Trade Tensions Bite: How Tariffs Are Reshaping Corporate Spending Strategies

Business

2025-04-24 15:58:09Content

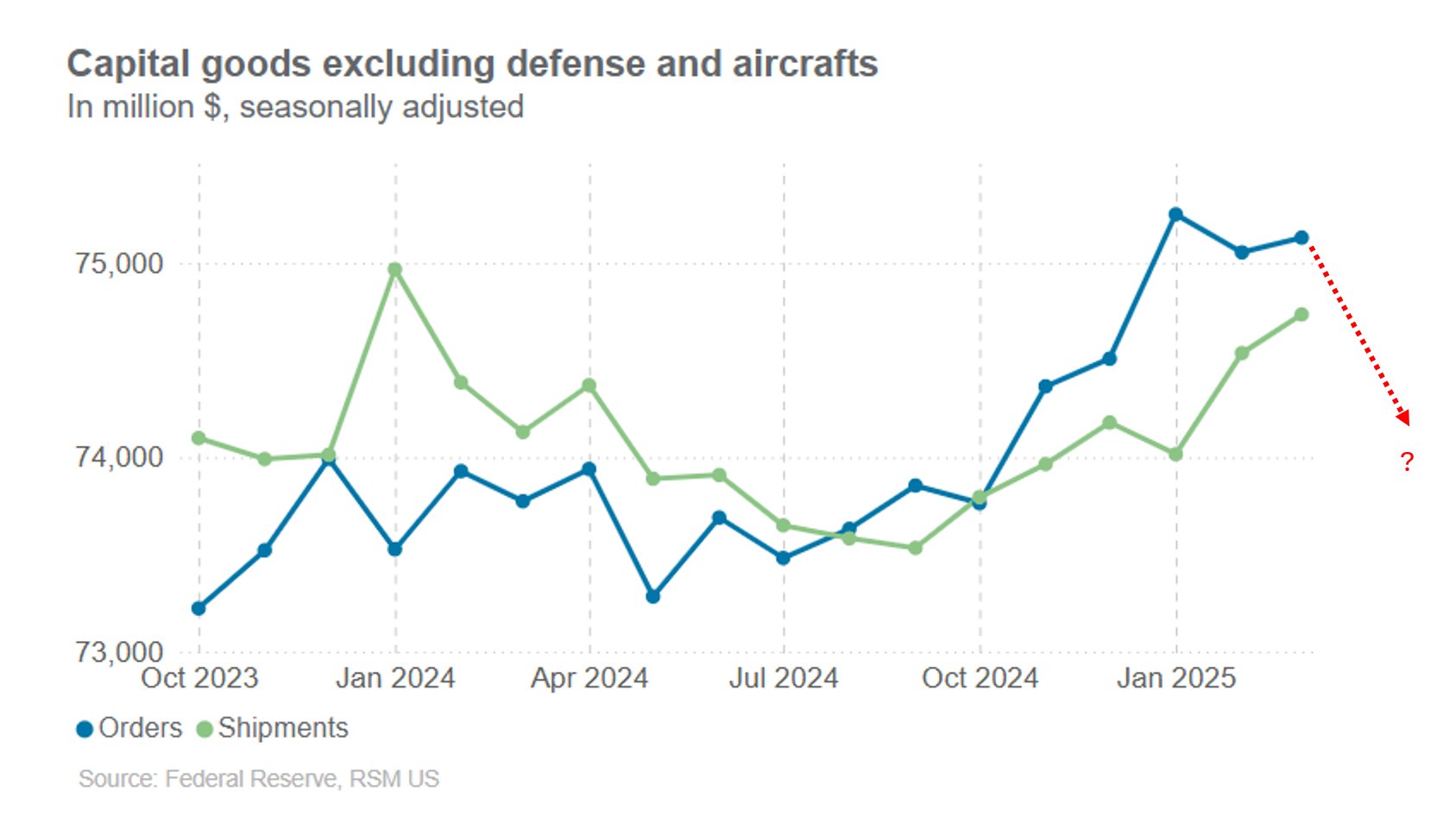

Beyond the Boeing aircraft orders, March revealed a concerning trend in business equipment spending, highlighting growing economic uncertainty. The underlying investment landscape appeared notably fragile as companies hesitated amid complex trade policy dynamics. Businesses seemed cautious, pulling back on capital expenditures and signaling potential economic headwinds that could impact broader economic growth and corporate confidence.

