Buffett's Berkshire Doubles Down: Why Japanese Trading Giants Just Won the Investor Lottery

Companies

2025-05-03 15:21:01Content

In a powerful vote of confidence, Warren Buffett lavished praise on the five Japanese trading giants that have captured Berkshire Hathaway's investment interest. The legendary investor's enthusiastic endorsement underscores his growing optimism about these strategic business powerhouses.

During the annual shareholders meeting of Berkshire Hathaway, Buffett highlighted the exceptional potential of these Japanese trading houses, signaling his deep belief in their robust business models and future growth prospects. His investment, which represents a significant strategic move, reflects his renowned ability to identify valuable long-term opportunities in global markets.

The billionaire investor's commitment to these Japanese firms demonstrates his continued global investment strategy, expanding Berkshire Hathaway's international portfolio with carefully selected, high-potential enterprises. Buffett's endorsement is likely to draw increased attention from global investors to these Japanese trading companies, potentially influencing market perceptions and investment strategies.

This latest move further cements Buffett's reputation as a visionary investor who looks beyond traditional market boundaries, seeking value and potential in diverse and sometimes unexpected economic landscapes.

Buffett's Bold Move: Japanese Trading Houses Receive Resounding Endorsement

In the dynamic world of global investment, Warren Buffett continues to demonstrate his unparalleled strategic acumen by making significant strategic investments that challenge conventional market wisdom. His recent endorsement of Japanese trading houses represents a calculated and potentially transformative approach to international financial positioning.Navigating Global Markets with Precision and Vision

Strategic Investment Landscape

Warren Buffett's Berkshire Hathaway has long been recognized for making calculated, long-term investment decisions that transcend traditional market expectations. The recent substantial investment in Japanese trading houses represents a nuanced understanding of global economic dynamics and emerging market opportunities. These trading houses, with their extensive networks and deep-rooted commercial infrastructures, offer unique value propositions that extend far beyond conventional investment paradigms. The strategic significance of these investments lies not merely in financial metrics but in the comprehensive ecosystem these trading companies represent. They operate across multiple sectors, including energy, technology, agriculture, and infrastructure, providing Berkshire Hathaway with diversified exposure to Japan's robust economic landscape.Understanding Japanese Trading House Dynamics

Japanese trading houses, historically known as "sogo shosha," are complex multinational corporations with intricate global connections. These entities differ substantially from traditional corporations by maintaining extensive international networks that facilitate cross-border trade, investment, and strategic partnerships. Buffett's endorsement signals a profound recognition of their adaptive capabilities and potential for sustained growth. These organizations have demonstrated remarkable resilience through complex economic transformations, navigating geopolitical challenges and technological disruptions with exceptional strategic agility. Their ability to create value across diverse economic sectors makes them particularly attractive to sophisticated investors like Buffett.Economic and Geopolitical Implications

Buffett's investment transcends mere financial speculation, representing a broader geopolitical statement about Japan's economic potential. By committing significant capital to these trading houses, Berkshire Hathaway signals confidence in Japan's economic recovery and future growth trajectory. The investment also highlights the interconnected nature of modern global economics, where strategic investments can bridge cultural and economic boundaries. These trading houses serve as critical conduits for international trade, facilitating complex economic interactions that extend well beyond traditional investment models.Long-Term Investment Philosophy

Consistent with Buffett's renowned investment philosophy, this move reflects a patient, value-oriented approach. Rather than pursuing short-term gains, Berkshire Hathaway demonstrates a commitment to understanding fundamental economic structures and identifying long-term value creation opportunities. The Japanese trading houses represent precisely the type of robust, adaptable enterprises that align with Buffett's investment criteria: companies with strong management, sustainable competitive advantages, and potential for consistent value generation. This investment underscores his belief in identifying and supporting enterprises with genuine transformative potential.Future Outlook and Market Perspectives

As global economic landscapes continue evolving, Buffett's strategic investment serves as a compelling case study in sophisticated international investment approaches. By recognizing the unique value proposition of Japanese trading houses, Berkshire Hathaway reinforces its reputation for innovative, forward-thinking investment strategies. The investment signals potential opportunities for other global investors to reconsider their perspectives on emerging market investments, particularly within the complex and nuanced Japanese economic ecosystem. It represents a masterclass in identifying value beyond conventional market narratives.RELATED NEWS

Companies

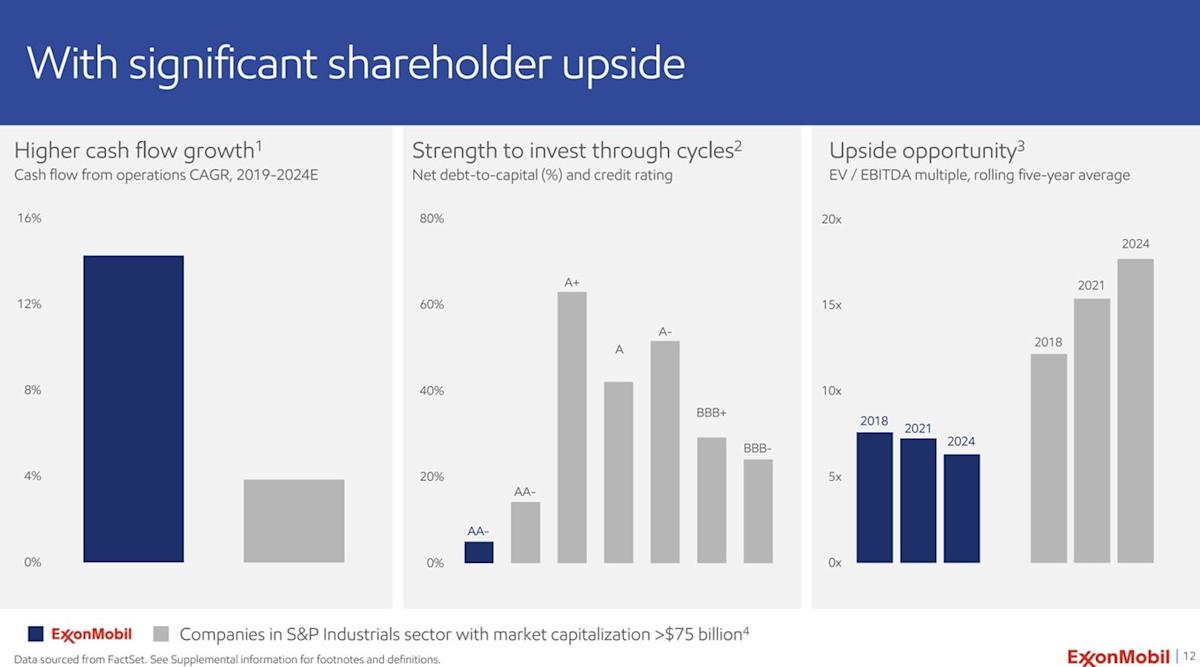

Fueling the Future: Can ExxonMobil Accelerate to a $1 Trillion Valuation?

2025-03-26 08:26:00