Insider Advantage: The Breakout Companies Poised to Dominate in 2025

Companies

2025-02-24 17:03:01Content

In the complex landscape of global financial markets, investors are increasingly seeking resilient investment strategies amid mounting geopolitical tensions and evolving consumer spending patterns. As major stock indexes experience notable volatility, a strategic approach is emerging that focuses on companies with significant insider ownership.

These organizations offer a unique value proposition, presenting a compelling opportunity for investors looking to navigate economic uncertainties. The key differentiator lies in the potential alignment between management and shareholders, where executives have a substantial personal stake in the company's success.

Insider ownership can serve as a powerful signal of confidence, suggesting that company leadership believes strongly in their organization's growth potential and long-term strategy. When executives have a meaningful financial investment in their own company, it often translates to more prudent decision-making, enhanced accountability, and a genuine commitment to creating shareholder value.

For savvy investors, identifying such companies represents a nuanced approach to building a robust investment portfolio that can potentially withstand market fluctuations and economic challenges. By focusing on businesses where management's interests are closely intertwined with those of shareholders, investors can discover promising growth opportunities in an increasingly unpredictable financial landscape.

Navigating Market Volatility: Insider Ownership as a Strategic Investment Compass

In the complex landscape of global financial markets, investors face an increasingly challenging terrain of economic uncertainties, geopolitical tensions, and rapidly shifting consumer behaviors. The quest for sustainable growth and resilient investment strategies has never been more critical, as traditional market indicators become less predictable and more volatile.Unlock the Hidden Potential of Strategic Investment Insights

The Evolving Dynamics of Insider Ownership in Modern Investment Strategies

The contemporary investment ecosystem presents a multifaceted challenge for discerning investors seeking meaningful growth opportunities. Insider ownership has emerged as a sophisticated lens through which sophisticated market participants can evaluate potential investment trajectories. Unlike traditional metrics, insider ownership provides a nuanced window into corporate governance, management commitment, and long-term strategic alignment. Sophisticated investors recognize that when corporate leadership maintains substantial equity stakes, it signals a profound alignment of interests. This alignment transcends mere financial metrics, representing a deeper commitment to organizational success and shareholder value creation. Executives with significant personal capital invested in their companies are inherently motivated to drive sustainable growth, make judicious strategic decisions, and navigate complex market landscapes with heightened diligence.Decoding the Complex Relationship Between Insider Motivation and Market Performance

The intricate relationship between insider ownership and market performance reveals compelling insights into corporate dynamics. Companies where executives maintain substantial equity positions often demonstrate remarkable resilience during economic turbulence. This phenomenon stems from a fundamental psychological and financial commitment that extends beyond quarterly performance metrics. Research indicates that organizations with high insider ownership tend to exhibit more disciplined capital allocation strategies, more measured risk management approaches, and a more holistic perspective on long-term value creation. These companies are less likely to engage in short-term, speculative maneuvers that might generate immediate market excitement but ultimately undermine sustainable growth potential.Technological Disruption and the Changing Landscape of Investor Intelligence

The digital transformation of financial markets has revolutionized how investors access and interpret insider ownership data. Advanced algorithmic platforms and real-time analytics now provide unprecedented transparency into corporate ownership structures, enabling investors to make more informed, data-driven decisions. Machine learning algorithms can now track insider trading patterns, correlate them with broader market trends, and generate predictive models that offer nuanced insights into potential investment opportunities. This technological evolution has democratized access to sophisticated investment intelligence, allowing both institutional and individual investors to leverage previously inaccessible strategic information.Global Economic Uncertainties: A Catalyst for Strategic Investment Approaches

Amid escalating geopolitical tensions and macroeconomic volatility, investors are increasingly seeking investment strategies that offer stability and potential for sustainable growth. Insider ownership emerges as a critical indicator of corporate resilience, providing a sophisticated framework for evaluating potential investment opportunities. The current global economic landscape demands a more nuanced, strategic approach to investment. Traditional metrics are no longer sufficient to capture the complex interplay of technological disruption, regulatory changes, and shifting consumer behaviors. Insider ownership represents a dynamic lens through which investors can gain deeper insights into corporate potential and strategic positioning.Risk Mitigation and Strategic Alignment in Modern Investment Paradigms

Sophisticated investors understand that risk mitigation is not about eliminating uncertainty but about developing robust, adaptive strategies. Insider ownership provides a unique risk assessment mechanism, offering insights into management's confidence, strategic vision, and commitment to long-term value creation. Companies with high insider ownership often demonstrate more disciplined approach to capital allocation, more transparent communication with shareholders, and a more holistic view of organizational success. These characteristics become increasingly valuable in an investment landscape characterized by unprecedented complexity and rapid transformation.RELATED NEWS

Companies

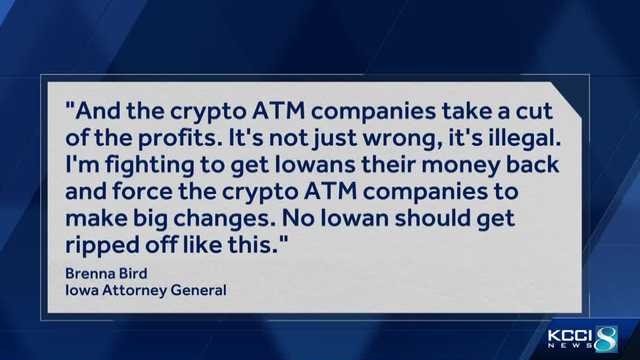

Crypto ATM Crackdown: Iowa AG Launches Legal Assault on Digital Currency Machines

2025-03-03 05:08:00

Companies

Tech Titans Trembling: China's Market Shake-Up Threatens Silicon Valley Giants

2025-04-20 16:29:24

Companies

Cyber Siege: Europe Braces for Unprecedented Wave of Digital Attacks in 2025

2025-03-17 09:30:36