Nvidia's Market Meltdown: Chip Giant Bleeds $270B as US Export Crackdown Intensifies

Finance

2025-04-17 20:17:09Content

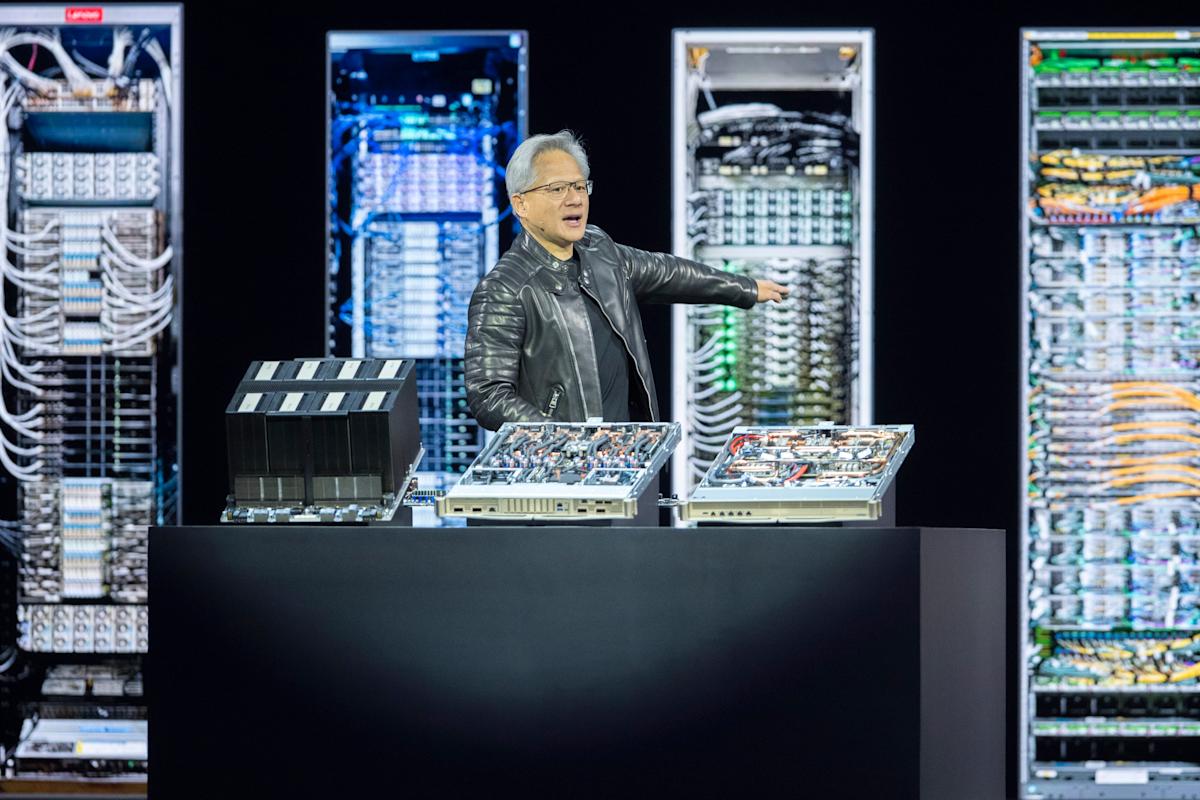

Nvidia's Market Value Takes a Massive Hit as Export Restrictions Rattle Investors

The tech giant's stock continued its downward spiral on Thursday, with the company experiencing a staggering $270 billion erosion in market capitalization since revealing new export controls. The dramatic decline highlights the significant challenges facing Nvidia in the rapidly evolving semiconductor landscape, as geopolitical tensions and regulatory constraints create unprecedented uncertainty for the chipmaking powerhouse.

Investors are closely watching how Nvidia will navigate these complex export restrictions, which threaten to disrupt its lucrative business in key international markets. The sharp stock slide reflects growing concerns about the potential long-term impact of these regulatory hurdles on the company's global growth strategy and financial performance.

Tech Titan's Tumble: Nvidia's Market Value Plummets Amid Export Restrictions

In the ever-evolving landscape of technological innovation and global trade, Nvidia finds itself at the epicenter of a dramatic market shift, facing unprecedented challenges that threaten its remarkable growth trajectory and global market dominance.When Regulations Reshape Tech Fortunes Overnight

The Seismic Impact of Export Controls

Nvidia's recent market performance has become a testament to the fragility of technological supremacy in an increasingly complex global economic environment. The company's stock has experienced a precipitous decline, triggering a massive erosion of market capitalization that sends shockwaves through the technology sector. Analysts are closely examining the intricate web of geopolitical tensions and regulatory constraints that have precipitated this sudden downturn. The export controls announced by regulatory authorities have struck at the heart of Nvidia's strategic positioning, potentially disrupting its carefully cultivated supply chains and international market access. These restrictions represent more than a mere bureaucratic hurdle; they symbolize a fundamental recalibration of technological sovereignty and global technological competition.Financial Implications and Market Dynamics

The financial repercussions of these export limitations are staggering. With nearly $270 billion in market capitalization evaporating, Nvidia confronts a challenging landscape that demands strategic agility and innovative problem-solving. Investors and industry observers are keenly watching how the company will navigate these turbulent waters, adapting its business model to accommodate increasingly stringent international trade regulations. The semiconductor industry has long been a battleground of technological and economic competition, and Nvidia's current predicament underscores the delicate balance between innovation, global commerce, and geopolitical considerations. Each regulatory constraint represents not just a limitation, but a potential catalyst for strategic reinvention.Technological Resilience in a Volatile Landscape

Despite the significant market challenges, Nvidia's historical track record suggests a remarkable capacity for adaptation. The company has consistently demonstrated an ability to pivot, innovate, and transform potential obstacles into opportunities for strategic repositioning. This current market turbulence might well be viewed as a crucible for technological resilience and strategic innovation. The broader implications extend far beyond Nvidia's immediate financial performance. These developments signal a profound transformation in how technological companies must approach global markets, supply chain management, and international regulatory compliance. Each restriction becomes a complex puzzle that demands creative solutions and forward-thinking strategies.Global Technology Ecosystem Recalibration

The ripple effects of Nvidia's current challenges will likely reverberate throughout the global technology ecosystem. Competitors, investors, and policymakers will be closely analyzing the company's response, potentially reshaping strategic approaches to international technology development and deployment. As the technological landscape continues to evolve at an unprecedented pace, Nvidia's current market experience serves as a powerful reminder of the intricate interconnections between technological innovation, regulatory frameworks, and global economic dynamics. The company's ability to navigate these complex waters will be a defining narrative in the ongoing saga of technological advancement and global commerce.RELATED NEWS

Finance

Money Moves: The Hottest Financial Stories That Shaped February's Landscape

2025-03-07 11:32:00

Finance

Breaking: OceanFirst Financial Surges with Impressive Q1 Loan Expansion and Strategic Momentum

2025-04-26 07:06:02

Finance

Streaming Struggles: Apple's Billion-Dollar Gamble Unravels as Subscribers Jump Ship

2025-03-20 17:29:01