Finance

2025-02-24 15:38:15

Content

Unveiling the Money-Making Machinery of Investment Banks

Investment banks – enigmatic financial powerhouses that seem to control the global economic landscape. But how exactly do they generate their massive revenues? Let's dive deep into their intricate money-making strategies.

Three Pillars of Investment Banking Revenue

- Investment Banking (IB): The strategic dealmakers

- Sales & Trading (S&T): The trading powerhouse

- Asset Management (AM): Wealth management experts

Investment Banking: The Deal Architects

Investment banks are not your typical banks. They don't handle mortgages or personal deposits. Instead, they generate revenue through sophisticated financial services:

- Advising on mergers and acquisitions

- Facilitating corporate transactions

- Underwriting stock and bond issuances

Example: When Microsoft acquired Activision for $69 billion, investment banks earned over $1 billion in fees – even if the deal ultimately succeeded or failed.

Sales & Trading: Wall Street's Heartbeat

This division generates revenue through:

- Market Making

- Proprietary Trading

- Trade Execution Commissions

Post-2008 financial regulations have significantly transformed this sector, particularly with the Volcker Rule limiting risky proprietary trading.

Asset Management: Wealth Optimization

Investment banks manage massive portfolios for high-net-worth individuals, institutions, and pension funds. Their revenue model is simple yet lucrative:

- Charge management fees between 0.5% - 2%

- Manage trillions in assets

- Generate consistent revenue streams

For instance, UBS manages around $6 trillion, potentially generating $60 billion annually through management fees.

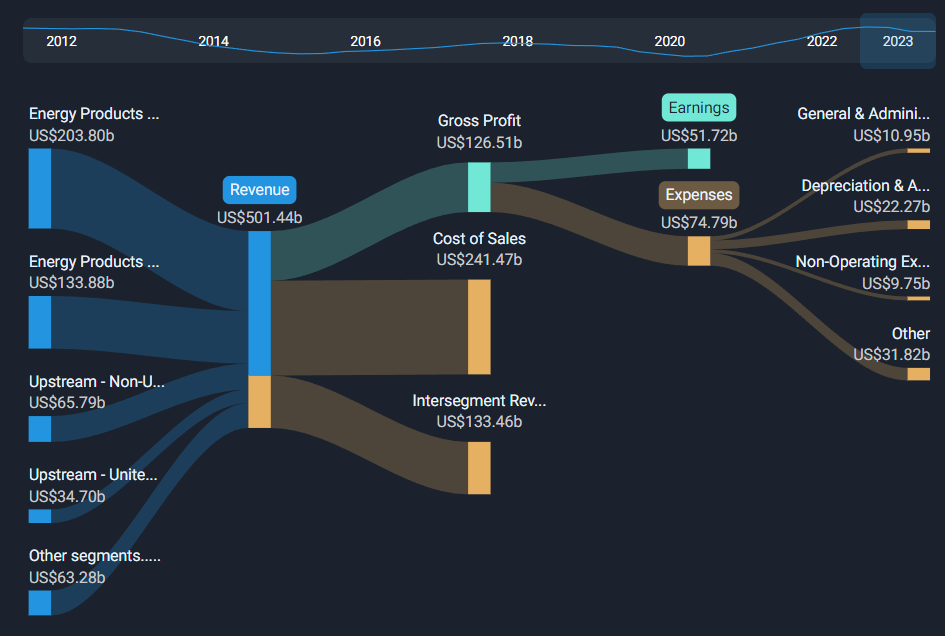

2023 Investment Banking Revenue Snapshot

Top global investment banks collectively generated over $100 billion. A typical breakdown might look like:

| Division |

Revenue Percentage |

| Sales & Trading |

40% |

| Investment Banking |

30% |

| Asset Management |

20% |

| Other Services |

10% |

The Resilient Business Model

Investment banks have mastered the art of generating revenue across market conditions – thriving in bull markets, recessions, and everything in between.

Decoding the Financial Wizardry: How Investment Banks Turn Complexity into Profit

In the labyrinthine world of global finance, investment banks stand as enigmatic powerhouses that transform complex financial strategies into astronomical revenues. These institutions are far more than mere financial intermediaries; they are sophisticated engines of economic transformation, wielding unprecedented influence over corporate landscapes and global markets.

Unraveling the Secrets of Wall Street's Most Powerful Financial Architects

The Strategic Landscape of Investment Banking

Investment banking represents a sophisticated ecosystem where financial expertise meets strategic innovation. Unlike traditional banking models, these institutions operate on a fundamentally different paradigm, focusing not on consumer deposits but on high-stakes financial engineering. Their primary value proposition lies in providing comprehensive advisory services that transcend conventional financial transactions.

The core competency of investment banks revolves around facilitating complex corporate transactions, including mergers, acquisitions, and initial public offerings. These institutions employ teams of highly specialized professionals who meticulously analyze market dynamics, corporate valuations, and strategic opportunities. Their expertise allows corporations to navigate intricate financial landscapes with precision and strategic foresight.

Navigating the Multifaceted Revenue Streams

Investment banks generate revenue through a sophisticated array of financial services that extend far beyond traditional banking models. Their revenue architecture is built upon three primary pillars: investment banking, sales and trading, and asset management.

In the realm of investment banking, these institutions act as critical intermediaries for corporate transformations. When major corporations contemplate significant strategic moves like mergers or acquisitions, investment banks provide comprehensive advisory services. Their compensation model is performance-driven, typically charging substantial percentage-based fees that can range from 1% to 3% of total transaction value.

The Art of Financial Intermediation

The underwriting process represents another critical revenue generation mechanism. By acting as intermediaries during stock or bond issuances, investment banks purchase securities at discounted rates and subsequently redistribute them to public markets. This strategic positioning allows them to generate substantial profits through price differentials and placement fees.

Sales and trading divisions represent the dynamic heartbeat of investment banking operations. These departments facilitate complex financial transactions across global markets, generating revenue through market-making activities, executing institutional trades, and managing sophisticated financial instruments. The intricate dance of buying and selling creates multiple revenue opportunities that require exceptional market intelligence and rapid decision-making capabilities.

Wealth Management and Institutional Strategies

Asset management represents a sophisticated revenue stream where investment banks manage substantial portfolios for high-net-worth individuals, institutional investors, and pension funds. By charging management fees typically ranging between 0.5% and 2% of total assets under management, these institutions create consistent revenue streams that are relatively insulated from market volatility.

The complexity of their asset management strategies involves intricate risk assessment, diversification techniques, and predictive financial modeling. Successful investment banks leverage advanced technological infrastructure and deep market insights to deliver superior investment performance.

Adaptive Financial Ecosystems

Modern investment banks have demonstrated remarkable adaptability in response to regulatory changes and market disruptions. The post-2008 financial landscape witnessed significant transformations, with institutions recalibrating their strategies to comply with more stringent regulatory frameworks while maintaining profitability.

Technological innovation has become a critical differentiator, with leading investment banks investing heavily in artificial intelligence, machine learning, and advanced analytics to gain competitive advantages. These technological investments enable more sophisticated risk management, more accurate predictive modeling, and enhanced decision-making capabilities.

Global Impact and Economic Significance

Investment banks are not merely financial institutions but pivotal economic architects that shape global business landscapes. Their ability to facilitate massive corporate transactions, provide strategic advisory services, and manage complex financial portfolios makes them indispensable components of the modern economic ecosystem.

By bridging capital markets, supporting corporate growth strategies, and managing institutional wealth, these institutions play a transformative role in driving economic progress and innovation across international markets.