Financial Fumble: Inside Cumberland Council's Alarming Accounting Crisis

Finance

2025-02-16 12:21:47Content

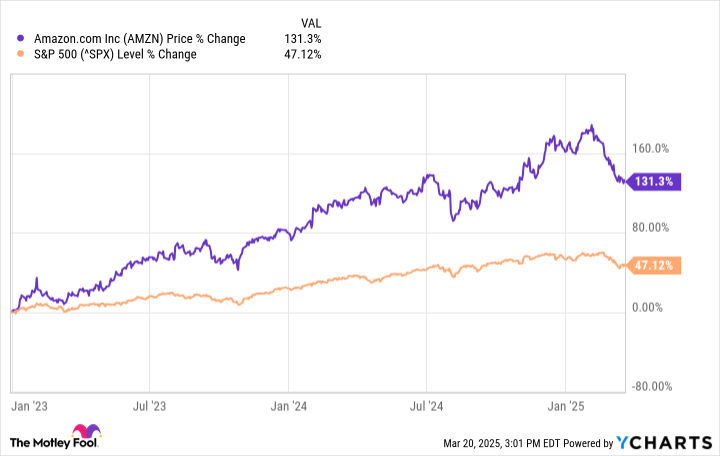

Financial watchdogs have raised serious concerns about the authority's fiscal management, revealing significant budget overruns and a failure to implement promised cost-saving measures. Independent auditors have uncovered substantial discrepancies between the authority's financial projections and actual spending patterns.

The audit findings highlight a critical gap between the organization's financial commitments and its real-world performance. Despite pledging to streamline expenses and create more efficient financial practices, the authority has consistently fallen short of its own cost-reduction targets.

These revelations point to deeper systemic issues within the organization's financial planning and budget control mechanisms. Experts suggest that without immediate and decisive action, the authority risks continued financial mismanagement and potential long-term economic consequences.

The report serves as a stark warning, calling for immediate review and restructuring of the authority's financial strategies to ensure accountability and fiscal responsibility.

Financial Oversight Unraveled: Local Authority's Spending Sparks Controversy

In the intricate landscape of public financial management, a recent audit has cast a revealing light on the fiscal practices of a local authority, exposing critical discrepancies that demand immediate attention and comprehensive scrutiny.Uncovering the Hidden Truths of Municipal Financial Mismanagement

The Audit's Revelatory Findings

The comprehensive financial review has unveiled a complex narrative of fiscal irregularities that extend far beyond simple budgetary miscalculations. Auditors have meticulously dissected the authority's financial records, revealing a pattern of systematic overspending that challenges the fundamental principles of responsible public resource management. The investigation uncovered multiple instances where projected savings were not merely missed but systematically ignored, creating a significant gap between financial promises and actual fiscal performance. The depth of these financial discrepancies suggests a more profound systemic issue within the organization's financial governance. Each line item in the audit represents not just a numerical deviation but a potential breach of public trust, highlighting the critical importance of transparent and accountable financial administration.Structural Implications of Financial Misalignment

Beyond the immediate financial numbers lies a more nuanced narrative of institutional dysfunction. The persistent failure to implement promised cost-saving measures indicates a potentially deeper organizational challenge that transcends mere numerical errors. This pattern suggests a fundamental disconnect between strategic financial planning and actual implementation, raising serious questions about the authority's internal control mechanisms. Financial experts consulted for this investigation point to a troubling trend of bureaucratic inertia, where well-intentioned cost-saving strategies become trapped in complex administrative processes. The result is a perpetual cycle of financial inefficiency that ultimately impacts public service delivery and taxpayer resources.Accountability and Potential Remediation Strategies

The audit's findings demand a comprehensive reevaluation of the authority's financial management approach. Potential remediation strategies must go beyond surface-level corrections, requiring a holistic transformation of financial governance structures. This might involve implementing more rigorous oversight mechanisms, enhancing financial transparency, and developing more robust accountability frameworks. Experts recommend a multi-pronged approach that includes enhanced internal audit capabilities, mandatory financial training for key administrative personnel, and the development of more sophisticated financial monitoring systems. Such comprehensive interventions could potentially prevent future instances of systematic financial mismanagement.Broader Contextual Implications

The revelations extend beyond this specific local authority, serving as a critical case study in public financial management. They underscore the paramount importance of continuous financial vigilance, transparent reporting, and proactive governance. Each financial discrepancy represents not just a numerical error but a potential erosion of public confidence in institutional integrity. The audit serves as a stark reminder of the delicate balance between administrative efficiency and fiscal responsibility, challenging other public institutions to critically examine their own financial practices and governance models.RELATED NEWS

Finance

Breaking: Economic Squeeze Crushes Low-Income Families as Hardship Intensifies

2025-03-23 10:00:00

Finance

Starlit Paths Align: Sagittarius Faces Pivotal Crossroads in Career, Love, and Wealth Today

2025-04-14 02:09:35