Healthcare Revolution: agilon health's Explosive Stock Trajectory Signals Major Market Shift

Health

2025-04-30 09:41:08Content

Healthcare Stocks 2025: Agilon Health's Remarkable Market Performance

As the healthcare sector continues to evolve and transform, investors are keenly watching the standout performers of 2025. After a relatively subdued performance in 2024, Agilon Health, Inc. (NYSE:AGL) has emerged as a compelling player in the rapidly changing healthcare landscape.

Our comprehensive analysis delves into how Agilon Health stacks up against other surging healthcare stocks, offering investors crucial insights into the company's potential and market positioning. The healthcare industry is experiencing a dynamic shift, with innovative companies like Agilon Health leading the charge in reimagining patient care and operational efficiency.

In this deep-dive exploration, we'll unpack the factors driving Agilon Health's recent market momentum, examining its strategic initiatives, financial performance, and competitive advantages that set it apart in the 2025 healthcare stock arena.

Stay tuned as we break down the key elements that make Agilon Health a stock worth watching in the current market environment.

Healthcare Revolution: Unveiling the Titans Reshaping Medical Investment Landscapes in 2025

In the dynamic world of healthcare investments, 2025 emerges as a transformative year where innovative companies are redefining market expectations and challenging traditional investment paradigms. As investors and healthcare enthusiasts seek breakthrough opportunities, understanding the nuanced landscape of emerging medical stocks becomes paramount to strategic financial decision-making.Discover the Groundbreaking Healthcare Stocks Poised to Disrupt the Market!

The Evolving Healthcare Investment Ecosystem

The contemporary healthcare investment landscape represents a complex tapestry of technological innovation, regulatory dynamics, and strategic market positioning. Investors navigating this intricate terrain must comprehend the multifaceted factors driving stock performance beyond traditional financial metrics. Emerging companies like Agilon Health are demonstrating remarkable potential by leveraging advanced technological infrastructures and innovative service delivery models. Technological integration has become a critical differentiator in healthcare investments. Companies that successfully blend data analytics, artificial intelligence, and patient-centric approaches are increasingly attracting sophisticated investor attention. These organizations are not merely providing medical services but are fundamentally reimagining healthcare delivery mechanisms.Decoding Agilon Health's Strategic Market Position

Agilon Health (NYSE:AGL) represents a fascinating case study in healthcare investment innovation. By developing comprehensive primary care management solutions, the company has positioned itself at the intersection of technological advancement and patient-centered healthcare delivery. Their unique approach focuses on creating integrated care models that optimize both patient outcomes and operational efficiency. The company's strategic framework emphasizes data-driven decision-making, leveraging advanced analytics to streamline healthcare processes. This approach allows for more personalized patient experiences while simultaneously reducing systemic inefficiencies. Investors are increasingly recognizing such holistic models as potential game-changers in the healthcare investment ecosystem.Technological Disruption and Investment Potential

Technological disruption continues to be a fundamental driver of healthcare stock performance in 2025. Companies like Agilon Health are not merely adapting to technological changes but are actively pioneering transformative solutions. Their investment in cutting-edge technologies such as predictive analytics, machine learning, and integrated care platforms demonstrates a forward-thinking approach that resonates with progressive investors. The convergence of digital health technologies, artificial intelligence, and personalized medicine creates unprecedented opportunities for strategic investments. Sophisticated investors are looking beyond traditional financial indicators, focusing instead on companies' capacity for continuous innovation and adaptability in a rapidly evolving healthcare landscape.Navigating Regulatory and Market Complexities

The healthcare investment environment in 2025 remains characterized by intricate regulatory frameworks and dynamic market conditions. Successful companies must demonstrate not only technological prowess but also regulatory compliance and strategic agility. Agilon Health's approach involves proactively engaging with regulatory challenges, developing flexible business models that can quickly adapt to changing healthcare policies. Understanding these complex interactions requires a nuanced perspective that goes beyond surface-level financial analysis. Investors must consider broader ecosystem dynamics, including technological trends, regulatory environments, and potential disruptive innovations that could reshape healthcare delivery models.Future Outlook and Investment Strategies

