Economic Alarm: Why a Longtime Skeptic Is Now Bracing for Recession

Business

2025-02-27 09:07:02Content

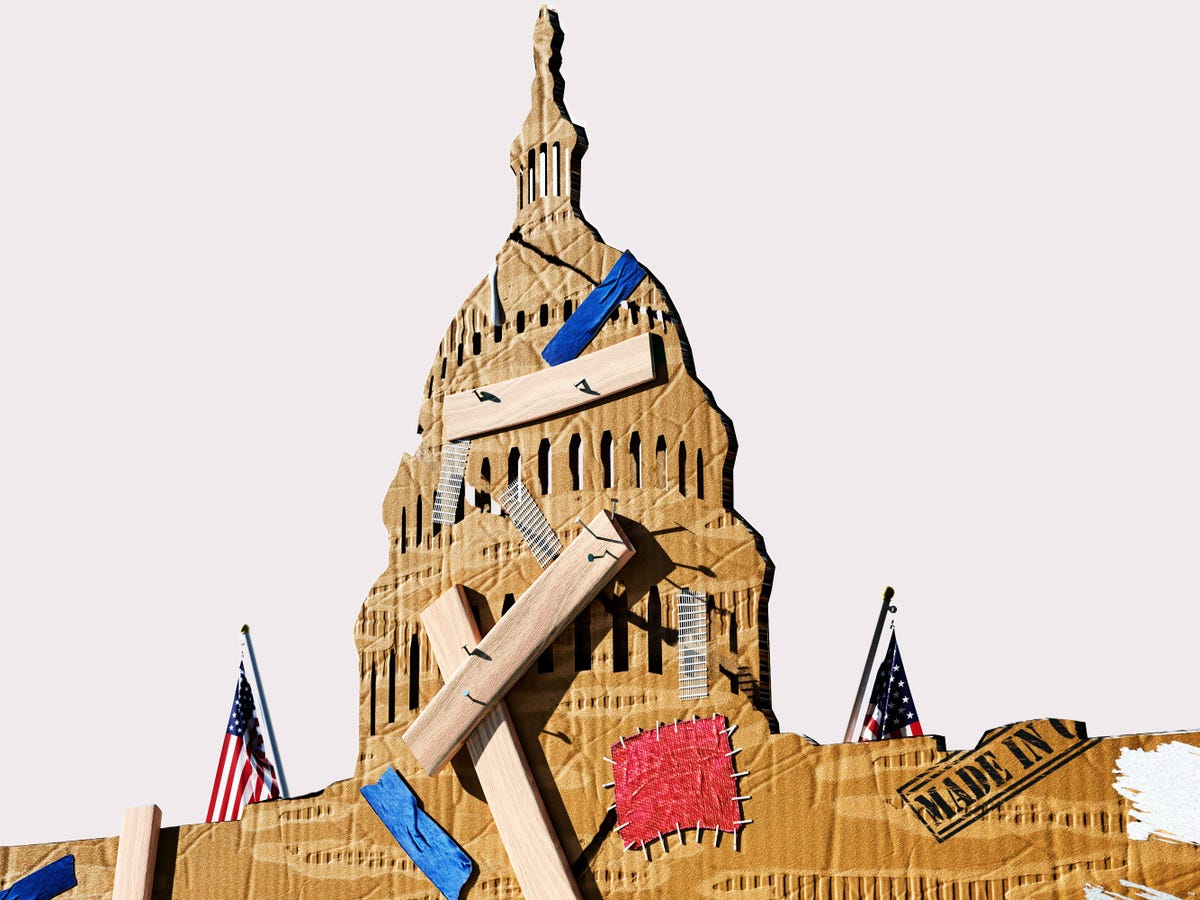

Economic Storm Clouds Gather: The Troubling Signals Threatening America's Financial Stability

The United States economy is showing increasingly concerning signs of potential turbulence. A perfect storm of economic challenges is brewing, with multiple critical indicators pointing to growing financial strain.

Unemployment is on the rise, casting a shadow over the job market and creating uncertainty for millions of workers. As companies tighten their belts and reduce hiring, more Americans find themselves facing job insecurity and reduced income.