The subdued spending patterns suggest that companies are adopting a wait-and-see approach, carefully monitoring trade negotiations and global economic signals before committing to significant equipment investments. This reluctance reflects the intricate challenges facing American businesses in an increasingly unpredictable economic environment.

Turbulent Tides: Unraveling the Complexities of American Business Equipment Spending

In the intricate landscape of economic indicators, the pulse of American business investment reveals a nuanced narrative of uncertainty and strategic recalibration. The machinery of economic progress often hinges on subtle shifts in corporate spending, where each investment decision reflects broader market sentiments and strategic anticipation.Decoding the Economic Signals: When Investment Whispers Speak Volumes

The Boeing Effect: Separating Signal from Noise

The aerospace giant's order book has long been a critical barometer of industrial momentum, yet beneath the surface of headline figures lies a more complex economic terrain. When Boeing's substantial aircraft orders are methodically extracted from the broader equipment spending landscape, a more subdued picture emerges. The underlying equipment investment trends suggest a marketplace wrestling with profound uncertainties, particularly surrounding international trade dynamics. Businesses are demonstrating remarkable caution, their capital expenditure strategies reflecting a heightened sensitivity to geopolitical and economic volatility. The traditional confidence that once propelled robust equipment investments now appears tempered by a more measured, risk-aware approach.Trade Policy Uncertainty: The Invisible Economic Headwind

The current economic environment is characterized by an unprecedented level of policy unpredictability. Trade negotiations, tariff landscapes, and international economic relationships have become increasingly complex, creating a challenging decision-making ecosystem for corporate leaders. This uncertainty manifests directly in equipment spending patterns, with companies adopting a wait-and-see strategy. Executives are carefully calibrating their investment horizons, recognizing that premature capital commitments could expose their organizations to significant financial risks. The traditional calculus of equipment investment—once driven by clear growth projections and stable market conditions—now requires a more nuanced, adaptive approach.Sectoral Dynamics and Investment Resilience

Different industrial sectors are experiencing this investment hesitation with varying intensities. Manufacturing, technology, and infrastructure-related industries are particularly sensitive to these macroeconomic undercurrents. The equipment spending slowdown is not uniform but reflects a sophisticated interplay of sector-specific challenges and broader economic indicators. Technological disruption, coupled with trade policy volatility, creates a complex decision-making environment. Companies are increasingly prioritizing flexibility and adaptability over traditional expansion strategies, leading to more conservative capital allocation approaches.Strategic Implications for Corporate Investment

The current economic landscape demands unprecedented strategic agility. Corporate leaders must navigate a multifaceted environment where traditional investment models are being fundamentally reimagined. The equipment spending trends reveal more than mere financial data—they represent a sophisticated organizational response to global economic complexity. Forward-thinking organizations are leveraging this period of uncertainty as an opportunity for strategic repositioning. By maintaining investment flexibility and developing robust scenario-planning capabilities, businesses can transform potential challenges into competitive advantages.Technological Innovation and Investment Resilience

Emerging technologies and digital transformation are providing alternative pathways for corporate investment. While traditional equipment spending might be experiencing a temporary contraction, investments in digital infrastructure, automation, and intelligent systems continue to demonstrate remarkable resilience. The convergence of technological innovation and strategic caution is creating a new investment paradigm. Companies are increasingly viewing technology not just as a capital expenditure but as a strategic enabler of organizational adaptability and long-term competitiveness.RELATED NEWS

Business

Blast Rocks East LA Storefront: Three Workers Caught in Sudden Gas Eruption

2025-02-24 02:24:00

Business

Fashion Faux Pas: Met Gala's Most Jaw-Dropping Red Carpet Disasters Unveiled

2025-05-03 12:48:01

Business

Economic Storm Brewing: Jamie Dimon Signals Potential Stagflation and Growth Slowdown

2025-04-07 10:15:02