Luxury Spending Unscathed: AmEx CEO Reveals Gen Z's Resilient Wallet Power

Business

2025-04-18 16:48:45Content

American Express cardholders are witnessing a fascinating spending trend, with younger customers leading the charge in financial activity. In the first quarter, millennials and Gen Z cardholders demonstrated remarkable spending power, increasing their card expenditures by an impressive 14% compared to older demographic groups.

This significant surge highlights a shifting consumer landscape, where younger generations are not just participating in the financial market, but actively driving economic momentum. The robust spending pattern suggests growing confidence and economic engagement among younger cardholders, who are showing greater willingness to use their American Express cards for various purchases and transactions.

The 14% spending increase stands in stark contrast to the more conservative spending habits of older cardholders, signaling a potential transformation in consumer behavior and financial attitudes across different age groups. This trend could have important implications for credit card companies, retailers, and economic analysts tracking consumer spending patterns.

Millennial Spending Surge: How Gen Z is Reshaping Credit Card Consumption

In the rapidly evolving landscape of financial consumption, a remarkable transformation is unfolding as younger generations redefine spending patterns and credit card usage. The traditional financial paradigms are being challenged by a new wave of consumers who are not just spending differently, but fundamentally reimagining their relationship with financial instruments.Unleashing the Power of Plastic: A Generational Financial Revolution

The Digital Native Spending Phenomenon

American Express has discovered a groundbreaking trend that signals a profound shift in consumer behavior. Younger cardholders are demonstrating unprecedented financial confidence and spending patterns that are dramatically diverging from previous generational norms. Unlike their predecessors, these digital-native consumers are leveraging credit cards as more than just transactional tools—they're using them as strategic financial instruments that reflect their lifestyle and values. The data reveals a compelling narrative of economic empowerment. Millennials and Gen Z are not merely spending; they're investing in experiences, personal development, and technological innovations that align with their worldview. Their 14% increased spending represents more than a statistical blip—it's a seismic economic signal that traditional financial institutions must carefully decode and understand.Technological Integration and Financial Behavior

The surge in spending is intrinsically linked to technological integration and digital financial ecosystems. Modern credit card platforms are no longer static payment mechanisms but dynamic, interactive financial companions. These cards offer real-time analytics, personalized rewards, and seamless digital experiences that resonate deeply with tech-savvy generations. Advanced algorithms and machine learning enable these financial products to provide unprecedented levels of personalization. From cashback strategies tailored to individual spending habits to instant reward redemption, these cards are transforming from mere transactional tools to intelligent financial partners that understand and anticipate user needs.Economic Implications and Market Adaptation

The spending patterns of younger consumers represent a critical economic indicator. Financial institutions are rapidly recalibrating their strategies to accommodate this new demographic. Traditional marketing approaches are being replaced by more nuanced, experience-driven engagement models that speak directly to the values and aspirations of younger generations. This shift goes beyond mere marketing—it represents a fundamental reimagining of financial services. Companies that can successfully decode the preferences of these digital natives will gain a significant competitive advantage. The ability to offer flexible, transparent, and technologically advanced financial products is becoming a critical differentiator in an increasingly competitive market.Psychological Dimensions of Modern Spending

Behind the statistical surge lies a complex psychological landscape. Younger consumers view financial transactions through a lens of personal empowerment and strategic life management. Their spending is not just about acquiring goods but about curating experiences, investing in personal growth, and making statements about their identity and values. The credit card has evolved from a simple payment method to a sophisticated tool of personal expression. Each transaction becomes a narrative, a choice that reflects individual priorities, ethical considerations, and lifestyle aspirations. This holistic approach to spending represents a profound cultural shift that extends far beyond mere economic transactions.Future Forecasting and Strategic Insights

