driving this revolution, seeking payment alternatives that offer greater financial autonomy and immediate gratification.Technological Infrastructure and Digital Adoption

Chile's advanced technological infrastructure provides a fertile ground for BNPL platforms to flourish. With high internet penetration rates and increasing smartphone usage, digital payment solutions are becoming increasingly mainstream. Financial technology companies are leveraging sophisticated algorithms and machine learning to create personalized credit assessment models that traditional banks cannot match. These innovative platforms are not just providing payment flexibility but are also democratizing access to credit. By utilizing alternative data points and advanced risk assessment techniques, BNPL providers can extend financial services to segments traditionally excluded from conventional banking systems.Sectoral Impact and Economic Implications

The BNPL phenomenon is creating ripple effects across multiple economic sectors. Retail, e-commerce, consumer electronics, and fashion industries are experiencing significant transformations as these flexible payment models become increasingly prevalent. Merchants are recognizing the competitive advantage of offering BNPL options, which can increase average transaction values and customer conversion rates. Moreover, the economic implications extend beyond immediate transactional benefits. By providing more accessible credit mechanisms, BNPL platforms are potentially stimulating consumer spending, supporting small and medium enterprises, and contributing to broader economic growth.Regulatory Landscape and Future Challenges

As the BNPL market continues its rapid expansion, regulatory bodies are closely monitoring these developments. The challenge lies in creating a balanced regulatory framework that protects consumer interests while fostering financial innovation. Chilean financial regulators are likely to develop comprehensive guidelines that ensure responsible lending practices and transparent consumer communication. Potential regulatory considerations might include stricter credit assessment protocols, enhanced disclosure requirements, and mechanisms to prevent over-indebtedness. These measures will be crucial in maintaining the long-term sustainability and credibility of the BNPL ecosystem.Consumer Behavior and Psychological Insights

The growing popularity of BNPL services reveals fascinating insights into consumer psychology. These platforms address a fundamental human desire for financial flexibility and immediate gratification. By breaking down large purchases into manageable installments, BNPL solutions reduce psychological barriers to spending and provide a sense of financial control. Psychological studies suggest that this payment model can reduce purchase anxiety and increase consumer confidence, particularly among younger demographics who are more comfortable with digital financial solutions.Global Context and Comparative Analysis

Chile's BNPL market growth is part of a broader global trend. Comparing the Chilean experience with other emerging markets provides valuable insights into the unique characteristics of this financial innovation. While the core principles remain consistent, local economic conditions, technological infrastructure, and consumer preferences create distinct market dynamics. The projected market size of US$871.7 million by 2025 positions Chile as a significant player in the global BNPL landscape, demonstrating the country's potential as a financial technology hub in Latin America.RELATED NEWS

Ad Tech Powerhouse Infillion Recruits Industry Maverick to Supercharge Enterprise Strategy

Goodbye Country Club: How Microsoft's Brutal Performance Purge Is Reshaping Tech's Talent Landscape