As we progress through 2025, healthcare investments will continue to represent a sophisticated and dynamic sector. Companies like Agilon Health exemplify the potential for strategic innovation, demonstrating that success lies in creating integrated, technology-driven solutions that address fundamental healthcare challenges. Investors seeking meaningful opportunities must adopt a holistic approach, considering technological capabilities, market positioning, and potential for sustained growth. The most successful investment strategies will prioritize companies that can effectively balance innovation, patient care, and operational efficiency.RELATED NEWS

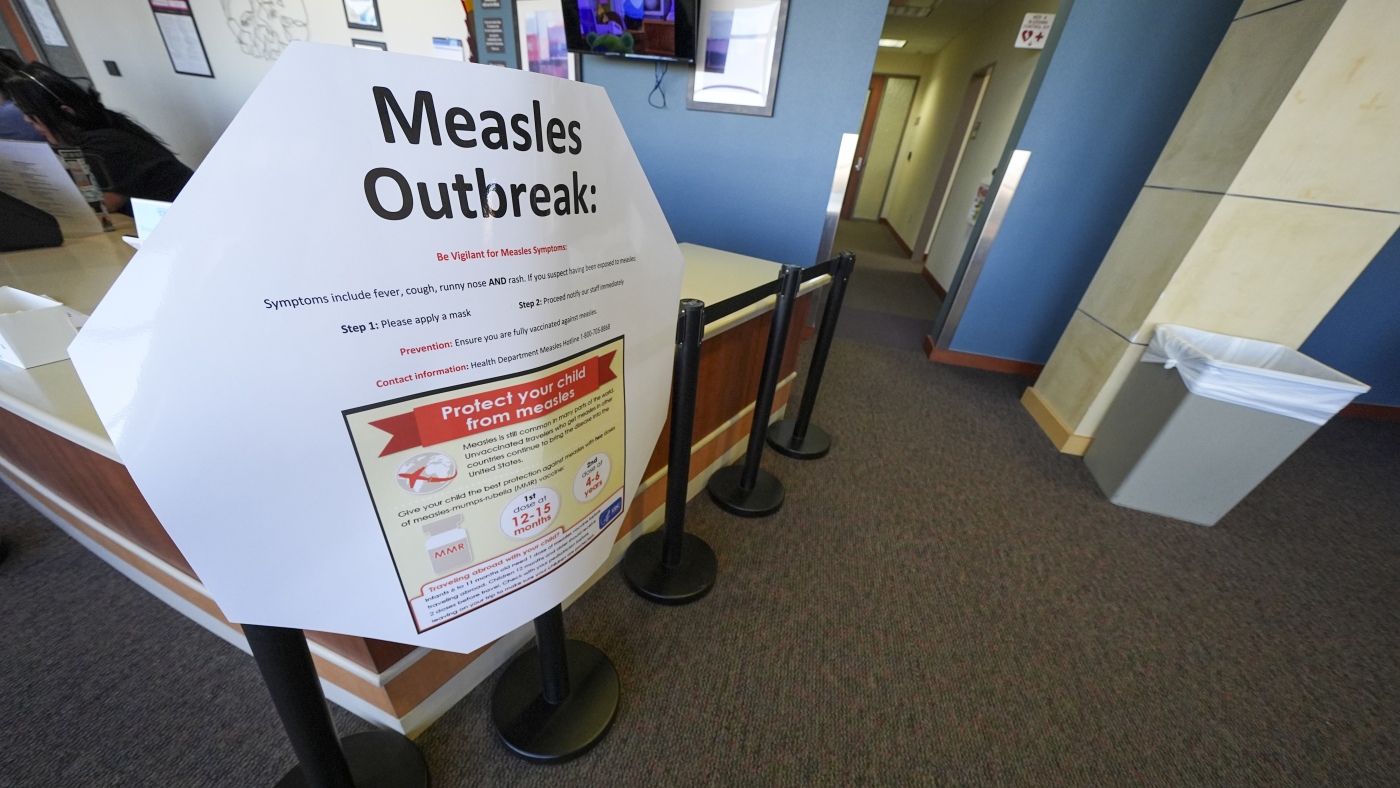

Tragedy Strikes: Measles Claims Second Young Life in West Texas as Outbreak Surges Past 500 Cases

Unlocking the Fountain of Youth: Breakthrough Science Reveals Secret to Slowing Down Aging

/who-shipment-in-gaza.tmb-1200v.jpg)