Presidential Power Showdown: Trump vs. Powell - Supreme Court Poised to Settle the Score

Politics

2025-04-17 19:57:09Content

In a dramatic escalation of his ongoing criticism of the Federal Reserve, President Donald Trump has once again targeted Jerome Powell, calling for his removal from the central bank's leadership. This latest salvo comes at a critical moment, as the Supreme Court deliberates on a complex legal challenge that could fundamentally reshape the governance of independent financial institutions.

The high-stakes appeal has rapidly transformed into a broader battle over the control and autonomy of the Federal Reserve, with potentially far-reaching implications for monetary policy and executive power. Trump's unprecedented public pressure on Powell highlights the growing tension between the White House and the nation's most influential financial regulatory body.

As the Supreme Court weighs the case, legal experts and financial analysts are closely watching how the proceedings might impact the traditional independence of critical government agencies. The unfolding drama underscores the delicate balance of power between the executive branch and independent financial institutions that play a crucial role in managing the nation's economic stability.

Power Struggle: Trump's Bold Challenge to the Federal Reserve's Independence

In the intricate landscape of American financial governance, a seismic confrontation is unfolding between political ambition and institutional autonomy. The recent provocative statements by former President Donald Trump targeting Federal Reserve Chair Jerome Powell have ignited a complex legal and political discourse that extends far beyond mere personal disagreement.When Presidential Rhetoric Challenges Institutional Boundaries

The Constitutional Battleground of Institutional Autonomy

The Supreme Court finds itself at the epicenter of a profound constitutional examination, evaluating the delicate balance of power between executive influence and independent regulatory agencies. Trump's unprecedented call for the "termination" of Jerome Powell represents more than a personal vendetta; it symbolizes a broader challenge to the fundamental principles of institutional independence. The legal landscape surrounding this conflict is nuanced and multifaceted. Constitutional scholars are closely analyzing the potential implications of such direct presidential intervention in the Federal Reserve's operations. The Supreme Court's current deliberations are not merely about Powell's leadership but represent a critical test of the checks and balances embedded in the American governmental system.Economic Implications of Political Interference

The potential ramifications of presidential attempts to undermine the Federal Reserve's autonomy extend far beyond immediate political theatrics. Financial markets are inherently sensitive to signals of political instability, and such direct challenges can create significant uncertainty. Economists and policy analysts are deeply concerned about the potential erosion of the Federal Reserve's credibility. The central bank's ability to make independent monetary policy decisions is crucial for maintaining economic stability and investor confidence. Trump's aggressive rhetoric threatens to destabilize this carefully constructed ecosystem of financial governance.Historical Context of Federal Reserve Independence

The current confrontation is not without historical precedent. Throughout American history, tensions between political leadership and monetary authorities have existed, but rarely have they been as publicly and directly confrontational as the current scenario. The Federal Reserve was deliberately designed to operate with a degree of insulation from direct political pressure. This structural independence allows monetary policymakers to make decisions based on long-term economic health rather than short-term political considerations. Trump's approach represents a significant departure from traditional presidential interactions with the central bank.Legal and Procedural Complexities

The Supreme Court's current deliberations are examining intricate legal questions about the boundaries of executive power and institutional autonomy. The case has transformed into a proxy battle that could potentially reshape understanding of regulatory agency independence. Legal experts are parsing the constitutional nuances, considering precedents, and evaluating the potential long-term consequences of any judicial decision. The outcome could establish critical guidelines for future interactions between political leadership and independent agencies.Global Financial Perspectives

International financial observers are watching this domestic dispute with considerable interest. The potential undermining of the Federal Reserve's independence could have significant global economic implications, potentially affecting international investor confidence and global monetary dynamics. The interconnected nature of modern global finance means that any substantial shift in the United States' monetary governance could trigger ripple effects across international markets, making this more than just a domestic political skirmish.Public and Political Reaction

Public discourse surrounding this confrontation has been intense and polarized. Political commentators, economic experts, and citizens are engaged in robust debates about the appropriate boundaries of presidential influence over monetary policy. The controversy highlights deeper philosophical differences about governance, institutional design, and the role of political leadership in economic management. It serves as a microcosm of broader debates about power, accountability, and institutional integrity.RELATED NEWS

