Homeowners Left Stunned: Insurance Giant's Jaw-Dropping Verdict Sparks Outrage

Companies

2025-04-19 23:00:00Content

In a troubling trend that's sending shockwaves through Jacksonville, Oregon, homeowners are facing an increasingly difficult insurance landscape as major insurance companies systematically withdraw coverage, even as the community has demonstrated remarkable dedication to wildfire prevention.

Despite the town's proactive measures and significant investments in reducing wildfire risks, insurers are pulling back, leaving residents in a precarious position. Local homeowners who have diligently worked to protect their properties and community are now confronting the harsh reality of potentially uninsurable homes.

Jacksonville's comprehensive wildfire mitigation strategies—including extensive forest management, creating defensible spaces, and implementing stringent building codes—seem to offer little reassurance to insurance providers. This unexpected exodus of coverage threatens not just individual homeowners, but the entire community's economic stability and property values.

The situation highlights a growing national concern where climate change risks and escalating natural disaster potential are forcing insurance companies to reassess their risk models, often at the expense of homeowners in vulnerable regions.

As residents grapple with this insurance crisis, local officials and community leaders are exploring alternative solutions and advocating for more nuanced risk assessment approaches that recognize their substantial prevention efforts.

Wildfire-Prone Paradise: The Unfolding Insurance Crisis in Jacksonville, Oregon

In the heart of Southern Oregon's picturesque landscape, a silent economic storm is brewing that threatens the very fabric of community resilience and homeownership. Jacksonville, a charming historic town known for its proactive wildfire prevention strategies, now faces an unprecedented challenge as insurance companies systematically withdraw coverage, leaving residents in a precarious financial predicament.When Protection Meets Abandonment: The Shocking Insurance Exodus

The Wildfire Vulnerability Paradox

Jacksonville's geographical positioning in the rugged Oregon wilderness makes it particularly susceptible to wildfire risks. Despite the community's substantial investments in advanced fire prevention infrastructure and comprehensive mitigation strategies, insurance providers are increasingly viewing the region as an unacceptable financial liability. Local homeowners find themselves caught in a complex web of environmental uncertainty and corporate risk assessment. The region's topography, characterized by dense forests and challenging terrain, has historically been a double-edged sword. While offering breathtaking natural beauty, these same landscapes create significant challenges for fire suppression and property protection. Insurance companies are now leveraging sophisticated risk modeling technologies that calculate potential losses with unprecedented precision, leading to widespread coverage withdrawals.Community Resilience in the Face of Corporate Retreat

Local government and community leaders have implemented an impressive array of wildfire mitigation techniques. These include creating extensive defensible spaces around residential areas, establishing advanced early warning systems, and investing in state-of-the-art firefighting equipment. However, these proactive measures seem increasingly insufficient to persuade insurance underwriters of the region's insurability. Residents are experiencing profound economic and emotional stress as their property values potentially plummet and mortgage requirements become increasingly complex. The insurance exodus represents more than a financial challenge; it symbolizes a broader narrative of climate adaptation and community vulnerability in an era of escalating environmental uncertainties.Economic and Social Implications of Insurance Withdrawal

The systematic removal of insurance coverage creates a domino effect with far-reaching consequences. Homeowners struggle to maintain property values, potential buyers become hesitant, and the local real estate market experiences significant turbulence. Small businesses and local economic ecosystems are equally impacted, as the perception of high-risk environments deters investment and economic growth. Municipal authorities are exploring innovative solutions, including potential public-private partnerships and alternative risk management strategies. Some proposals include community-based insurance pools, enhanced state-level regulatory interventions, and collaborative risk mitigation programs that could potentially reassure insurance providers.Technological and Environmental Adaptation Strategies

Emerging technologies offer potential pathways for addressing these challenges. Advanced satellite monitoring, artificial intelligence-driven predictive modeling, and real-time environmental sensing could provide more nuanced risk assessments. These technologies might help bridge the communication gap between local communities and insurance providers, offering more dynamic and responsive risk evaluation mechanisms. Climate change adaptation requires holistic approaches that integrate technological innovation, community resilience, and adaptive policy frameworks. Jacksonville's current predicament serves as a microcosm of broader environmental and economic challenges facing communities in fire-prone regions across the United States.Legal and Regulatory Landscape

State legislators are increasingly scrutinizing the insurance industry's practices, exploring potential regulatory interventions to protect homeowners. Proposed legislation aims to create more balanced risk assessment frameworks and prevent arbitrary coverage withdrawals that disproportionately impact vulnerable communities. The ongoing situation in Jacksonville represents a critical intersection of environmental risk, corporate strategy, and community survival. As climate patterns become increasingly unpredictable, the ability of communities to adapt and innovate will become paramount in maintaining economic stability and social cohesion.RELATED NEWS

Companies

Titans of the Archipelago: The 20 Game-Changing Companies Powering the Philippine Economy

2025-03-10 12:00:00

Companies

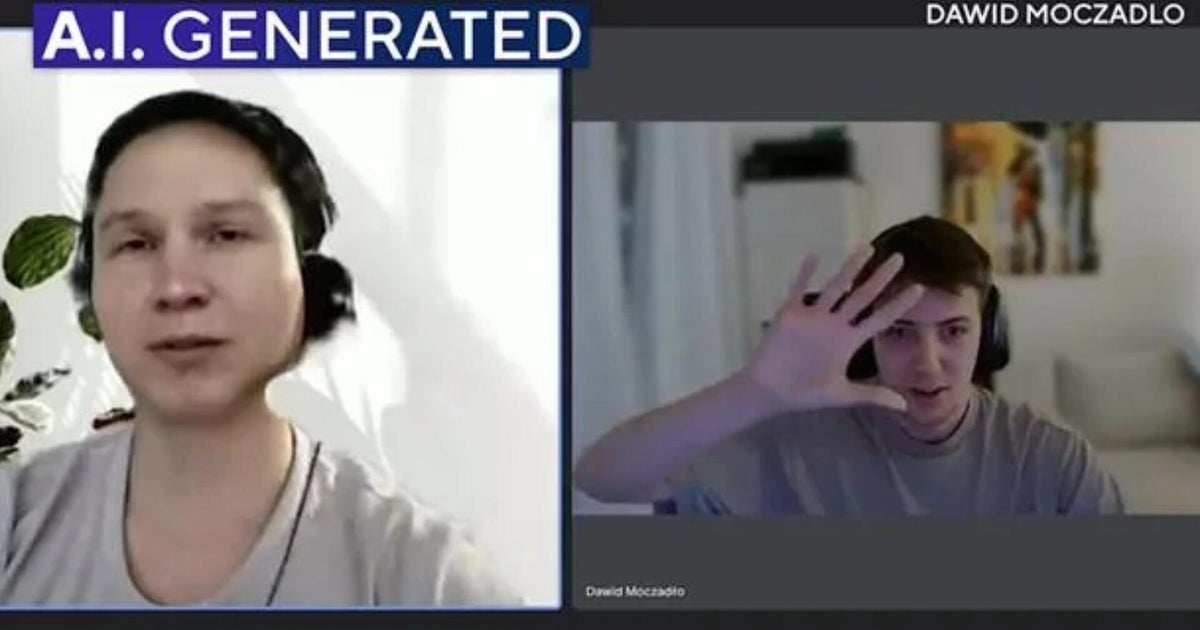

Unmasked: AI's Sneaky Job Market Infiltration - Companies Sound the Alarm

2025-04-23 21:39:38

Companies

Payroll Pandemonium: 62% of Businesses Admit to Botching Sales Commission Calculations

2025-05-06 15:00:00