Wall Street Trembles: Trump's Fed Feud Sparks Market Mayhem

Business

2025-04-22 09:25:33Content

Wall Street Plummets as Market Turmoil Intensifies

Investors braced for impact as the stock market nosedived on Monday, with the sell-off reaching unprecedented levels of volatility. The financial landscape continues to be roiled by a perfect storm of economic uncertainties, driven by escalating tensions between political rhetoric and monetary policy.

Following a series of disruptive trade policies, the market is now grappling with mounting pressure from unexpected presidential critiques of the Federal Reserve. The ongoing economic uncertainty has sent shockwaves through investor confidence, triggering a widespread market retreat that shows no immediate signs of abating.

Traders and analysts are closely monitoring the situation, with growing concerns about the potential long-term implications of the current market turbulence. The dramatic downturn reflects a complex interplay of geopolitical tensions, trade uncertainties, and increasingly unpredictable economic policy directives.

As Wall Street continues to reel from the recent market shock, investors are left wondering about the potential trajectory of financial markets in the coming weeks and months.

Market Tremors: Trump's Federal Reserve Critique Sends Wall Street into Tailspin

In the volatile landscape of financial markets, political rhetoric and economic policy intersect with dramatic consequences. The recent upheaval on Wall Street underscores the delicate balance between presidential commentary and investor confidence, revealing the profound impact of leadership communication on global financial ecosystems.Navigating Turbulent Economic Waters: When Presidential Words Shake Markets

The Escalating Tension Between Political Rhetoric and Financial Stability

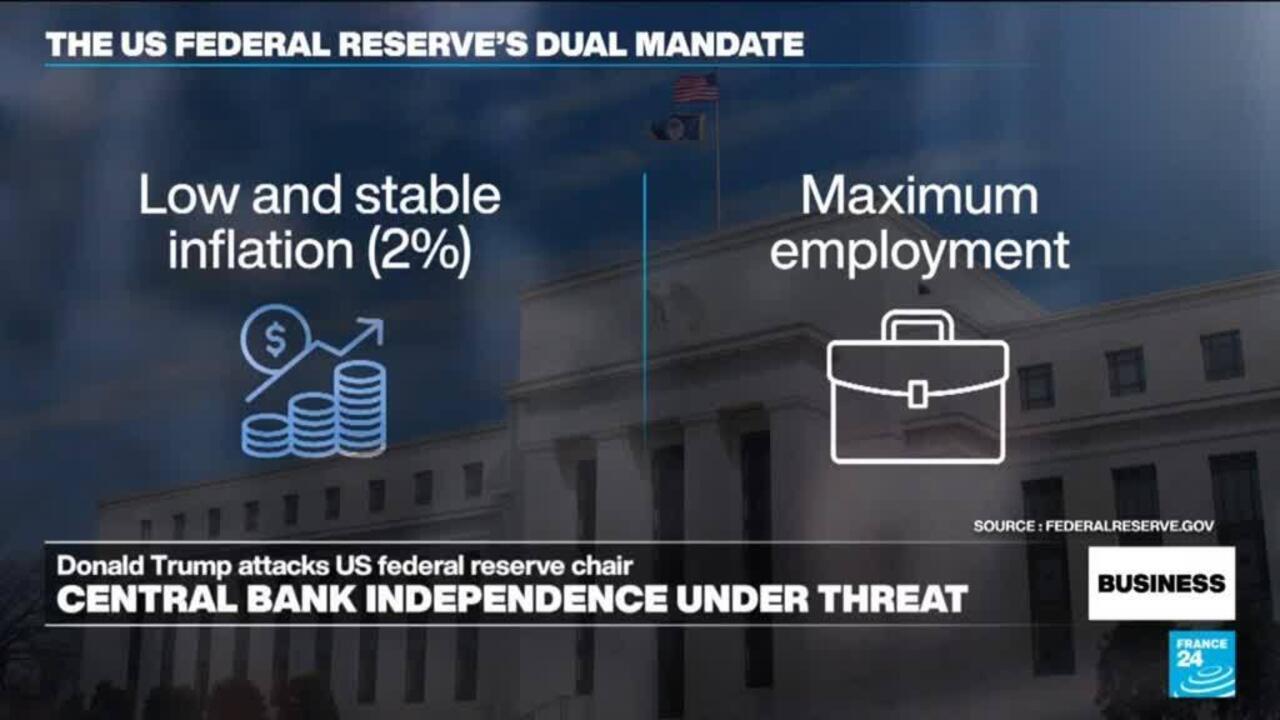

The financial markets have become an intricate battleground where political discourse and economic strategy collide with unprecedented intensity. President Trump's sustained critique of the Federal Reserve represents more than a mere disagreement—it's a seismic event that reverberates through investment portfolios, institutional strategies, and global economic perceptions. Historically, presidential commentary on monetary policy has been measured and strategic. However, Trump's approach defies traditional diplomatic norms, transforming economic communication into a high-stakes performance that keeps investors perpetually on edge. His unfiltered critiques challenge established institutional boundaries, creating an environment of uncertainty that traders and analysts find increasingly difficult to navigate.Decoding the Market's Psychological Landscape

Wall Street's negative trajectory isn't merely a numerical decline but a complex psychological phenomenon. Investors respond not just to economic indicators but to the narrative surrounding those indicators. Trump's persistent attacks on the Federal Reserve create a narrative of institutional instability that triggers defensive market behaviors. The market's reaction reveals a deeper psychological mechanism where uncertainty breeds conservative investment strategies. Each provocative statement becomes a potential trigger for market recalibration, forcing institutional investors to constantly reassess risk models and portfolio allocations.The Ripple Effect of Tariff Policies and Monetary Critique

Trump's economic strategy has been characterized by aggressive tariff policies and direct challenges to monetary institutions. These approaches create a multifaceted disruption that extends beyond immediate market reactions. International trade relationships, investment confidence, and long-term economic planning all become subject to unprecedented volatility. The cumulative impact of these strategies manifests in a complex economic ecosystem where traditional predictive models struggle to maintain relevance. Investors find themselves navigating a landscape where political communication is as significant as economic data in determining market movements.Institutional Resilience in the Face of Unprecedented Challenges

Despite the turbulence, financial institutions demonstrate remarkable adaptability. The Federal Reserve, while publicly maintaining a composed stance, must internally recalibrate its strategies to address the unique challenges presented by direct presidential criticism. This ongoing tension represents more than a simple policy disagreement—it's a fundamental reshaping of how economic institutions interact with political leadership. The market's response becomes a real-time experiment in institutional resilience and adaptive capacity.Global Implications of Domestic Economic Volatility

The reverberations of Wall Street's current instability extend far beyond domestic borders. International investors, multinational corporations, and global economic strategists closely monitor these developments, recognizing that U.S. market dynamics have profound worldwide implications. The interconnected nature of modern financial systems means that each market tremor in the United States creates corresponding vibrations in economic ecosystems across continents. This global sensitivity underscores the critical importance of measured, strategic economic communication.RELATED NEWS

Business

Unlocking Business Growth: The Lifetime Income Strategy Revolutionizing Entrepreneurship

2025-03-25 22:29:36

Business

Xi's Economic Lifeline: Inside the Rare Summit Calming China's Business Nerves

2025-02-17 07:33:34

Business

Startup Boost: How Colorado Springs is Transforming Local Talent into Business Success

2025-03-18 02:09:39