Politics

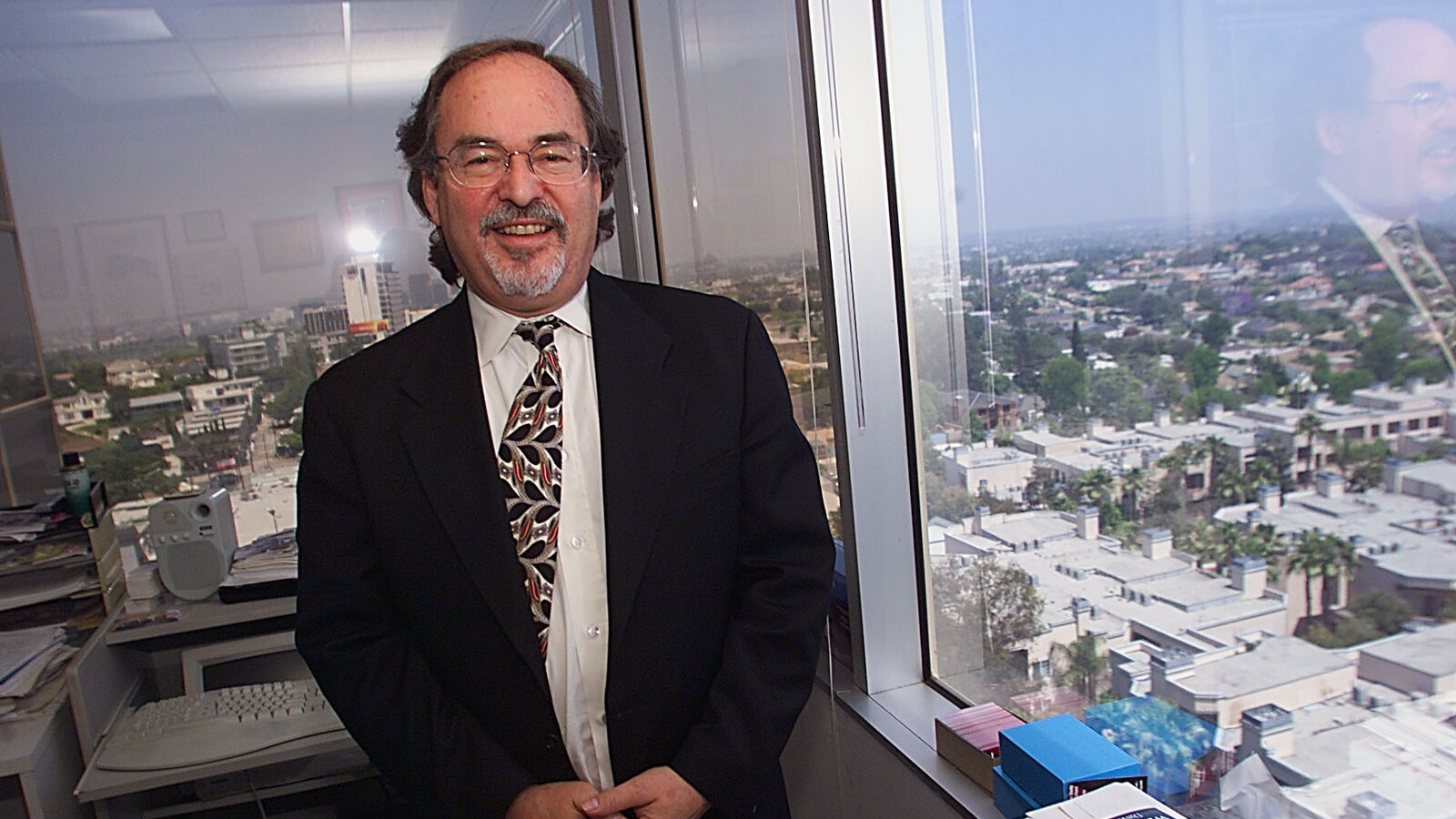

From Radical Left to MAGA Champion: David Horowitz's Provocative Political Journey Ends at 86

2025-04-30 23:17:32

Politics

Silent Shift: Justice Department Weighs Backing Down from Gun Suppressor Regulations

2025-03-26 08:00:53