Trade Chaos: How Trump's Tariff Rollercoaster Is Leaving Businesses Guessing

Business

2025-05-06 15:14:01Content

In a stark reflection of the current economic uncertainty, automotive giant Ford and toy manufacturer Mattel have joined a growing list of major corporations stepping back from their previously announced financial projections. These strategic adjustments signal the mounting challenges businesses face in navigating today's volatile market landscape.

Both companies are recalibrating their financial expectations, acknowledging the complex economic headwinds that are reshaping corporate forecasting. From supply chain disruptions to shifting consumer behaviors, Ford and Mattel are demonstrating a pragmatic approach to financial planning in an unpredictable global environment.

The move underscores a broader trend among corporate leaders who are increasingly prioritizing flexibility and realistic assessment over rigid financial commitments. By revising their outlooks, these companies are sending a clear message: adaptability is key to surviving and thriving in today's rapidly changing business ecosystem.

Investors and market analysts are closely watching these developments, recognizing that such forecast revisions often provide critical insights into the broader economic health and corporate resilience of major industries.

Corporate Financial Forecasting Chaos: How Major Brands Navigate Economic Uncertainty

In the rapidly evolving landscape of global business, corporations are facing unprecedented challenges that demand strategic financial recalibration. The traditional models of economic prediction are being systematically dismantled by complex market dynamics, forcing industry giants to reassess their financial strategies with unprecedented agility and precision.Navigating Turbulent Economic Waters: A Corporate Survival Guide

The Shifting Paradigms of Corporate Financial Planning

The contemporary business ecosystem is experiencing a seismic transformation that challenges conventional financial forecasting methodologies. Companies like Ford and Mattel are not merely adjusting numbers; they are fundamentally reimagining their strategic approaches to economic uncertainty. This radical shift represents more than a temporary adaptation—it signals a profound restructuring of corporate financial intelligence. Financial experts are witnessing an extraordinary moment where traditional predictive models are becoming increasingly obsolete. The complexity of global economic interactions demands a more nuanced, dynamic approach to financial planning that transcends historical data and embraces real-time adaptability.Technological Disruption and Economic Resilience

Modern corporations are leveraging advanced technological frameworks to enhance their financial forecasting capabilities. Machine learning algorithms, artificial intelligence, and sophisticated data analytics are transforming how companies like Ford and Mattel interpret market signals and develop predictive strategies. The integration of cutting-edge technological tools enables these organizations to create more responsive and flexible financial models. By implementing advanced predictive technologies, companies can rapidly identify potential economic risks and opportunities, allowing for more strategic decision-making in an increasingly unpredictable global marketplace.Strategic Implications of Financial Forecast Revisions

When major corporations publicly revise their financial forecasts, it sends profound ripples through entire industry ecosystems. These adjustments are not merely numerical recalibrations but strategic communications that signal deeper economic insights and potential market transformations. The decision to modify financial projections reflects a sophisticated understanding of complex economic variables. Companies must balance transparency with strategic positioning, carefully communicating changes that maintain investor confidence while accurately representing emerging challenges and opportunities.Global Economic Pressures and Corporate Adaptation

The current economic landscape is characterized by unprecedented volatility, driven by geopolitical tensions, technological disruptions, and rapidly evolving market dynamics. Corporations like Ford and Mattel are demonstrating remarkable resilience by developing more agile financial frameworks that can withstand multiple potential scenarios. This adaptive approach requires a holistic understanding of interconnected economic systems, recognizing that financial forecasting is no longer a linear process but a multidimensional strategic endeavor. Companies must simultaneously manage immediate financial requirements while maintaining long-term strategic vision.The Human Element in Financial Strategy

Behind every financial forecast revision lies a complex network of human decision-makers who interpret data, assess risks, and make strategic choices. The most successful corporations recognize that technological tools are ultimately guided by human insight and intuition. Leadership teams at companies like Ford and Mattel are cultivating organizational cultures that embrace uncertainty, encourage innovative thinking, and develop robust, flexible financial strategies. This human-centric approach transforms potential challenges into opportunities for growth and transformation.RELATED NEWS

Business

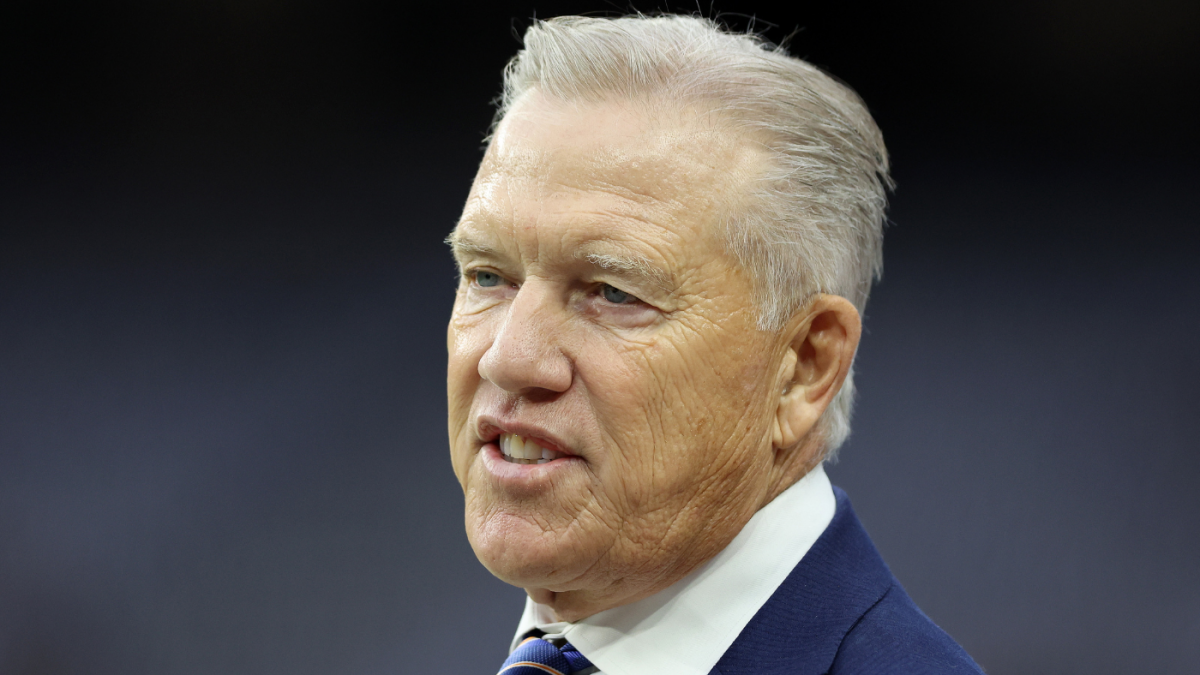

Tragedy on the Green: John Elway's Business Associate Dies in Shocking Golf Cart Incident

2025-05-01 01:03:09

Business

Diversity Shakeup: BlackRock's Radical Pivot Signals Major Corporate Policy Shift

2025-02-28 13:30:00

Business

From Kitchen Table to Catwalk: How House of Amor Conquered the Fashion World

2025-03-22 19:49:48