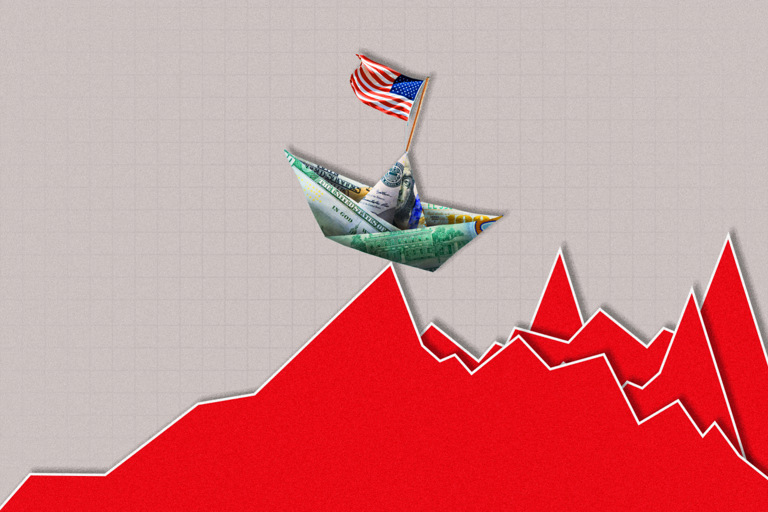

Trade War Showdown: How Trump's Tariff Tactics Could Unravel U.S. Economic Dominance

Finance

2025-04-21 01:00:00Content

Global financial markets are experiencing a seismic shift, with mounting volatility and a weakening U.S. dollar signaling potential dramatic changes in the international economic landscape. Investors and economic experts are growing increasingly concerned about a possible realignment of financial power that could challenge the long-standing dominance of U.S. financial institutions.

The current economic climate is characterized by unprecedented uncertainty, with traditional market indicators suggesting a profound transformation may be on the horizon. Currency fluctuations and increasing global economic tensions are creating an environment where established financial paradigms are being fundamentally questioned.

Emerging markets and alternative financial centers are watching closely, sensing an opportunity to reshape global economic dynamics. The potential for a significant redistribution of financial influence appears more tangible than at any point in recent history, as traditional economic strongholds face mounting pressures from both internal challenges and external competitive forces.

Analysts warn that this period of volatility could represent more than a temporary market fluctuation, potentially marking the beginning of a more substantial restructuring of global financial networks. The implications of such a shift could be far-reaching, affecting everything from international trade to investment strategies and geopolitical relationships.

Global Financial Tremors: The Shifting Tectonic Plates of Economic Power

In an era of unprecedented economic uncertainty, the global financial landscape is undergoing a profound transformation that threatens to reshape the traditional dominance of U.S. financial markets. The intricate dance of international currencies, investment flows, and geopolitical tensions is creating a complex narrative of economic realignment that demands careful scrutiny and strategic understanding.Navigating the Turbulent Waves of Global Economic Disruption

The Unraveling of Dollar Supremacy

The longstanding hegemony of the U.S. dollar is experiencing unprecedented challenges from multiple fronts. Emerging economic powerhouses are increasingly seeking alternatives to dollar-denominated transactions, signaling a potential seismic shift in global financial architecture. Nations like China and Russia have been actively developing strategies to reduce their dependence on U.S. financial infrastructure, exploring alternative payment mechanisms and bilateral trade agreements that circumvent traditional dollar-based systems. Geopolitical tensions and economic sanctions have accelerated this trend, compelling countries to develop more resilient and independent financial ecosystems. The growing momentum of de-dollarization represents more than a mere economic strategy; it is a fundamental reimagining of global economic power dynamics.Volatility as the New Economic Paradigm

Financial markets are experiencing unprecedented levels of volatility, characterized by rapid and unpredictable fluctuations that challenge traditional economic models. This instability is not merely a temporary phenomenon but reflects deeper structural transformations in the global economic system. Institutional investors and central banks are recalibrating their strategies, recognizing that conventional risk management approaches may no longer be sufficient. The interconnectedness of global markets means that a disruption in one region can trigger cascading effects across continents, creating a complex web of economic interdependence and potential vulnerability.Emerging Market Dynamics and Strategic Repositioning

Developing economies are no longer passive recipients of global economic trends but active architects of a new financial landscape. Countries in Asia, Latin America, and Africa are leveraging technological innovations, strategic partnerships, and indigenous financial technologies to create more resilient economic frameworks. The rise of digital currencies, blockchain technologies, and alternative financial instruments is democratizing economic participation and challenging established financial intermediaries. These innovations are not just technological upgrades but represent fundamental shifts in how economic value is conceived, transferred, and managed.Geopolitical Undercurrents of Economic Transformation

The current economic realignment is deeply intertwined with complex geopolitical dynamics. Trade tensions, technological competition, and strategic rivalries are reshaping the traditional boundaries between economic and political domains. Nations are increasingly viewing economic strategies through a lens of national security and strategic autonomy. The ability to control financial infrastructure, protect critical economic assets, and maintain technological sovereignty has become as important as traditional military capabilities.Technological Innovation and Financial Resilience

Technological advancements are serving as both a catalyst and an enabler of economic transformation. Artificial intelligence, machine learning, and advanced data analytics are providing unprecedented insights into economic patterns and potential disruptions. Financial institutions and governments are investing heavily in technological capabilities that can provide early warning systems, predictive modeling, and adaptive strategies. The future of economic resilience lies not just in financial resources but in the ability to rapidly understand, anticipate, and respond to complex global dynamics.RELATED NEWS

Finance

Cosmic Crossroads: Libra's Strategic Pivot Unveiled for March 9th - Love, Luck, and Lifelines Align

2025-03-08 06:15:28

Finance

Job Market Resilience: February Hiring Slows but Steady, Unemployment Nudges Higher

2025-03-07 13:33:17