As American Express and other financial institutions continue to analyze these emerging trends, one thing becomes crystal clear: the future of financial services will be defined by adaptability, technological integration, and a deep understanding of generational nuances. The 14% spending increase is not an endpoint but a signpost pointing toward a more dynamic, personalized financial ecosystem. Financial strategists, marketers, and product developers must now engage in continuous learning and rapid innovation. The consumers of tomorrow will demand financial tools that are not just functional but transformative—instruments that understand their complex, multifaceted lives and provide value beyond traditional transactional frameworks.RELATED NEWS

Business

Data Disaster Averted? Actiphy Reveals Critical Backup Strategies on Global Awareness Day

2025-03-31 15:00:00

Business

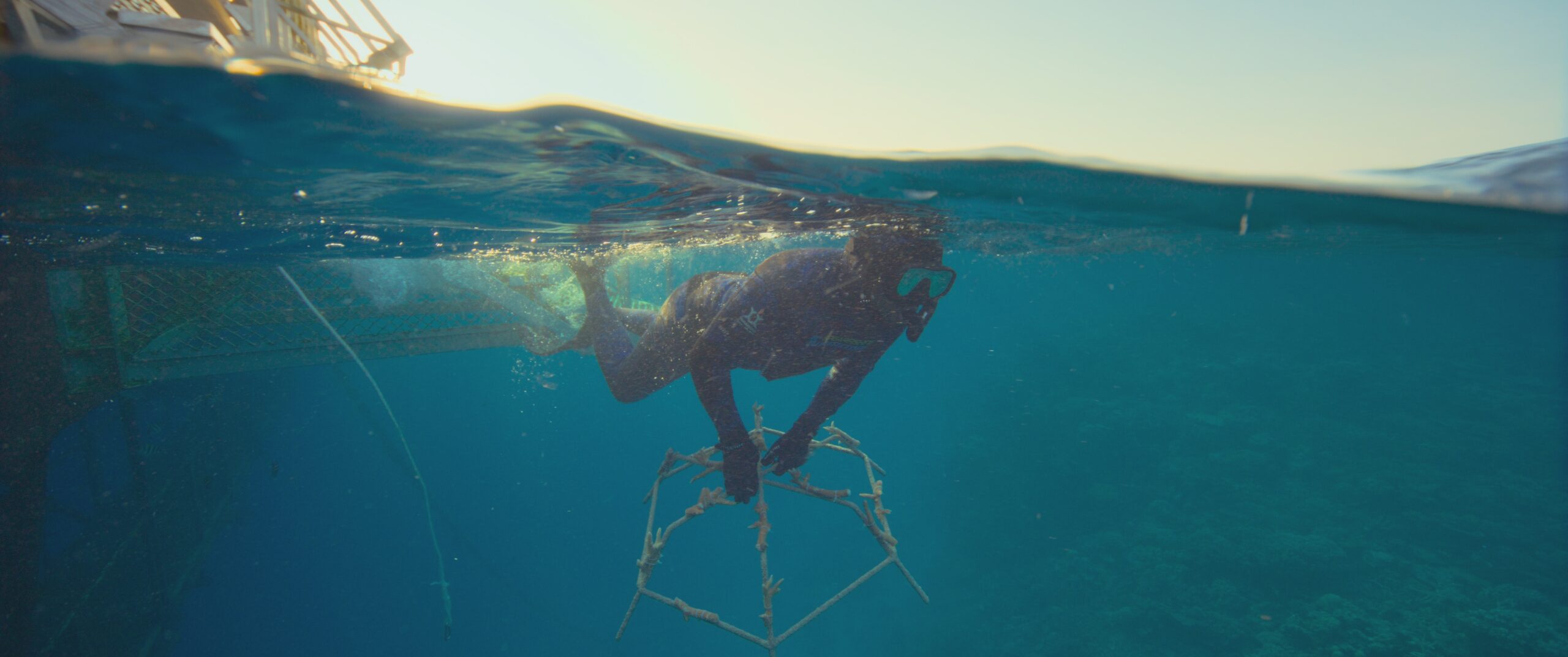

Coral Revival: How Community Partnerships Are Saving Our Underwater Ecosystems

2025-04-01 16:44:47