Musk's DOGE Contract Purge: Massive Cuts Yield Minimal Financial Gains

Politics

2025-02-25 15:01:36Content

In a revealing analysis of Dogecoin's (DOGE) financial landscape, recent data from the "Wall of Receipts" exposes a surprising trend: over one-third of contract cancellations are projected to generate no meaningful cost savings. This insight sheds light on the complex economic dynamics surrounding the popular cryptocurrency's operational strategies.

The data suggests that while contract terminations are often viewed as a potential cost-cutting measure, a significant portion of these cancellations may not deliver the expected financial benefits. This revelation challenges conventional wisdom about contract management and highlights the nuanced decision-making processes within the DOGE ecosystem.

Investors and stakeholders are now prompted to take a closer look at the underlying factors driving these contract cancellations and reassess their expectations for potential financial optimization. The findings underscore the importance of strategic evaluation beyond surface-level cost-reduction efforts.

Cryptocurrency Chaos: The Shocking Truth Behind DOGE's Contract Cancellation Conundrum

In the volatile world of digital currencies, a startling revelation has emerged that threatens to shake the foundations of investor confidence. The cryptocurrency landscape continues to evolve in unpredictable ways, challenging traditional financial paradigms and leaving investors scrambling to understand the complex dynamics of digital asset management.Unraveling the Cryptocurrency Puzzle: What Investors Need to Know Now

The Unexpected Economic Landscape of Digital Contracts

The cryptocurrency ecosystem has long been characterized by its unpredictability, but recent data surrounding Dogecoin (DOGE) reveals a more nuanced and potentially troubling trend. Investors and market analysts are grappling with a phenomenon that challenges conventional wisdom about digital asset contracts. The "Wall of Receipts" – a transparent mechanism tracking contract dynamics – has exposed a critical insight that sends ripples through the cryptocurrency community. More than one-third of contract cancellations are projected to yield no tangible financial benefits, a revelation that strikes at the heart of investment strategies. This unexpected pattern suggests a deeper complexity in the cryptocurrency market, where traditional economic principles seem to bend and twist in ways that defy conventional financial logic.Decoding the Financial Implications

The implications of these contract cancellations extend far beyond simple numerical calculations. Each cancelled contract represents a complex interplay of technological innovation, market sentiment, and investor psychology. Cryptocurrency experts are now diving deep into the underlying mechanisms that drive these seemingly irrational market behaviors. Sophisticated investors understand that these cancellations are not mere statistical anomalies but potential indicators of broader market transformations. The lack of anticipated savings suggests a more intricate ecosystem where value is not always measured in traditional monetary terms, but in technological potential, community engagement, and future possibilities.The Human Element in Digital Currency Dynamics

Behind every contract cancellation lies a human story of decision-making, risk assessment, and technological adaptation. The cryptocurrency world is not just about algorithms and blockchain technology; it's about the people who navigate this complex landscape, making split-second decisions that can have profound financial consequences. Psychological factors play a crucial role in these market dynamics. Investors are not merely responding to cold, hard data but are influenced by sentiment, community perception, and the ever-shifting narrative of digital currencies. The "Wall of Receipts" provides a transparent window into these intricate human-driven processes.Technological Disruption and Market Resilience

The current trend of contract cancellations highlights the remarkable resilience of the cryptocurrency ecosystem. Where traditional markets might crumble under similar circumstances, digital currencies demonstrate an extraordinary capacity for adaptation and transformation. Blockchain technology continues to evolve, creating mechanisms that provide unprecedented transparency and accountability. The "Wall of Receipts" is a testament to this technological innovation, offering investors and analysts a real-time view of market dynamics that was previously unimaginable.Future Perspectives and Strategic Considerations

As the cryptocurrency landscape continues to mature, investors must develop increasingly sophisticated strategies. The current trend of contract cancellations is not a setback but an opportunity for deeper understanding and more nuanced investment approaches. Successful navigation of this complex terrain requires a combination of technological insight, psychological awareness, and a willingness to challenge existing financial paradigms. The digital currency revolution is not just about making money but about reimagining the very concept of value and exchange.RELATED NEWS