Consumer spending, the traditional backbone of economic growth, is experiencing a significant pullback. Everyday Americans are becoming more cautious, cutting back on discretionary expenses and prioritizing essential needs. This reduction in spending could potentially trigger a broader economic slowdown.

The housing market remains particularly stagnant, with potential buyers and sellers locked in a state of hesitation. High mortgage rates, elevated home prices, and economic uncertainty have effectively frozen much of the real estate activity, creating a challenging environment for both homeowners and prospective buyers.

These converging economic pressures suggest that the United States may be approaching a critical economic crossroads, with policymakers and financial experts closely monitoring the developing situation.

Economic Tremors: Decoding the Unfolding Financial Landscape of America

In an era of unprecedented economic volatility, the United States finds itself navigating a complex terrain of financial challenges that are reshaping the economic narrative. The intricate interplay of labor markets, consumer behavior, and real estate dynamics is painting a nuanced picture of economic uncertainty that demands careful analysis and strategic understanding.Navigating Uncertain Economic Waters: A Critical Examination of Emerging Trends

Labor Market Transformation: Beyond Unemployment Statistics

The contemporary American job market is experiencing a profound metamorphosis that transcends traditional unemployment metrics. Structural shifts driven by technological disruption, automation, and evolving industry paradigms are fundamentally restructuring employment landscapes. Workers across diverse sectors are confronting unprecedented challenges, with traditional career pathways becoming increasingly fragmented and unpredictable. Emerging economic indicators suggest a complex narrative of workforce recalibration. The rise of gig economies, remote work platforms, and skill-based employment models are challenging conventional employment frameworks. Professionals are increasingly required to demonstrate adaptability, continuous learning, and cross-disciplinary competencies to remain competitive in this dynamic environment.Consumer Spending Dynamics: Psychological and Economic Implications

Consumer spending patterns are revealing deep-seated economic anxieties that extend far beyond mere statistical representations. Americans are demonstrating remarkable financial prudence, strategically recalibrating consumption habits in response to broader economic uncertainties. This behavioral shift represents more than a temporary reaction; it signifies a fundamental reevaluation of personal financial strategies. The psychological underpinnings of reduced consumer expenditure are multifaceted. Economic uncertainty, inflationary pressures, and concerns about long-term financial stability are compelling individuals to adopt more conservative spending approaches. This trend is not merely about reducing discretionary expenses but represents a broader cultural shift towards financial resilience and strategic resource allocation.Real Estate Landscape: Frozen Markets and Emerging Opportunities

The contemporary housing market presents a complex tableau of challenges and potential transformations. Traditional transactional models are experiencing significant disruption, with market liquidity becoming increasingly constrained. Potential homebuyers and sellers are navigating an environment characterized by heightened uncertainty, stringent lending criteria, and evolving valuation paradigms. Underlying these market dynamics are intricate economic mechanisms involving interest rates, demographic shifts, and broader macroeconomic trends. The current "frozen" state of real estate markets is not a static condition but a dynamic process of recalibration, where traditional investment strategies are being fundamentally reimagined.Interconnected Economic Ecosystems: A Holistic Perspective

The current economic landscape cannot be understood through isolated lens. The intricate connections between labor markets, consumer behavior, and real estate sectors create a complex, interdependent ecosystem where changes in one domain instantaneously reverberate across others. This systemic interconnectedness demands a sophisticated, nuanced approach to economic analysis. Emerging economic research suggests that resilience in such environments stems not from resistance to change but from adaptive capacity. Organizations, professionals, and policymakers must develop flexible strategies that can rapidly respond to evolving economic conditions, transforming potential challenges into strategic opportunities.RELATED NEWS

Business

Flavor Fest: Encanto's 'Daygo Eatz' Showcases Culinary Creativity of Local Entrepreneurs

2025-02-17 02:50:12

Business

Trade Tensions Loom: Metro Detroit Executives Brace for Economic Turbulence

2025-04-01 15:31:25

Business

Buffett's Bold Move: Strategic Spending and Japan Investment Signal Economic Confidence

2025-02-22 15:14:48