Voices of Worry: Seniors Reveal Economic Fears in Candid Conversations

Business

2025-05-04 11:19:01Content

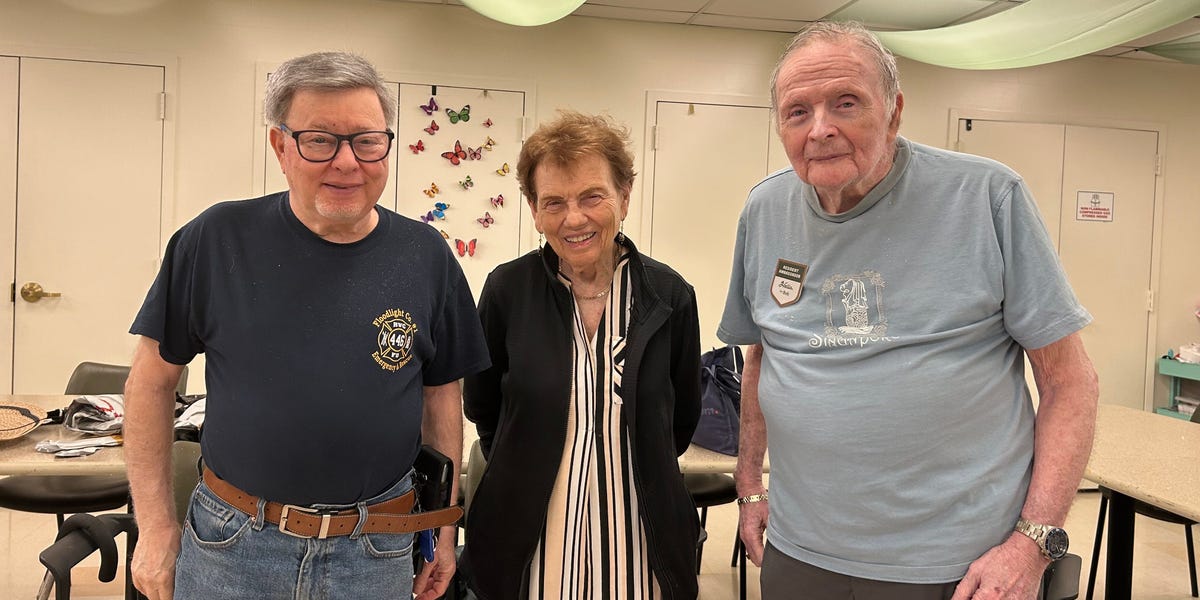

In the heart of New York, a retirement community reveals a stark reality facing many seniors today. Despite living in a facility with minimal out-of-pocket expenses, residents are grappling with mounting financial anxieties about their Social Security benefits and dwindling savings.

The comfortable surroundings mask a deeper economic uncertainty. Retirees who once felt secure are now confronting the harsh challenges of stretched retirement funds, rising healthcare costs, and an uncertain economic landscape. Their conversations are filled with quiet worry about whether their carefully accumulated nest eggs will truly sustain them through their golden years.

These residents represent a growing demographic of seniors navigating the delicate balance between fixed incomes and escalating living expenses. Their stories underscore a national concern: the increasing financial vulnerability of older Americans who have worked hard their entire lives, only to find themselves uncertain about their financial future.

While their current living situation provides some relief, the underlying stress of potential economic instability continues to weigh heavily on their minds. It's a poignant reminder that financial security in retirement is far more complex than simply having a roof over one's head.

Retirement Realities: The Hidden Financial Struggles of Senior Living

In the heart of New York, a retirement community reveals a stark narrative of economic uncertainty that challenges the conventional perception of golden years. As seniors navigate the complex landscape of fixed incomes and escalating living costs, their stories of financial resilience and anxiety emerge as a poignant reflection of broader societal challenges facing aging Americans.Unmasking the Economic Vulnerability of Retirement Communities

The Illusion of Financial Security

Retirement homes often present themselves as havens of comfort and stability, yet beneath the surface lies a complex web of economic challenges that many residents silently endure. Despite seemingly reduced living expenses, seniors find themselves grappling with unprecedented financial pressures that threaten their sense of security and well-being. The perception of a worry-free retirement environment quickly dissipates when residents confront the harsh realities of limited Social Security benefits and dwindling personal savings. Many individuals who have diligently planned for their retirement discover that their carefully constructed financial strategies are increasingly inadequate in the face of rising healthcare costs, inflation, and unexpected economic fluctuations.Social Security: A Fragile Safety Net

The Social Security system, once considered a reliable financial foundation for retirees, now appears increasingly precarious. Residents in this New York retirement community articulate profound concerns about the sustainability and sufficiency of their monthly benefits. The fixed income provided by Social Security often falls dramatically short of covering essential living expenses, forcing seniors to make increasingly difficult financial trade-offs. Economic experts argue that the current Social Security framework fails to keep pace with the escalating cost of living, creating a systemic challenge that disproportionately impacts vulnerable senior populations. The monthly stipend, which was originally designed as a supplemental income source, has transformed into a primary financial lifeline for many retirees.Savings Strategies in a Volatile Economic Landscape

Personal savings represent another critical component of retirement financial planning, yet residents reveal significant anxiety about the long-term sustainability of their accumulated resources. Traditional investment strategies that once promised stable returns now seem increasingly uncertain in a rapidly changing economic environment. Many seniors report implementing aggressive cost-cutting measures, ranging from minimizing discretionary spending to exploring alternative healthcare options. The psychological toll of constant financial vigilance creates an additional layer of stress that extends far beyond mere monetary concerns.Healthcare Costs: The Silent Financial Predator

Perhaps the most significant financial challenge facing retirement community residents involves healthcare expenditures. Medical expenses continue to escalate at rates that far outpace standard inflation, creating a persistent source of economic vulnerability for seniors with limited financial resources. Comprehensive health insurance coverage becomes increasingly complex and expensive, forcing many individuals to make challenging decisions about their medical care. The potential for unexpected health complications represents a perpetual source of financial uncertainty that undermines any sense of economic stability.Systemic Challenges and Potential Solutions

The experiences of these New York retirement home residents illuminate broader systemic issues within current retirement support structures. Policymakers, financial institutions, and social service organizations must collaborate to develop more comprehensive and adaptive approaches to senior economic security. Potential solutions might include more flexible Social Security adjustment mechanisms, enhanced retirement savings incentives, and innovative healthcare financing models that provide greater predictability and protection for aging populations. The narrative emerging from this retirement community transcends individual experiences, representing a microcosm of a larger national conversation about aging, economic resilience, and societal responsibility towards its senior citizens.RELATED NEWS

Business

Tariff Tremors: Windy City Entrepreneurs Fortify Businesses Against Trump's Trade War

2025-04-16 10:00:00

Business

Tariff Uncertainty: Business Leaders Reveal Their Deepest Economic Fears

2025-05-02 09:02:32

Business

Tech Titan Showdown: Inside the Surprising Workplace Culture of Meta and Google

2025-04-26 09:07:02