Politics

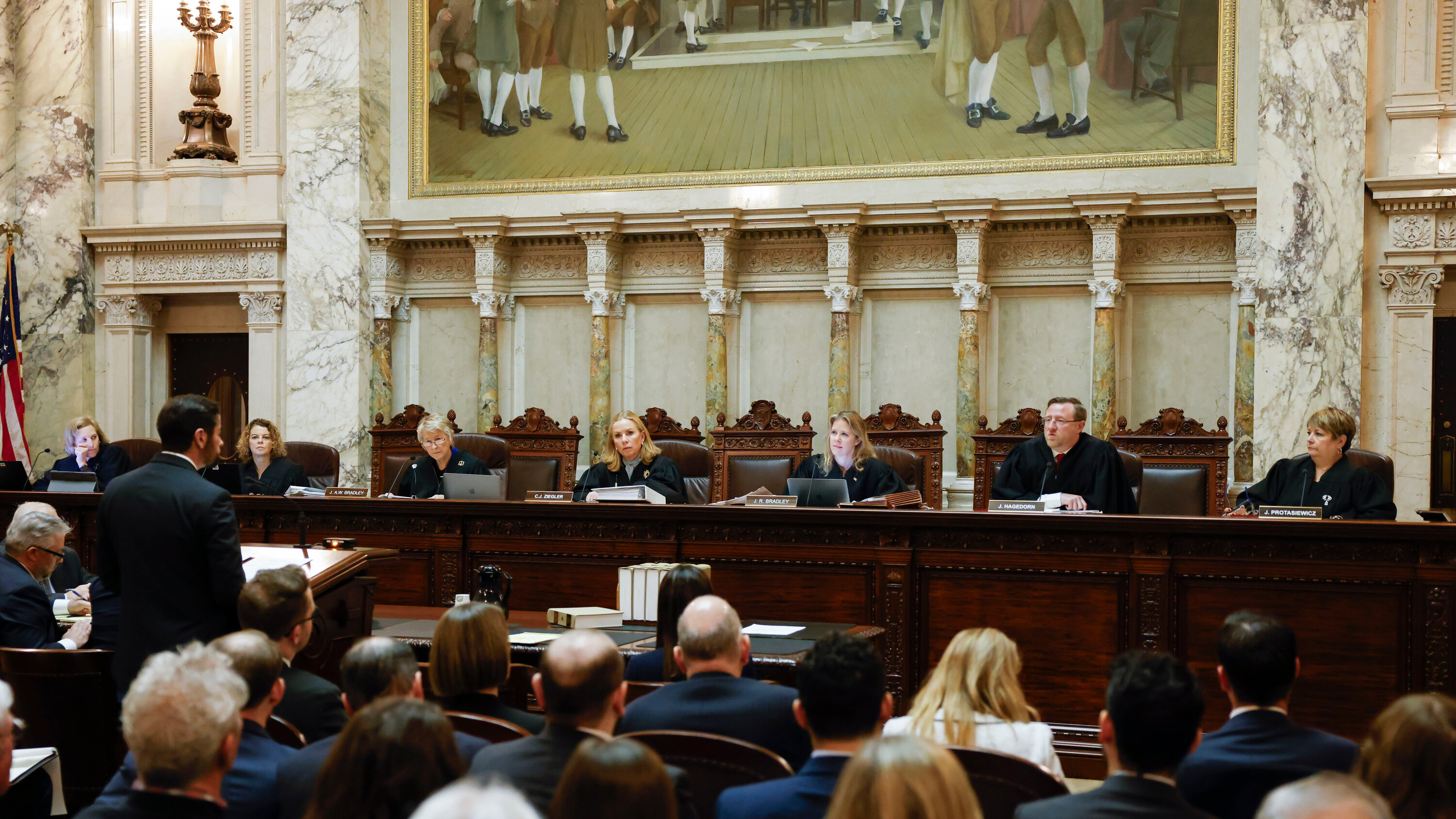

Legal Eagles Mobilize: Inside Big Law's Counteroffensive Against Trump's Revenge Tactics

2025-03-29 16:08:25